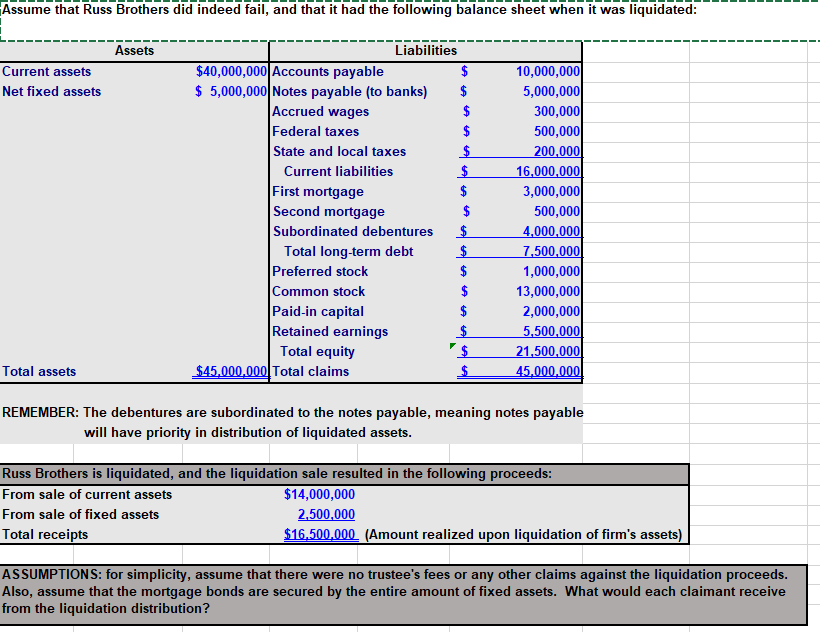

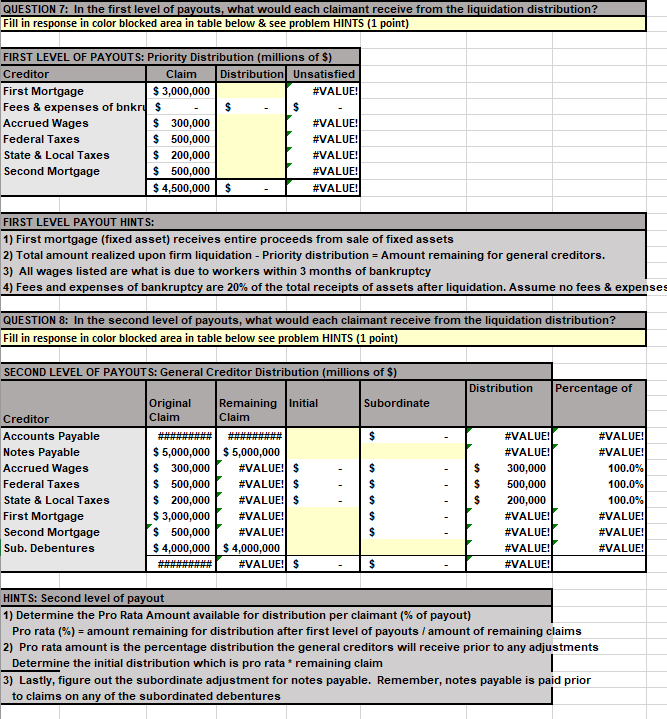

Assume that Russ Brothers did indeed fail, and that it had the following balance sheet when it was liquidated: Assets Liabilities -- Current assets Net fixed assets $40,000,000 Accounts payable $5,000,000 Notes payable (to banks) 10,000,000 5,000,000 300,000 500,000 Accrued wages Federal taxes State and local taxes Current liabilities First mortgage Second mortgage 16,000,000 3,000,000 500,000 Subordinated debentures 4,000,00 Preferred stock Common stock Paid-in capital Retained earnings Total long-term debt7.500,000 1,000,000 13,000,000 2,000,000 Total equity S21.500000 Total assets $45,000,000 Total claims REMEMBER: The debentures are subordinated to the notes payable, meaning notes payable will have priority in distribution of liquidated assets. Russ Brothers is liquidated, and the liquidation sale resulted in the following proceeds From sale of current assets From sale of fixed assets Total receipts $14,000,000 2.500,000 $16.500,000 (Amount realized upon liquidation of firm's assets) ASSUMPTIONS: for simplicity, assume that there were no trustee's fees or any other claims against the liquidation proceeds Also, assume that the mortgage bonds are secured by the entire amount of fixed assets. What would each claimant receive from the liquidation distribution? Fill in response in color blocked area in table below & see problem HINTS (1 point) FIRST LEVEL OF PAYOUTS: Priority Distribution (millions of S) Creditor First Mortgage Fees & expenses of bnkru S Accrued Wages Federal Taxes State & Local Taxes Second Mortgage Claim Distribution Unsatisfie $ 3,000,000 #VALUE! S 300,000 S 500,000 $ 200,000 S 500,000 $ 4,500,000 S #VALUE! #VALUE! #VALUE! #VALUE! #VALUE FIRST LEVEL PAYOUT HINTS: 1) First mortgage (fixed asset) receives entire proceeds from sale of fixed assets 2) Total amount realized upon firm liquidation - Priority distribution Amount remaining for general creditors. 3) All wages listed are what is due to workers within 3 months of bankruptcy 4) Fees and expenses of bankruptcy are 20% of the total receipts of assets after liquidation-Assumen fees & expene QUESTION 8: In the second level of payouts, what would each claimant receive from the liquidation distribution? Fill in response in color blocked area in table below see problem HINTS (1 point) SECOND LEVEL OF PAYOUT S: General Creditor Distribution (millions of $) Distribution Percentage of Subordinate Claim Claim Creditor Accounts Payable Notes Payable Accrued Wages Federal Taxes State & Local Taxes First Mortgage Second Mortgage Sub. Debentures #VALUE! #VALUE! 300,000 #VALUE! #VALUE! 100.0% 100.0% 100.0% #VALUE! #VALUE! #VALUE! $ 5,000,000 5,000,000 300,000 . #VALUEIs 500,000 #VALUEIs S $ 200,000 $ 3,000,000 #VALUE!! $ #VALUE! - 200,000 #VALUE . 500,000 #VALUE #VALUE! S 4,000,000 S4,000,000 VALUE! HINTS: Second level of payout 1) Determine the Pro Rata Amount available for distribution per claimant % of payout, Pro rata (%)-amount remaining for distribution after first level of payouts l amount of remaining claims Determine the initial distribution which is pro rata * remaining claim to claims on any of the subordinated debentures 2) Pro rata amount is the percentage distribution the general creditors will receive prior to any adjustments 3) Lastly, figure out the subordinate adjustment for notes