Question

Assume that CAT is also contemplating the purchase of a new computer-based order entry system as described in Ex. 14, Chapter 10. Please refer to

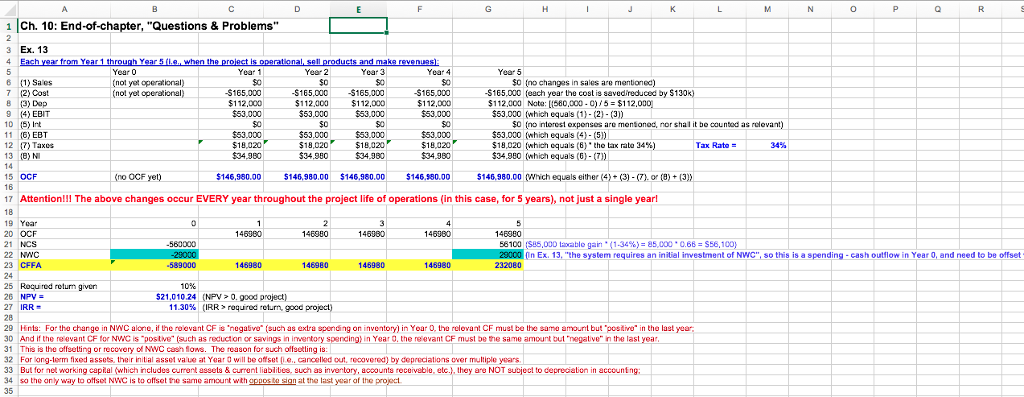

Assume that CAT is also contemplating the purchase of a new computer-based order entry system as described in Ex. 14, Chapter 10. Please refer to those CFs you have computed for that specific exercise for NPV and IRR applications.

Assume that CAT is also contemplating the purchase of a new computer-based order entry system as described in Ex. 14, Chapter 10. Please refer to those CFs you have computed for that specific exercise for NPV and IRR applications.

Application 1: Some financial analysts recommend using debt capital (because debt is typically cheaper than equity), so CAT shall only use long-term bond debt to finance the purchase of the system. As in the web-based Part B of Chapter 07 HW, we have found that the longest-maturity CAT bond (01-March-2097) has a most current "yield to maturity" of 4.900% per year, and thus this 4.900% (per year) on CAT bond is used as the required return for your long-term-debt-financed capital investment.

Based on the required return (financing cost of capital) of 4.900%, if CAT applies the IRR rule, shall CAT purchase the order entry system or not?

Based on the required return (financing cost of capital) of 4.900%, if CAT applies the NPV rule, shall CAT purchase the order entry system or not? (You need to show me the resulting NPV)

Application 2: Some other financial analysts recommend using equity capital (because the bankruptcy risk is smaller for using equity financing instead of bond debt financing), so CAT shall only use common stock to finance the purchase of the system. We thus refer to Chapter 08, "dividend growth model", P0 = D0 * (1 + g)/(R - g) ==> R = D0 * (1 + g) / P0 + g.

Based on our findings in Chapter 08 HW Part B, CAT stock's required return R = D0*(1+g)/P0 + g = xxx% (check Ch. 08 HW sample solutions), and thus this xxx% (per year) on CAT stock is used as the required return for your equity-financed capital investment.

Based on the required return (financing cost of capital) of xxx%, if CAT applies the IRR rule, shall CAT purchase the order entry system or not?

Based on the required return (financing cost of capital) of xxx%, if CAT applies the NPV rule, shall CAT purchase the order entry system or not? (You need to show me the resulting NPV amount.)

Application 3: Based on your answers to Applications 1 & 2, which one of the two financing methods (long-term bond debt vs. common stock equity) would make the order entry system project to be more value-adding to CAT? In other words, CAT wants to maximize shareholders' wealth by trying to earn the largest NPV, so shall CAT choose "long-term bond debt" or "common stock equity" as its financing tool?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started