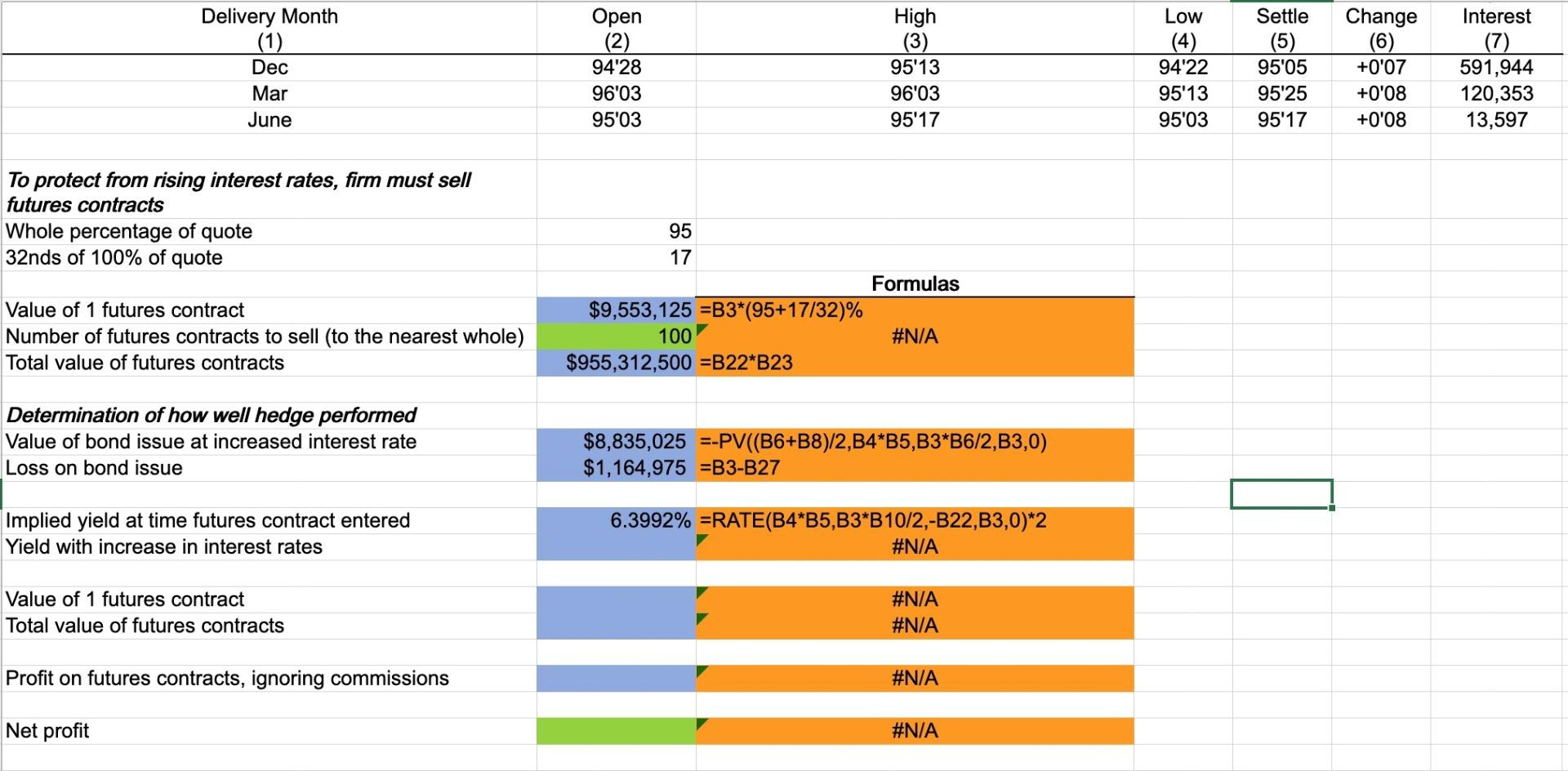

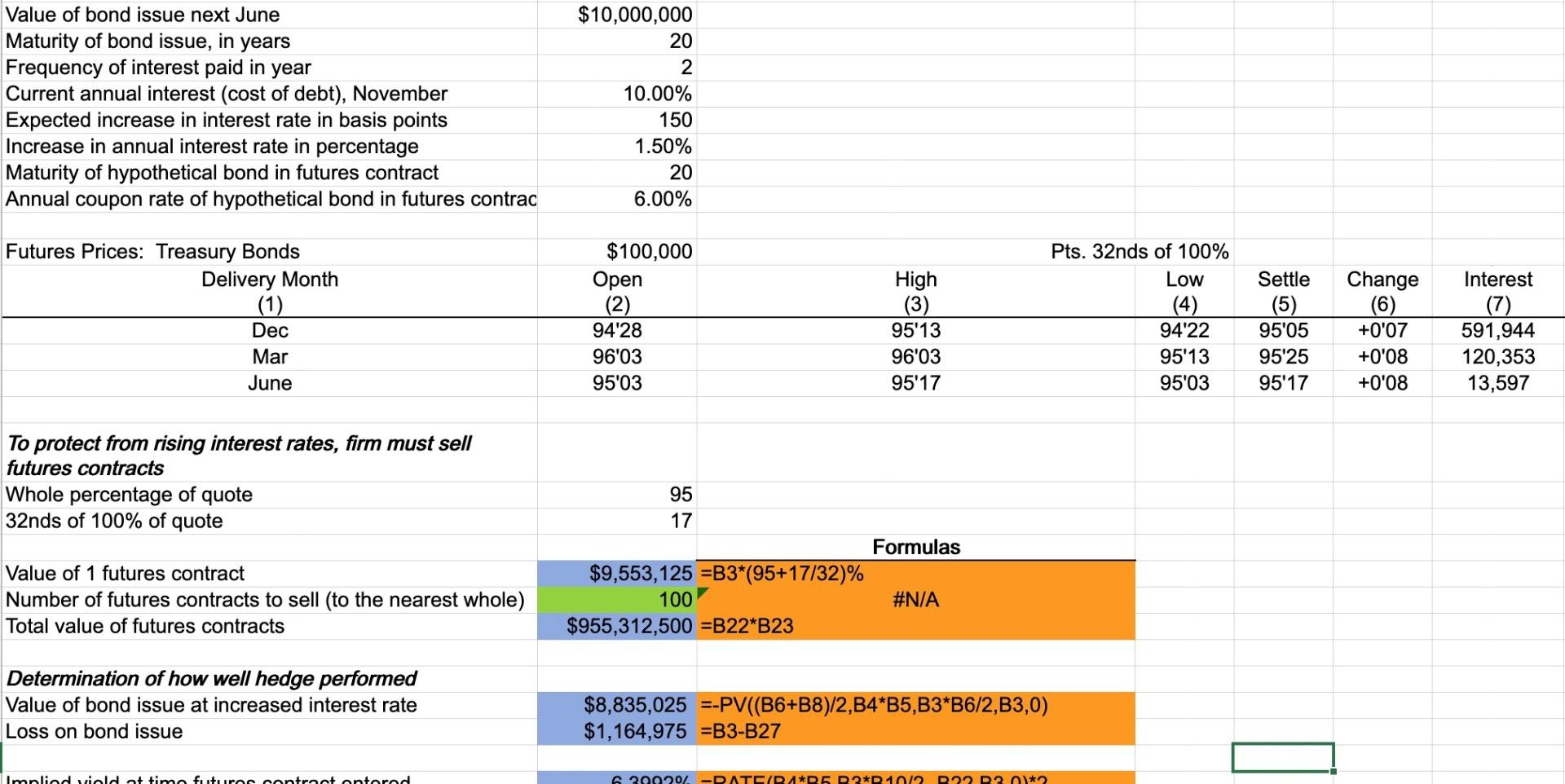

