Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assume that D and S are married, and that S is a US citizen, for this and the following questions until indicated otherwise. D was

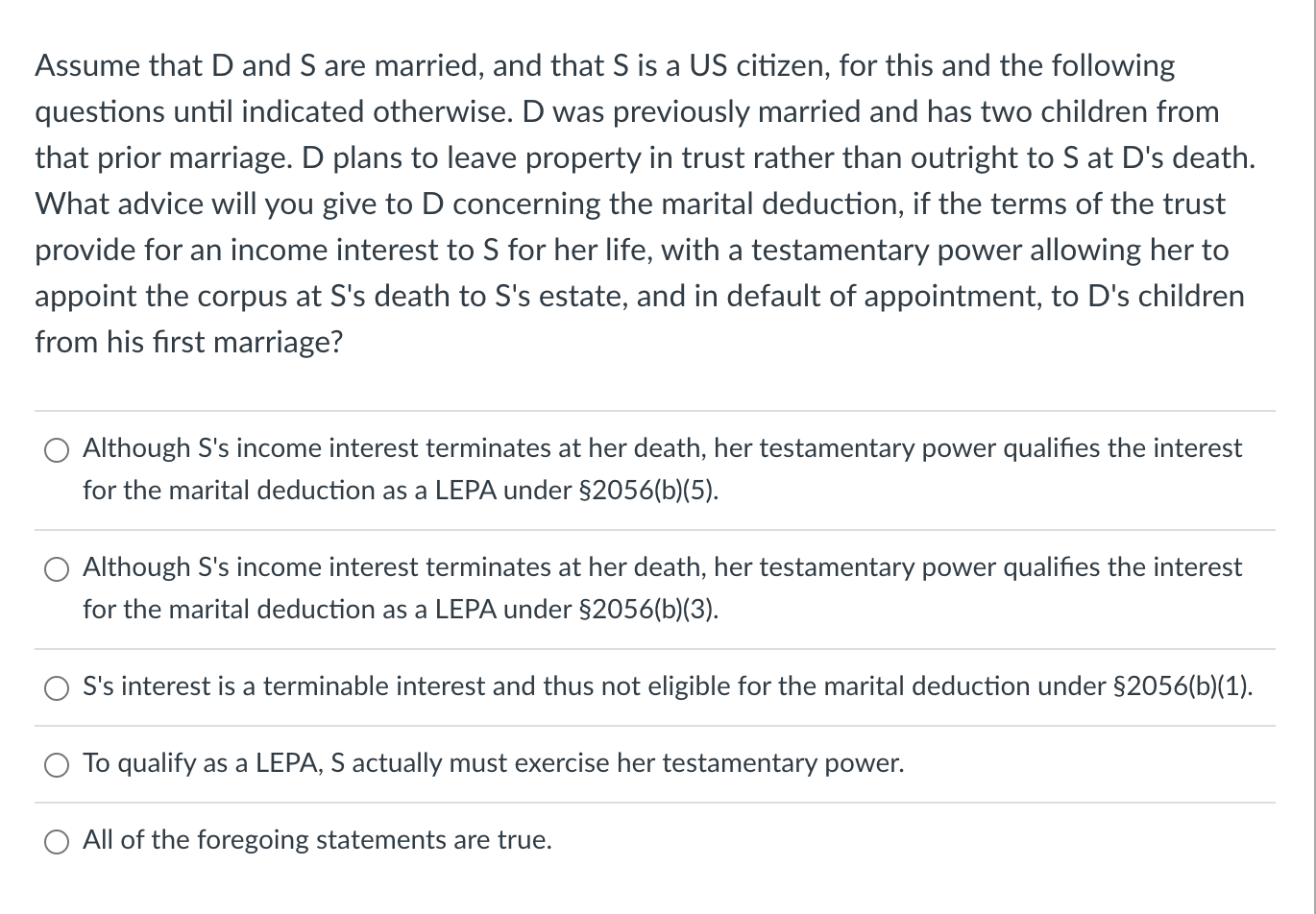

Assume that and are married, and that is a US citizen, for this and the following

questions until indicated otherwise. D was previously married and has two children from

that prior marriage. D plans to leave property in trust rather than outright to at Ds death.

What advice will you give to concerning the marital deduction, if the terms of the trust

provide for an income interest to for her life, with a testamentary power allowing her to

appoint the corpus at Ss death to Ss estate, and in default of appointment, to Ds children

from his first marriage?

Although Ss income interest terminates at her death, her testamentary power qualifies the interest

for the marital deduction as a LEPA under

Although Ss income interest terminates at her death, her testamentary power qualifies the interest

for the marital deduction as a LEPA under

Ss interest is a terminable interest and thus not eligible for the marital deduction under b

To qualify as a LEPA, S actually must exercise her testamentary power.

All of the foregoing statements are true.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started