Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assume that asset A has no storage cost and there is a convenience yield. Every 9 months, the holder of the asset receives $13

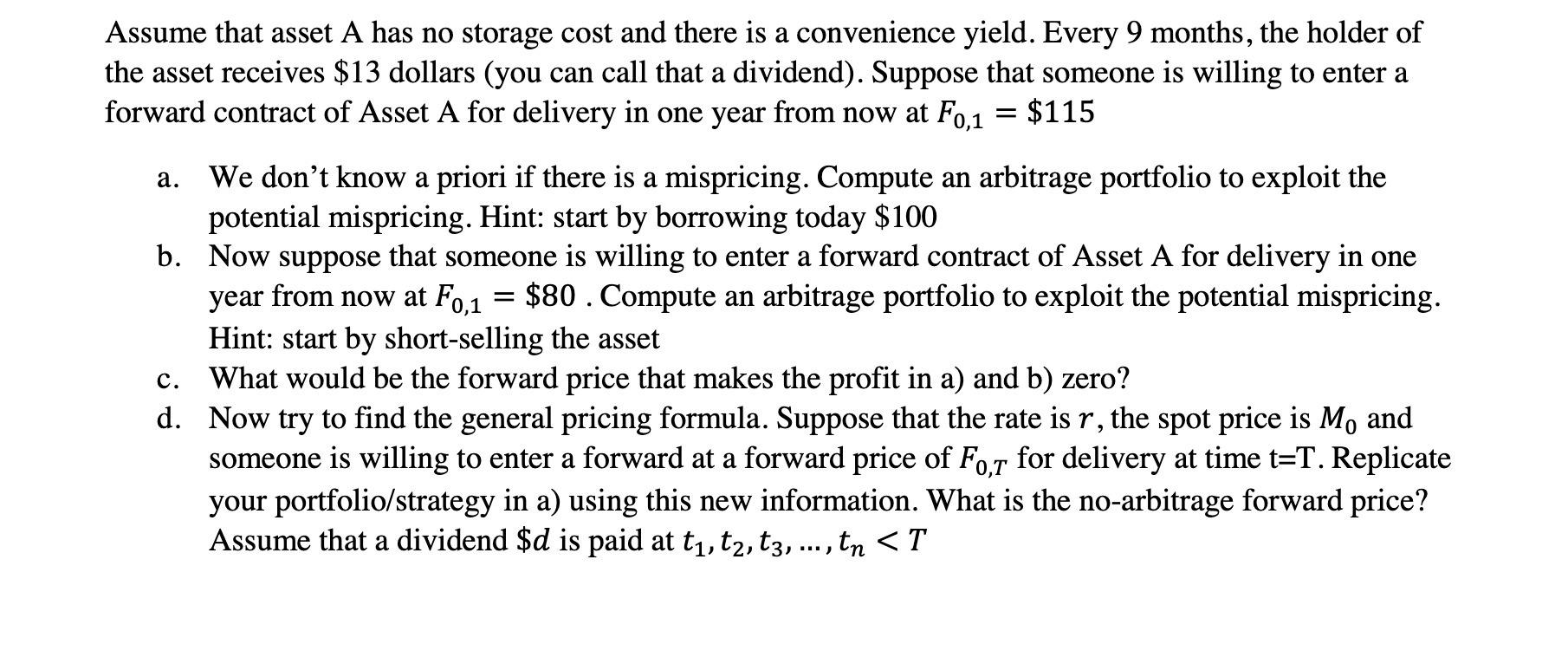

Assume that asset A has no storage cost and there is a convenience yield. Every 9 months, the holder of the asset receives $13 dollars (you can call that a dividend). Suppose that someone is willing to enter a forward contract of Asset A for delivery in one year from now at F0,1 = $115 a. We don't know a priori if there is a mispricing. Compute an arbitrage portfolio to exploit the potential mispricing. Hint: start by borrowing today $100 b. Now suppose that someone is willing to enter a forward contract of Asset A for delivery in one year from now at F0,1 = $80 . Compute an arbitrage portfolio to exploit the potential mispricing. Hint: start by short-selling the asset What would be the forward price that makes the profit in a) and b) zero? d. Now try to find the general pricing formula. Suppose that the rate is r, the spot price is Mo and someone is willing to enter a forward at a forward price of Fo,r for delivery at time t=T. Replicate your portfolio/strategy in a) using this new information. What is the no-arbitrage forward price? Assume that a dividend $d is paid at t, t2, t3, ... , tn < T

Step by Step Solution

★★★★★

3.41 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

a Borrow 100 today Enter into a long forward contract to deliver the asset in 1 year at 115 Sell the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started