Answered step by step

Verified Expert Solution

Question

1 Approved Answer

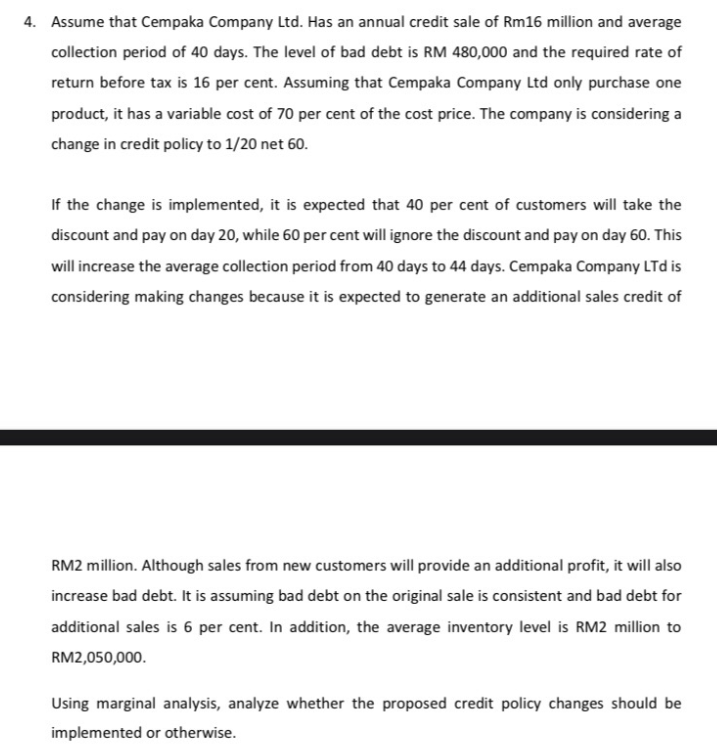

Assume that Cempaka Company Ltd . Has an annual credit sale of Rm 1 6 million and average collection period of 4 0 days. The

Assume that Cempaka Company Ltd Has an annual credit sale of Rm million and average

collection period of days. The level of bad debt is RM and the required rate of

return before tax is per cent. Assuming that Cempaka Company Ltd only purchase one

product, it has a variable cost of per cent of the cost price. The company is considering a

change in credit policy to net

If the change is implemented, it is expected that per cent of customers will take the

discount and pay on day while per cent will ignore the discount and pay on day This

will increase the average collection period from days to days. Cempaka Company LTd is

considering making changes because it is expected to generate an additional sales credit of

RM million. Although sales from new customers will provide an additional profit, it will also

increase bad debt. It is assuming bad debt on the original sale is consistent and bad debt for

additional sales is per cent. In addition, the average inventory level is RM million to

RM

Using marginal analysis, analyze whether the proposed credit policy changes should be

implemented or otherwise.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started