Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assume that one share of the S&P 500 index can be purchased for $4,100.00 and that the dividend yield is 2.25% over the holding

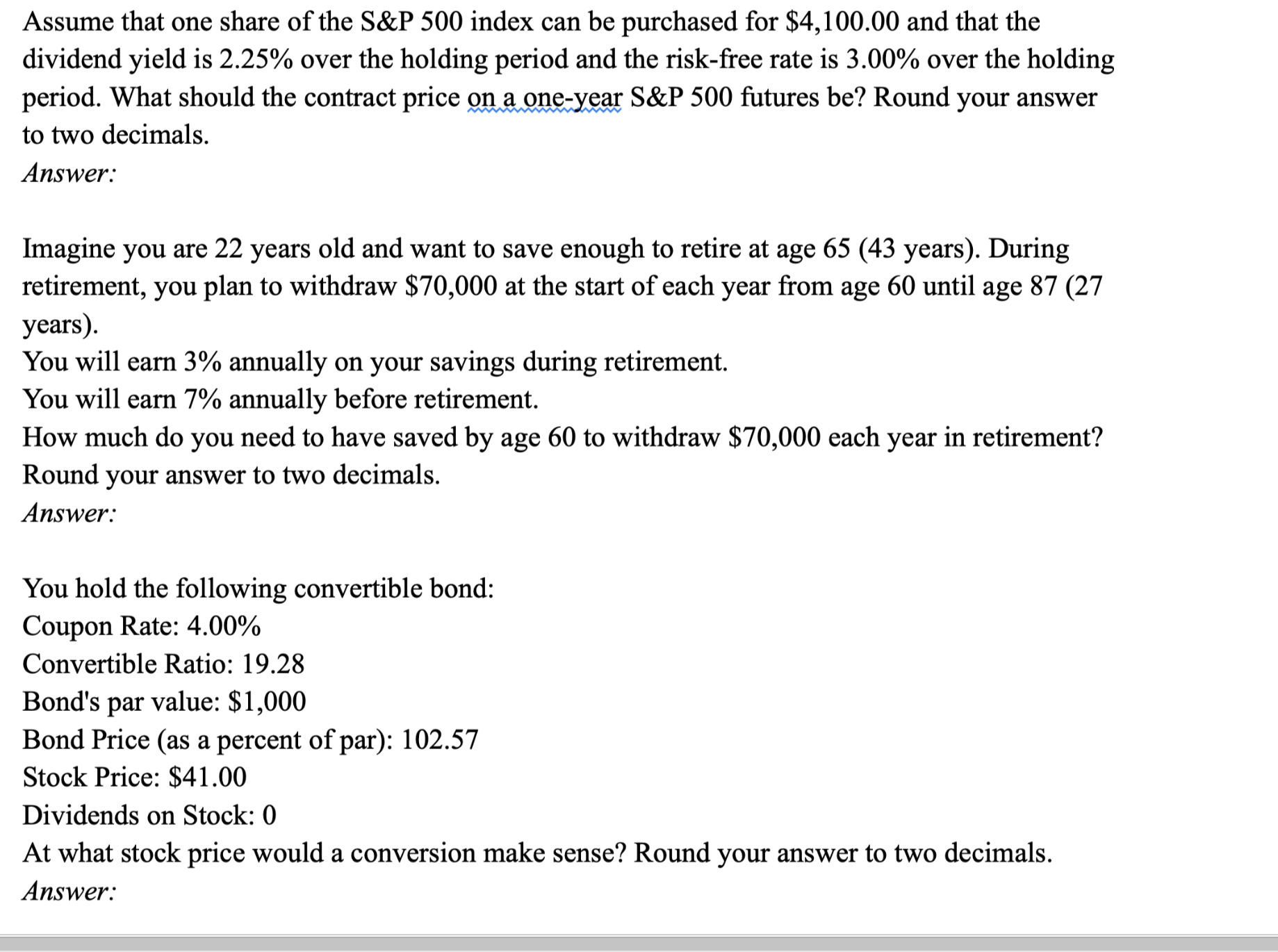

Assume that one share of the S&P 500 index can be purchased for $4,100.00 and that the dividend yield is 2.25% over the holding period and the risk-free rate is 3.00% over the holding period. What should the contract price on a one-year S&P 500 futures be? Round your answer to two decimals. Answer: Imagine you are 22 years old and want to save enough to retire at age 65 (43 years). During retirement, you plan to withdraw $70,000 at the start of each year from age 60 until age 87 (27 years). You will earn 3% annually on your savings during retirement. You will earn 7% annually before retirement. How much do you need to have saved by age 60 to withdraw $70,000 each year in retirement? Round your answer to two decimals. Answer: You hold the following convertible bond: Coupon Rate: 4.00% Convertible Ratio: 19.28 Bond's par value: $1,000 Bond Price (as a percent of par): 102.57 Stock Price: $41.00 Dividends on Stock: 0 At what stock price would a conversion make sense? Round your answer to two decimals. Answer:

Step by Step Solution

★★★★★

3.23 Rating (144 Votes )

There are 3 Steps involved in it

Step: 1

1 Calculating the contract price on a oneyear SP 500 futures Using the cost of carry model F S er q ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started