Answered step by step

Verified Expert Solution

Question

1 Approved Answer

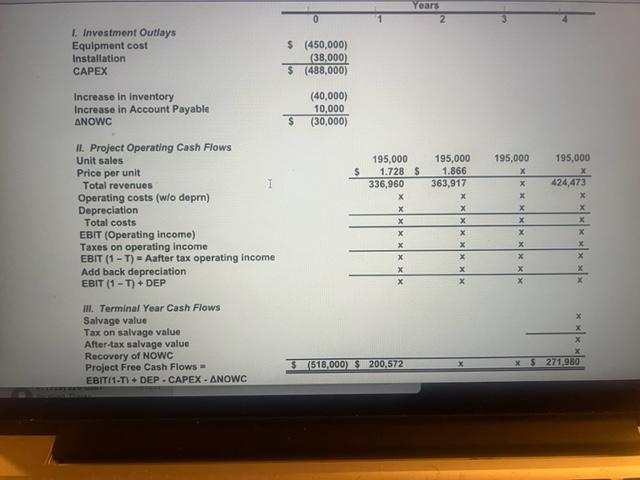

Assume that inflation is expected to average 8% over the next 4 years and that this expectation is reflected in the WACC. Moreover, inflation is

Assume that inflation is expected to average 8% over the next 4 years and that this expectation is reflected in the WACC. Moreover, inflation is expected to increase revenues and variable costs by this same 8%. Does it appear that inflation has been dealt with properly in the initial analysis to this point? If not, what should be done and how would the required adjustment affect the decision? Please show in excel as well as the formulas used to get them in excel.

I. Investment Outlays Equlpment cost Instalfation CAPEX \begin{tabular}{lr} $ & (450,000) \\ \hline$(38,000) \\ \hline & (488,000) \end{tabular} Increase in inventory Increase in Account Payable \begin{tabular}{rr} & (40,000) \\ & 10,000 \\ \hline$(30,000) \end{tabular} II. Project Operating Cash Flows Unit sales Price per unit Total revenues Operating costs (w/o deprn) Depreciation Total costs EBIT (Operating income) Taxes on operating income EBIT (1T)= Aafter tax operating income Add back depreciation EBIT (1T)+ DEP \begin{tabular}{rrrrr} & 195,000 & 195,000 & 195,000 & 195,000 \\ $1.728 & $ & 1.866 & x & x \\ \hline 336,960 & 363,917 & x & 424,473 \\ & & & x & x \end{tabular} III. Terminal Year Cash Flows Salvage value Tax on salvage value After-tax salvage value Recovery of NOWC Project Free Cash Flows = \begin{tabular}{cccc} x & x & x & x \\ x & x & x & x \\ \hlinex & x & x & x \\ \hlinex & x & x & x \end{tabular} EBIT(1-T) + DEP - CAPEX - ANOWCStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started