payable. Remember, notes payable is paid prior Assume that Russ Brothers did indeed fail, and that it had the following balance sheet when it was liquidated: Assets Liabilities -- Current assets Net fixed assets $40,000,000 Accounts payable $5,000,000 Notes payable (to banks) 10,000,000 5,000,000 300,000 500,000 Accrued wages Federal taxes State and local taxes Current liabilities First mortgage Second mortgage 16,000,000 3,000,000 500,000 Subordinated debentures 4,000,00 Preferred stock Common stock Paid-in capital Retained earnings Total long-term debt7.500,000 1,000,000 13,000,000 2,000,000 Total equity S21.500000 Total assets $45,000,000 Total claims REMEMBER: The debentures are subordinated to the notes payable, meaning notes payable will have priority in distribution of liquidated assets. Russ Brothers is liquidated, and the liquidation sale resulted in the following proceeds From sale of current assets From sale of fixed assets Total receipts $14,000,000 2.500,000 $16.500,000 (Amount realized upon liquidation of firm's assets) ASSUMPTIONS: for simplicity, assume that there were no trustee's fees or any other claims against the liquidation proceeds Also, assume that the mortgage bonds are secured by the entire amount of fixed assets. What would each claimant receive from the liquidation distribution? Fill in response in color blocked area in table below & see problem HINTS (1 point) FIRST LEVEL OF PAYOUTS: Priority Distribution (millions of S) Creditor First Mortgage Fees & expenses of bnkru S Accrued Wages Federal Taxes State & Local Taxes Second Mortgage Claim Distribution Unsatisfie $ 3,000,000 #VALUE! S 300,000 S 500,000 $ 200,000 S 500,000 $ 4,500,000 S #VALUE! #VALUE! #VALUE! #VALUE! #VALUE FIRST LEVEL PAYOUT HINTS: 1) First mortgage (fixed asset) receives entire proceeds from sale of fixed assets 2) Total amount realized upon firm liquidation - Priority distribution Amount remaining for general creditors. 3) All wages listed are what is due to workers within 3 months of bankruptcy 4) Fees and expenses of bankruptcy are 20% of the total receipts of assets after liquidation-Assumen fees & expene QUESTION 8: In the second level of payouts, what would each claimant receive from the liquidation distribution? Fill in response in color blocked area in table below see problem HINTS (1 point) SECOND LEVEL OF PAYOUT S: General Creditor Distribution (millions of $) Distribution Percentage of Subordinate Claim Claim Creditor Accounts Payable Notes Payable Accrued Wages Federal Taxes State & Local Taxes First Mortgage Second Mortgage Sub. Debentures #VALUE! #VALUE! 300,000 #VALUE! #VALUE! 100.0% 100.0% 100.0% #VALUE! #VALUE! #VALUE! $ 5,000,000 5,000,000 300,000 . #VALUEIs 500,000 #VALUEIs S $ 200,000 $ 3,000,000 #VALUE!! $ #VALUE! - 200,000 #VALUE . 500,000 #VALUE #VALUE! S 4,000,000 S4,000,000 VALUE! HINTS: Second level of payout 1) Determine the Pro Rata Amount available for distribution per claimant % of payout, Pro rata (%)-amount remaining for distribution after first level of payouts l amount of remaining claims Determine the initial distribution which is pro rata * remaining claim to claims on any of the subordinated debentures 2) Pro rata amount is the percentage distribution the general creditors will receive prior to any adjustments 3) Lastly, figure out the subordinate adjustment for notes payable. Remember, notes payable is paid prior