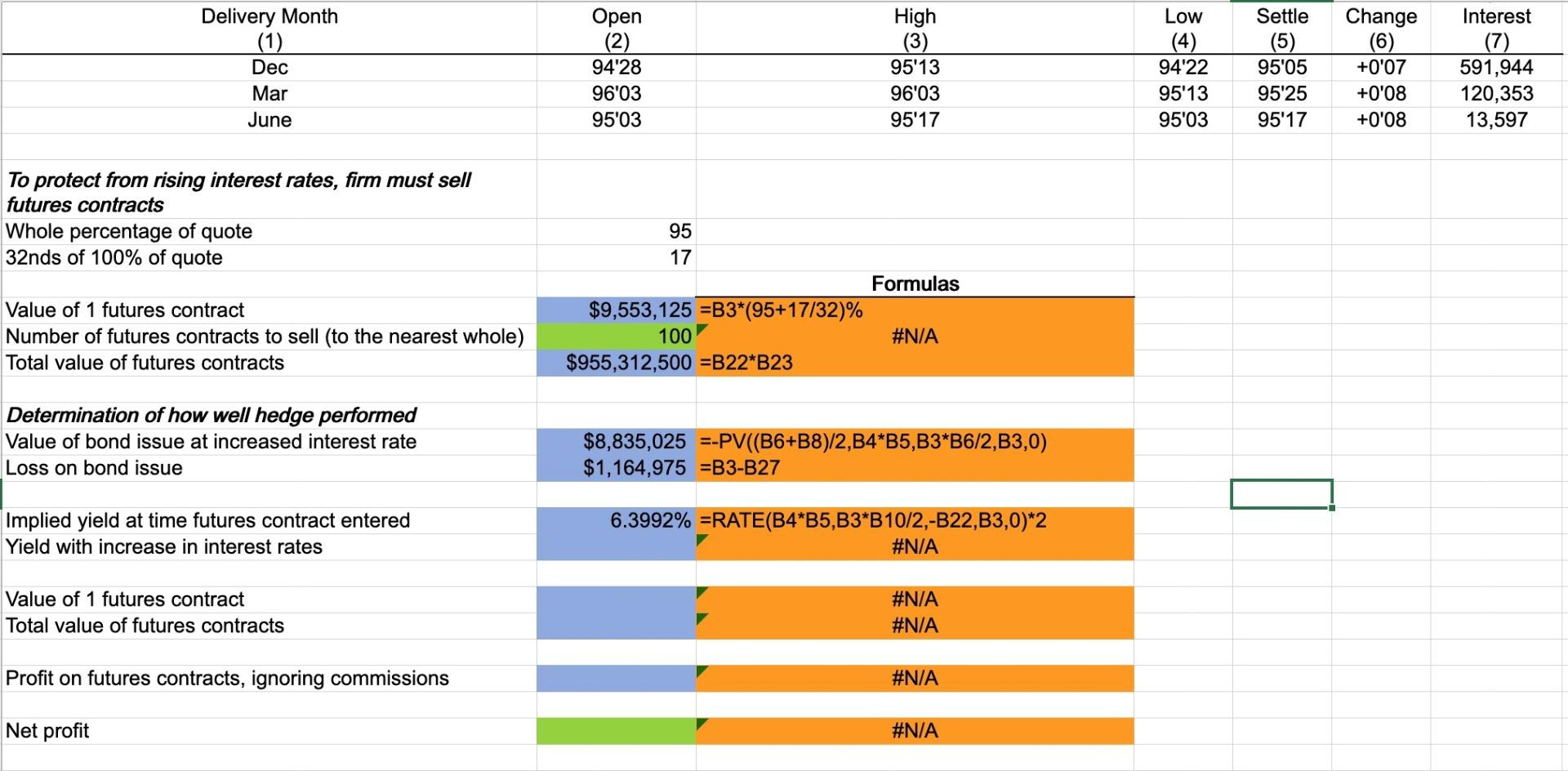

Assume that interest rates in general increase by 150 basis points. How well did your hedge perform? (i.e., What is the net gain or loss?)

