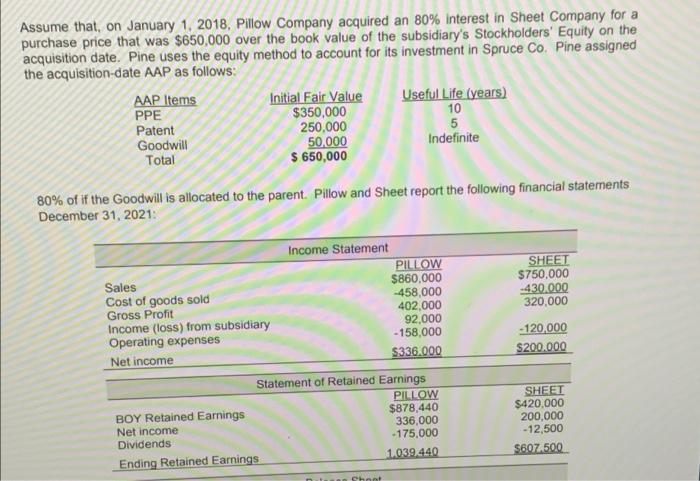

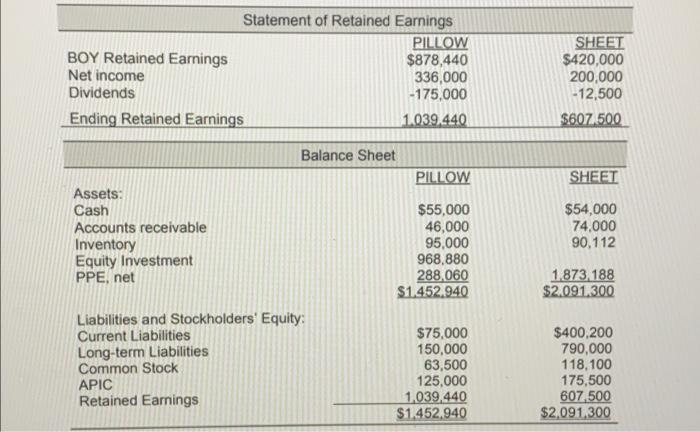

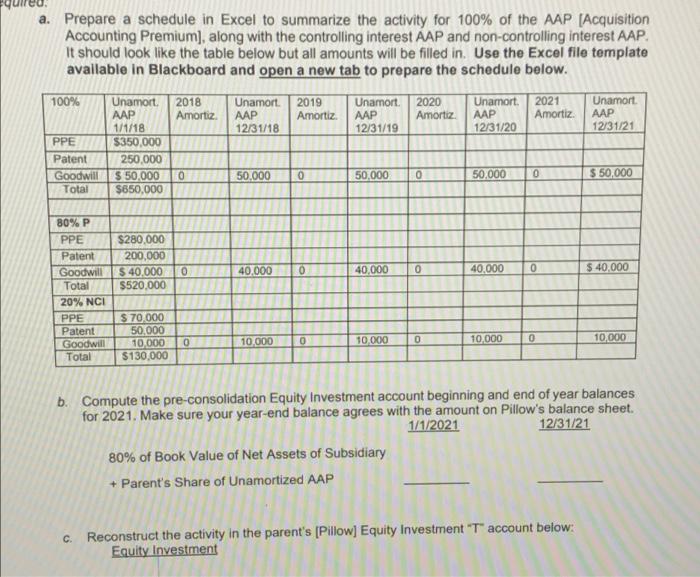

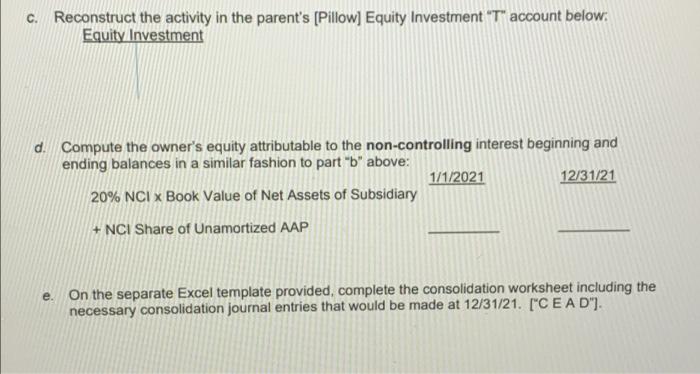

Assume that, on January 1, 2018, Pillow Company acquired an 80% interest in Sheet Company for a purchase price that was $650,000 over the book value of the subsidiary's Stockholders' Equity on the acquisition date. Pine uses the equity method to account for its investment in Spruce Co. Pine assigned the acquisition-date AAP as follows: AAP Items Initial Fair Value Useful Life (years) PPE $350,000 10 Patent 250.000 5 Goodwill 50,000 Indefinite Total $ 650,000 80% of if the Goodwill is allocated to the parent. Pillow and Sheet report the following financial statements December 31, 2021 Income Statement PILLOW $860,000 -458,000 402,000 92,000 - 158,000 $336,000 SHEET $750,000 -430.000 320,000 Sales Cost of goods sold Gross Profit Income (loss) from subsidiary Operating expenses Net income - 120.000 $200.000 Statement of Retained Earnings PILLOW BOY Retained Earnings $878,440 Net income 336.000 Dividends - 175,000 Ending Retained Earnings 1.039 440 SHEET $420,000 200.000 -12,500 5607.500 ht SHEET $420,000 200,000 -12,500 $607.500 SHEET Statement of Retained Earnings PILLOW BOY Retained Earnings $878,440 Net income 336,000 Dividends -175,000 Ending Retained Earnings 1.039.440 Balance Sheet PILLOW Assets: Cash $55,000 Accounts receivable 46,000 Inventory 95,000 Equity Investment 968.880 PPE, net 288,060 $1.452.940 Liabilities and Stockholders' Equity: Current Liabilities $75,000 Long-term Liabilities 150,000 Common Stock 63,500 APIC 125.000 Retained Eamings 1,039,440 $1.452.940 $54,000 74.000 90,112 1873 188 $2,091.300 $400,200 790,000 118,100 175,500 607,500 $2,091,300 a. Prepare a schedule in Excel to summarize the activity for 100% of the AAP (Acquisition Accounting Premium), along with the controlling interest AAP and non-controlling interest AAP. It should look like the table below but all amounts will be filled in. Use the Excel file template available in Blackboard and open a new tab to prepare the schedule below. 100% 2018 Amortiz Unamort. AAP 12/31/18 2019 Amortiz Unamnort 12/31/19 2020 Amortiz Unamort 12/31/20 2021 Amortiz. Unamort AAP 12/31/21 PPE Patent Goodwill Total Unamort AAP 1/1/18 $350,000 250.000 $ 50.000 $650,000 0 50.000 0 50,000 0 50.000 0 $ 50,000 $280.000 200,000 $ 40,000 S520.000 0 40.000 0 40,000 lo 40.000 0 80%P PPE Patent Goodwill Total 20% NCI PPE Patent Goodwill Total $ 40,000 $ 70 000 50.000 10,000 $130.000 0 10,000 0 10,000 0 10.000 0 10,000 b. Compute the pre-consolidation Equity Investment account beginning and end of year balances for 2021. Make sure your year-end balance agrees with the amount on Pillow's balance sheet. 1/1/2021 12/31/21 80% of Book Value of Net Assets of Subsidiary + Parent's Share of Unamortized AAP C. Reconstruct the activity in the parent's (Pillow] Equity Investment T account below: Equity Investment C. Reconstruct the activity in the parent's (Pillow] Equity Investment "T" account below: Equity Investment d. Compute the owner's equity attributable to the non-controlling interest beginning and ending balances in a similar fashion to part "b" above: 1/1/2021 12/31/21 20% NCI x Book Value of Net Assets of Subsidiary + NCI Share of Unamortized AAP e. On the separate Excel template provided, complete the consolidation worksheet including the necessary consolidation journal entries that would be made at 12/31/21. ["CE A D")