Answered step by step

Verified Expert Solution

Question

1 Approved Answer

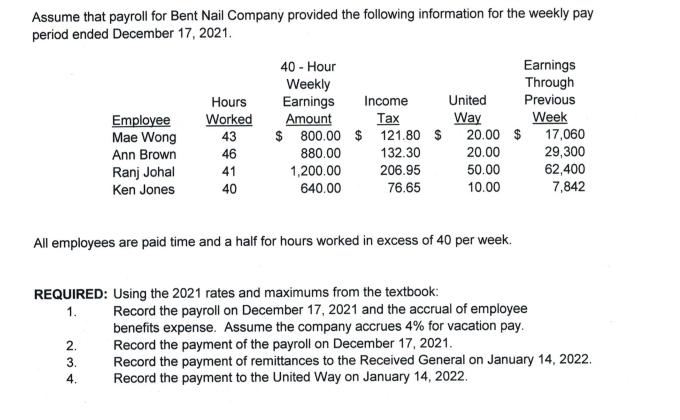

Assume that payroll for Bent Nail Company provided the following information for the weekly pay period ended December 17, 2021. 40-Hour Weekly Earnings Through

Assume that payroll for Bent Nail Company provided the following information for the weekly pay period ended December 17, 2021. 40-Hour Weekly Earnings Through Hours Earnings Income United Previous Employee Worked Amount Tax Way Week Mae Wong Ann Brown 43 $ 800.00 $ 121.80 $ 20.00 $ 17,060 46 880.00 132.30 20.00 29,300 Ranj Johal 41 1,200.00 206.95 50.00 62,400 Ken Jones 40 640.00 76.65 10.00 7,842 All employees are paid time and a half for hours worked in excess of 40 per week. REQUIRED: Using the 2021 rates and maximums from the textbook: 1. Record the payroll on December 17, 2021 and the accrual of employee benefits expense. Assume the company accrues 4% for vacation pay. Record the payment of the payroll on December 17, 2021. 2. 3. 234 Record the payment of remittances to the Received General on January 14, 2022. Record the payment to the United Way on January 14, 2022.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started