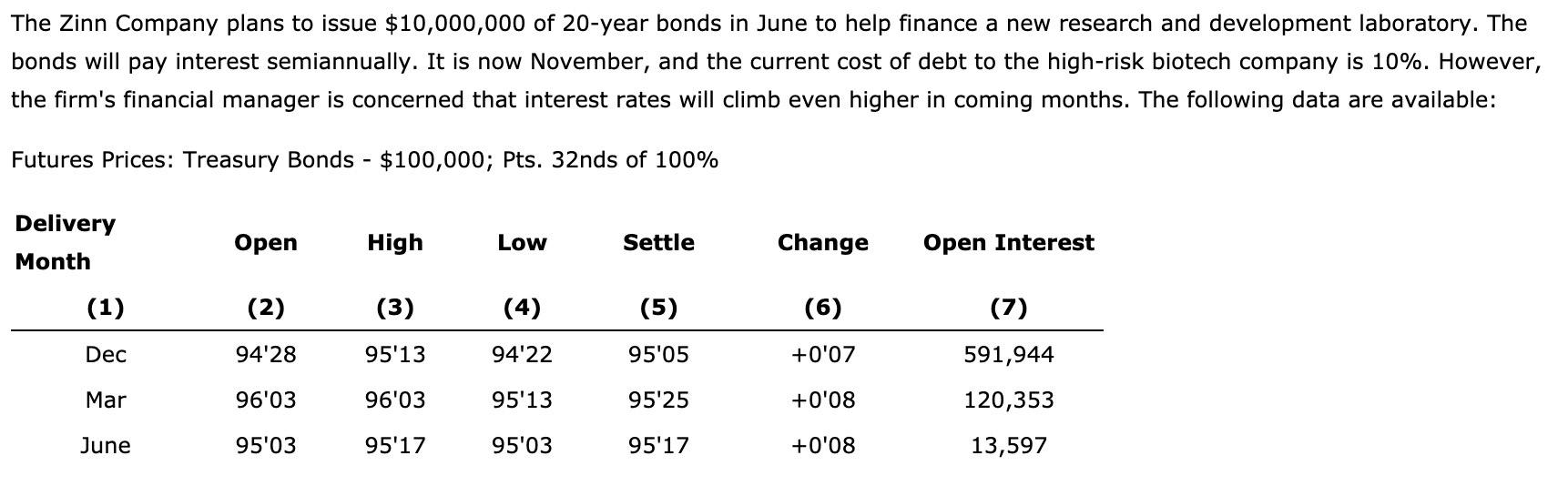

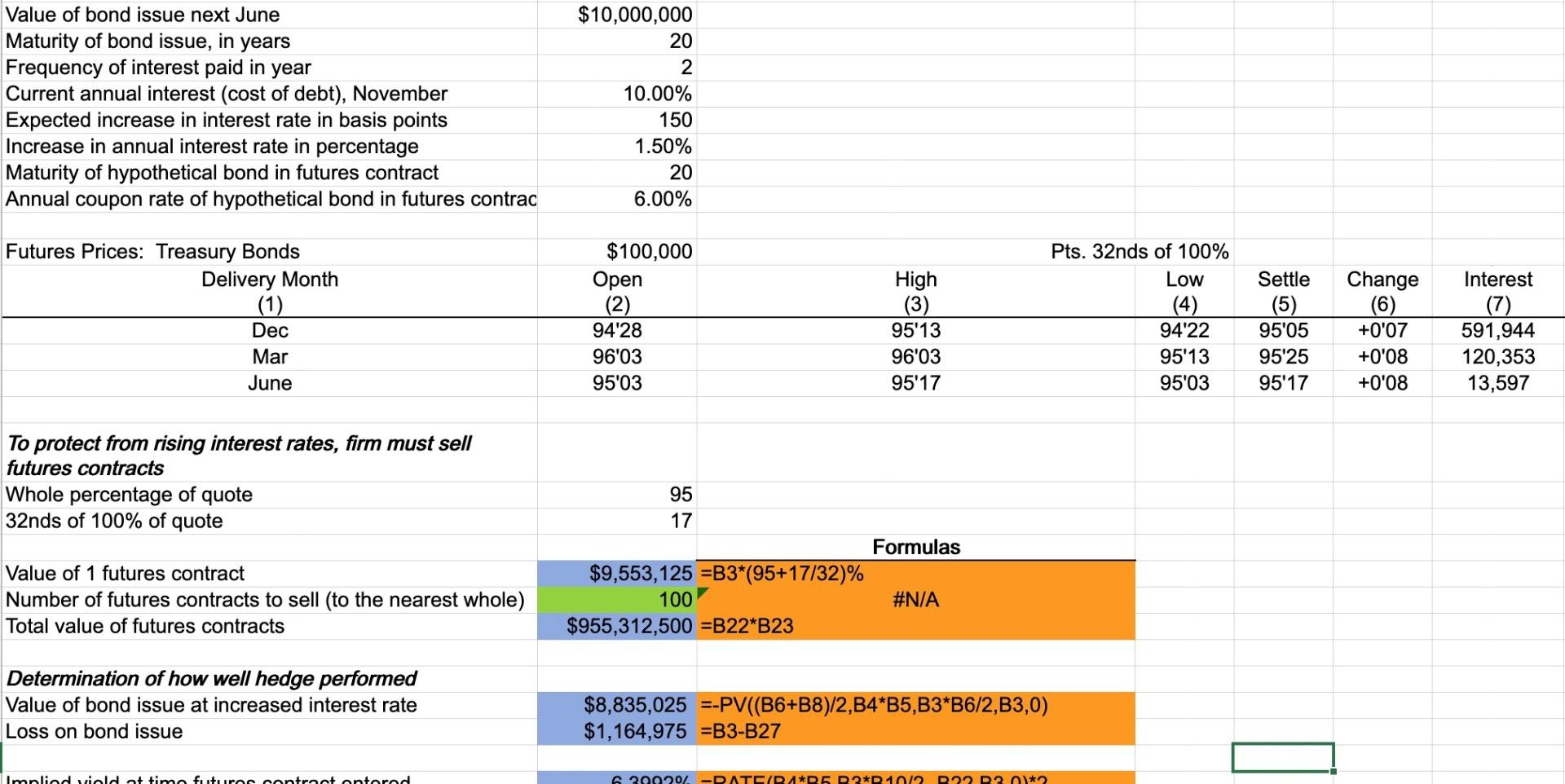

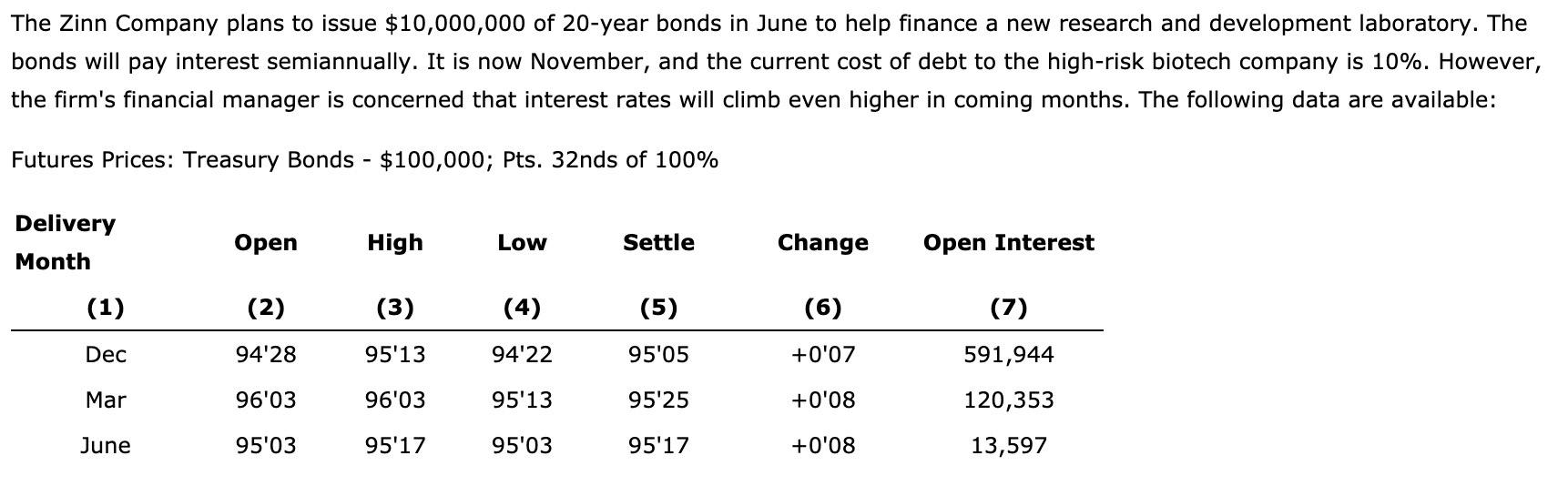

The Zinn Company plans to issue $10,000,000 of 20-year bonds in June to help finance a new research and development laboratory. The bonds will pay interest semiannually. It is now November, and the current cost of debt to the high-risk biotech company is 10%. However, the firm's financial manager is concerned that interest rates will climb even higher in coming months. The following data are available: Futures Prices: Treasury Bonds - $100,000; Pts. 32nds of 100% Delivery Month Open High Low Settle Change Open Interest (1) (2) (3) (4) (5) (6) (7) Dec 94'28 95'13 94'22 95'05 +0'07 591,944 Mar 96'03 96'03 95'13 95'25 +0'08 120,353 June 95'03 95'17 95'03 95'17 +0'08 13,597 Value of bond issue next June Maturity of bond issue, in years Frequency of interest paid in year Current annual interest (cost of debt), November Expected increase in interest rate in basis