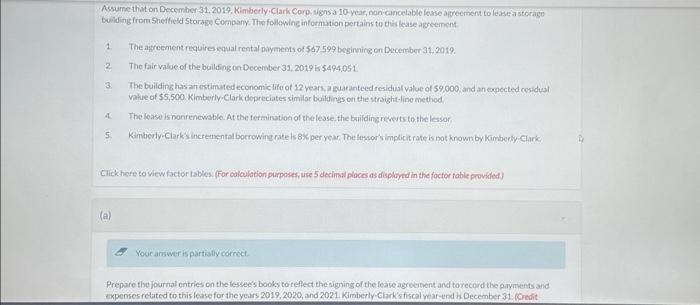

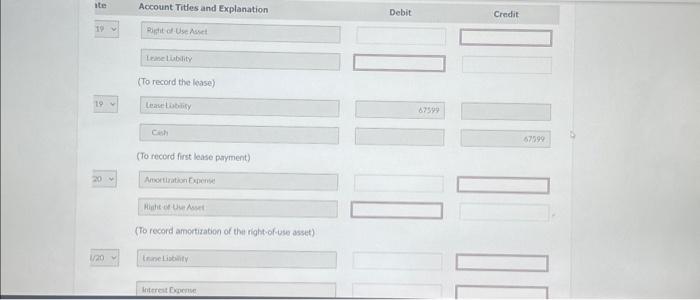

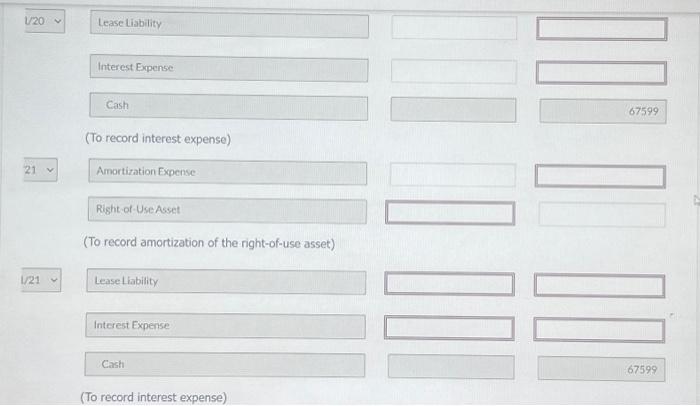

Assume that on Docember 31,2019. Kimberly. Clark Corp. Nigns a 10 -yeae, non cancelable lease abreement to lease a storage bulding from Sheifiesd Storage Company. The following informition pertains to thils lease abrecment 1. The aqreement requires equal rental poyments of 567,599 begiming on December 31, 2019. 2. The fair value of the building onDecenber 31,2019 is 5494,051 3. The building has ancestimated economiclife of 12 years a guarinteed residual yalue of 59.000 and an copected cesidual value of 55,500 . Kimberly. Clark depreciates similor buildings on the straight-line method 4. The lease is nonrencwable. At the termination of the lease, the buiding reverts to the lessor 5. Kimberly-Clark's inceemental bocrowing rate is B. per year. The hessor's implicit rate is not known by kimberiy-Clark: Click here to vitw factor tables. (For calculaeion purposes, use 5 decimal ploces as displented in the foctor fable provhled) (To record the loase) lisatiotrisy (To record first laase payment) Anortiration fenense Hinhit-de-tient Assil (To record amortizabion of the right-of-use asset) Irinelisbility intereat Cugene V/20 Lease lisbility Interest Expense Cash (To record interest expense) Amortization Expense Right-of-UseAsset (To record amortization of the right-of-use asset) 1/21 Lease Liability Interest Expense Cash (To record interest expense) Assume that on Docember 31,2019. Kimberly. Clark Corp. Nigns a 10 -yeae, non cancelable lease abreement to lease a storage bulding from Sheifiesd Storage Company. The following informition pertains to thils lease abrecment 1. The aqreement requires equal rental poyments of 567,599 begiming on December 31, 2019. 2. The fair value of the building onDecenber 31,2019 is 5494,051 3. The building has ancestimated economiclife of 12 years a guarinteed residual yalue of 59.000 and an copected cesidual value of 55,500 . Kimberly. Clark depreciates similor buildings on the straight-line method 4. The lease is nonrencwable. At the termination of the lease, the buiding reverts to the lessor 5. Kimberly-Clark's inceemental bocrowing rate is B. per year. The hessor's implicit rate is not known by kimberiy-Clark: Click here to vitw factor tables. (For calculaeion purposes, use 5 decimal ploces as displented in the foctor fable provhled) (To record the loase) lisatiotrisy (To record first laase payment) Anortiration fenense Hinhit-de-tient Assil (To record amortizabion of the right-of-use asset) Irinelisbility intereat Cugene V/20 Lease lisbility Interest Expense Cash (To record interest expense) Amortization Expense Right-of-UseAsset (To record amortization of the right-of-use asset) 1/21 Lease Liability Interest Expense Cash (To record interest expense)