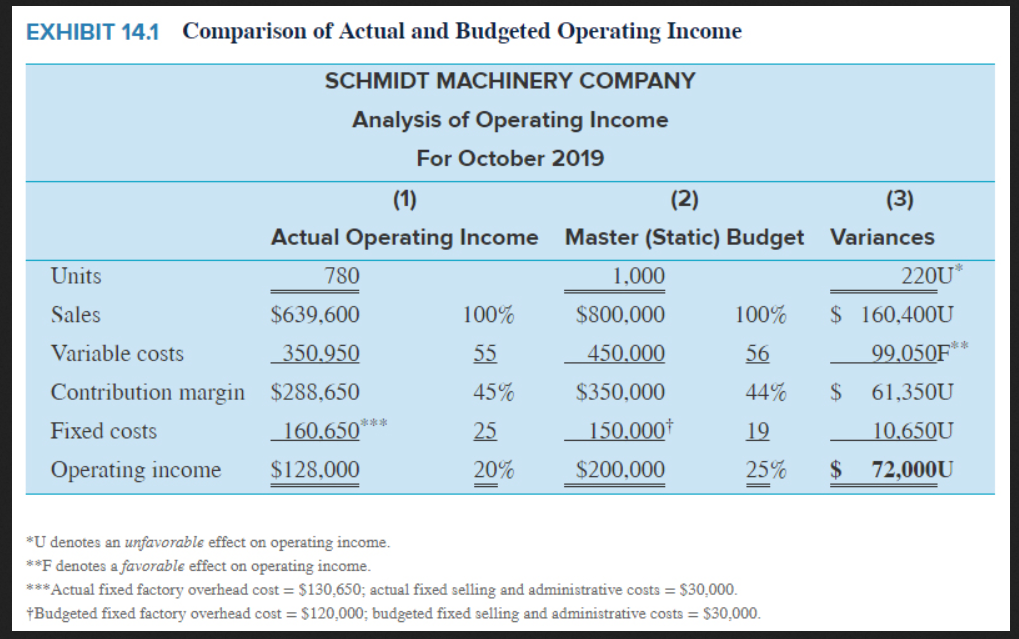

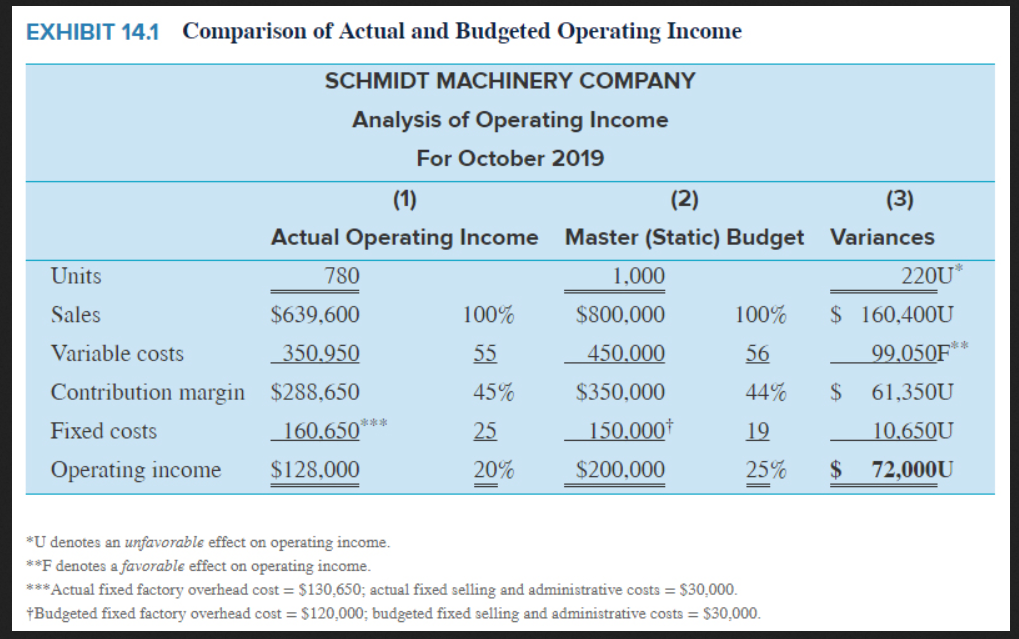

Assume that in October 2019 the Schmidt Machinery Company (Exhibit 14.1) manufactured and sold 900 units for $710 each. During this month, the company incurred $387,000 total variable costs and $180,500 total fixed costs. The master (static) budget data for the month are as given in Exhibit 14.1. Required: 1. Prepare a flexible budget for the production and sale of 900 units. 2. Compute for October 2019: a. The sales volume variance, in terms of operating income. Indicate whether this variance was favorable (F) or unfavorable (U). b. The sales volume variance, in terms of contribution margin. Indicate whether this variance was favorable (F) or unfavorable (U). 3. Compute for October 2019: a. The total flexible-budget (FB) variance. Indicate whether this variance was favorable (F) or unfavorable (U). b. The total variable cost flexible-budget variance. Indicate whether this variance was favorable (F) or unfavorable (U). c. The total fixed cost flexible-budget (FB) variance. Indicate whether this variance was favorable (F) or unfavorable (U). d. The selling price variance. Indicate whether this variance was favorable (F) or unfavorable (U). Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Prepare a flexible budget for the production and sale of 900 units. Units sold Sales EXHIBIT 14.1 Comparison of Actual and Budgeted Operating Income SCHMIDT MACHINERY COMPANY Analysis of Operating Income For October 2019 (1) (2) (3) Actual Operating Income Master (Static) Budget Variances Units 780 1,000 2200 Sales $639,600 100% $800,000 100% $ 160,400U Variable costs 350.950 55 450.000 56 99,050F** Contribution margin $288,650 45% $350,000 44% $ 61,350U Fixed costs | 160,650 25 150.000 19 10,650U Operating income $128,000 20% $200,000 25% $ 72,000U *** *U denotes an unfavorable effect on operating income. **F denotes a favorable effect on operating income. ***Actual fixed factory overhead cost = $130,650; actual fixed selling and administrative costs = $30,000. Budgeted fixed factory overhead cost = $120,000; budgeted fixed selling and administrative costs = $30,000