points Increase in annual interest rate in percentage Maturity of hypothetical bond in futures contract Annual coupon rate of hypothetical bond in futures contrac $10,000,000 20 2 10.00% 150 1.50% 20 6.00% Futures Prices: Treasury Bonds Delivery Month (1) Dec Mar June $100,000 Open (2) 94'28 96'03 9503 High (3) 95'13 96'03 95'17 Pts. 32nds of 100% Low (4) 94'22 95'13 9503 Settle (5) 95'05 95'25 95'17 Change (6) +0'07 +0'08 +0'08 Interest (7) 591,944 120,353 13,597 To protect from rising interest rates, firm must sell futures contracts Whole percentage of quote 32nds of 100% of quote 95 17 Formulas $9,553,125 =B3*(95+17/32)% 100 #N/A $955,312,500 =B22*B23 Value of 1 futures contract Number of futures contracts to sell (to the nearest whole) Total value of futures contracts Determination of how well hedge performed Value of bond issue at increased interest rate Loss on bond issue $8,835,025 =-PV((B6+B8)/2,B4*B5,B3*B6/2,B3,0) $1,164,975 =B3-B27 Ilmoliad vialdattimo futuron ontroetantorod 200202 DATE/DA*05 D2*01012 R22 R2 *2 Low Delivery Month (1) Dec Mar June Open (2) 94'28 96'03 95'03 High (3) 95'13 96'03 95'17 94'22 95'13 9503 Settle (5) 95'05 95'25 95'17 Change (6) +0'07 +0'08 +0'08 Interest (7) 591,944 120,353 13,597 To protect from rising interest rates, firm must sell futures contracts Whole percentage of quote 32nds of 100% of quote 95 17 Formulas $9,553,125 =B3*(95+17/32)% 100 #N/A $955,312,500 =B22*B23 Value of 1 futures contract Number of futures contracts to sell (to the nearest whole) Total value of futures contracts Determination of how well hedge performed Value of bond issue at increased interest rate Loss on bond issue $8,835,025 =-PV((B6+B8)/2,B4*B5,B3*B6/2,B3,0) $1,164,975 =B3-B27 Implied yield at time futures contract entered Yield with increase in interest rates 6.3992% =RATE(B4*B5,B3*B10/2,-B22,B3,0)*2 #N/A Value of 1 futures contract Total value of futures contracts #N/A #N/A Profit on futures contracts, ignoring commissions #N/A Net profit #N/A