Question

Kenzi Kayaking, a manufacturer of kayaks, began operations this year. During this first year, the company produced 1,075 kayaks and sold 825 at a price

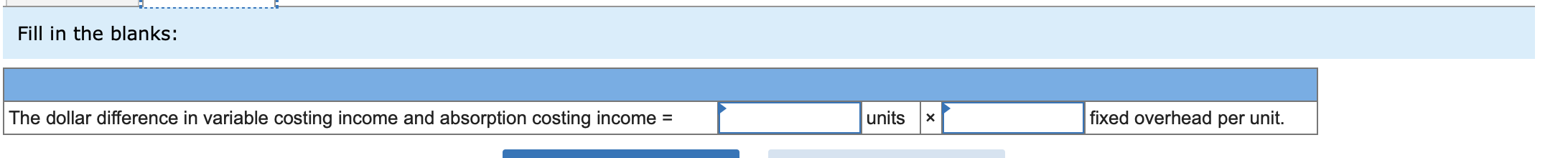

Kenzi Kayaking, a manufacturer of kayaks, began operations this year. During this first year, the company produced 1,075 kayaks and sold 825 at a price of $1,075 each. At this first year-end, the company reported the following income statement information using absorption costing. Sales (825 $1,075) $ 886,875 Cost of goods sold (825 $425) 350,625 Gross margin 536,250 Selling and administrative expenses 200,000 Net income $ 336,250 Additi onal Information Product cost per kayak totals $425, which consists of $325 in variable production cost and $100 in fixed production costthe latter amount is based on $107,500 of fixed production costs allocated to the 1,075 kayaks produced. The $200,000 in selling and administrative expense consists of $75,000 that is variable and $125,000 that is fixed. Required: 1. Prepare an income statement for the current year under variable costing. 2. Fill in the blanks:

onal Information Product cost per kayak totals $425, which consists of $325 in variable production cost and $100 in fixed production costthe latter amount is based on $107,500 of fixed production costs allocated to the 1,075 kayaks produced. The $200,000 in selling and administrative expense consists of $75,000 that is variable and $125,000 that is fixed. Required: 1. Prepare an income statement for the current year under variable costing. 2. Fill in the blanks:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started