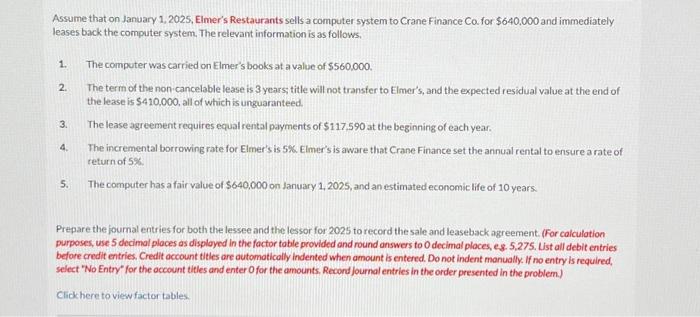

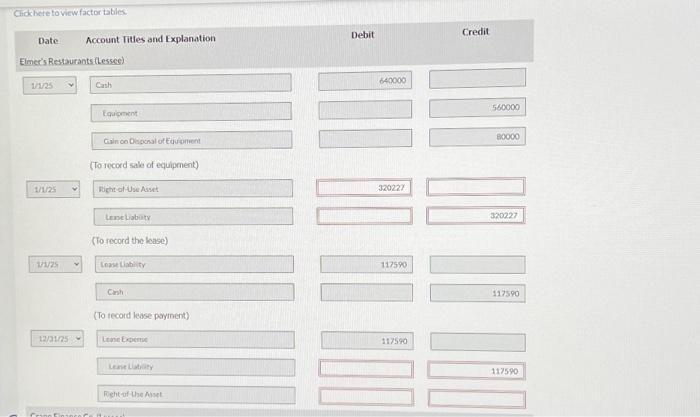

Assume that on January 1, 2025, Elmer's Restaurants sells a computer system to Crane Finance Ca for $640,000 and immediately leases back the computer system. The relevant information is as follows, 1. The computer was carried on Elmer's books at a value of $560,000. 2. The term of the non cancelable lease is 3 years; title will not transfer to Elmer's, and the expected residual value at the end of the lease is $410,000, all of which is unguaranteed. 3. The lease agreement requires equal rental payments of $117.590 at the beginning of each year. 4. The incremental borrowing rate for Elmer's is 5%. Elmer's is aware that Crane Finance set the annual rental to ensure a rate of return of 5%. 5. The computer has a fair value of $640,000 on January 1,2025 , and an estimated economic life of 10 years. Prepare the journal entries for both the lessee and the lessor for 2025 to record the sale and leaseback agreement. (For calculation purposes, use 5 decimal places as disployed in the factor table provided and round answers to 0 decimal ploces, e 8 . 5,275. List all debit entries before credit entries, Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select 'No Entry' for the account titles and enter O for the amounts. Recond journal entries in the order presented in the problem.) Clickhere to view factor tables Cickbete to vicw factor tabies Date Account Titles and Explanation Elmer's Restaurantsithessec) Debit 1/25 Cash forionent Gincon Daconal of Euverient (Torecord sale of equipment) 1/1/25 Fight of Use Asset Leneliabuty (To record the lease) 12125 121/25 640000 Credit 640000 560000080000 cmh (To tecord lease payment) 12/31/25 temie Eenine. 117590 Lene Latiaty 127590 Peht of Uhe Auset Rgetit of Une Asiet Crane Finance Co.(Lessor) (To record purchase of equipment) 1 cin Unearned Lene Reveres (To record the hasebock) 1223125 Unearned Lase Hownot: Tine Ricuenue (To record the recognition of the revenub) Orpredation Enperse Acoumulent Deprecintion Eouipmem (To record depreciation expense on the leased equipment)