please help

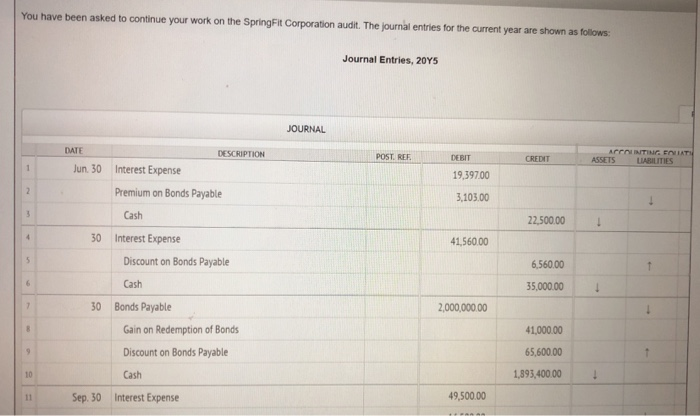

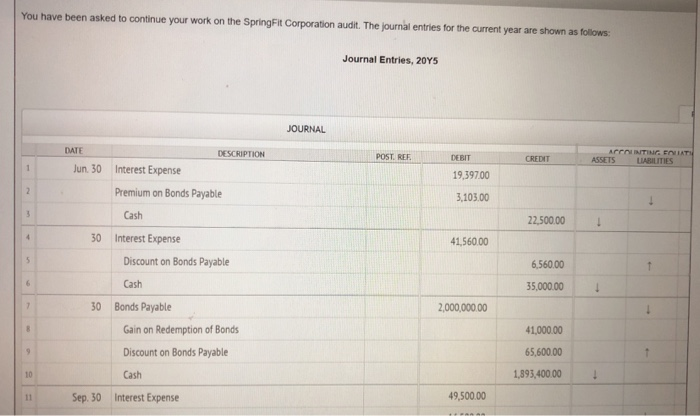

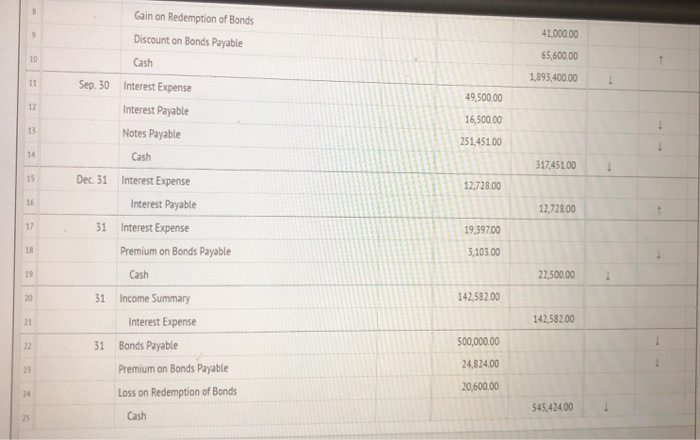

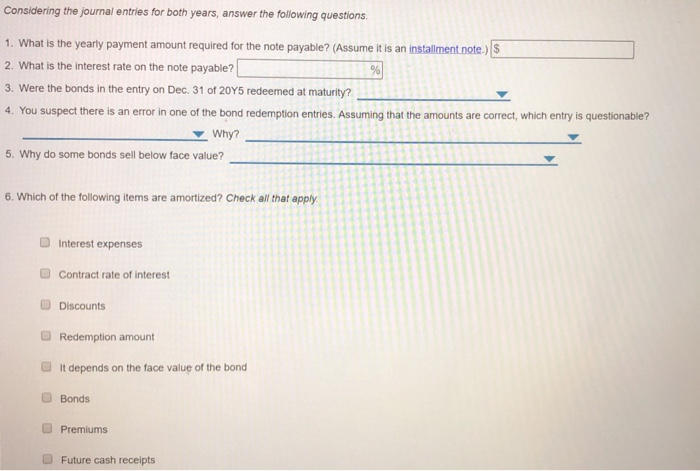

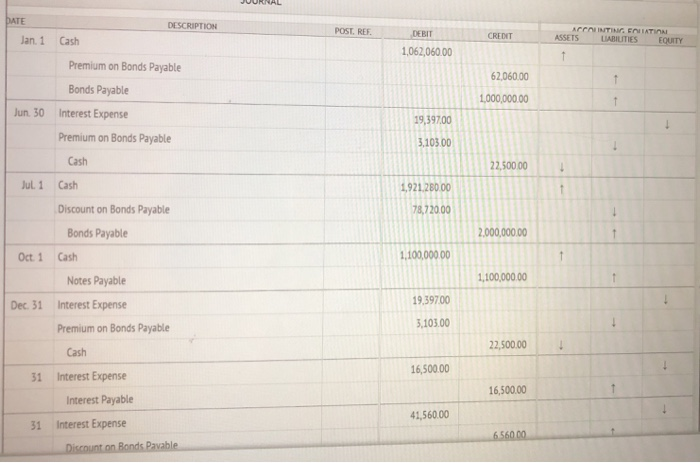

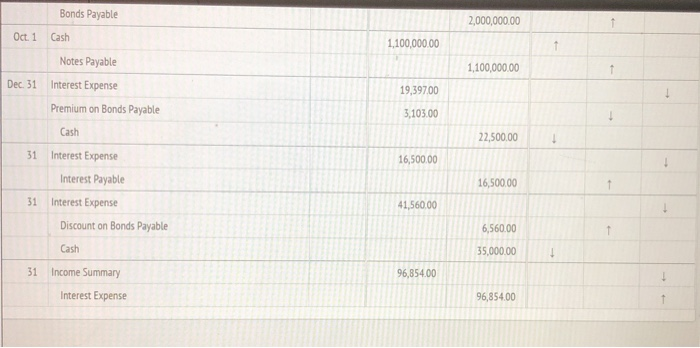

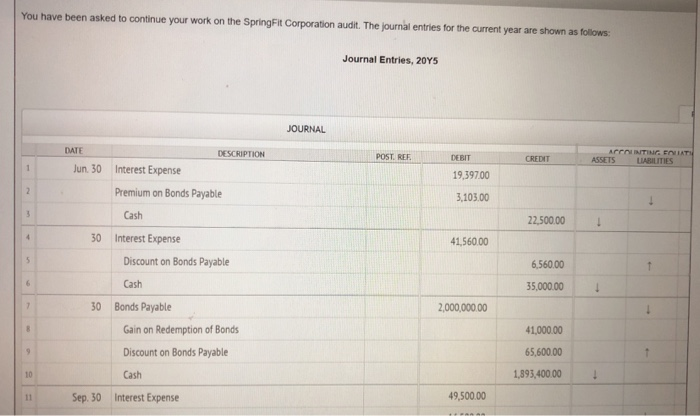

You have been asked to continue your work on the SpringFit Corporation audit. The journal entries for the current year are shown as follows: Journal Entries, 20YS JOURNAL DATE ACCOUNTING EOUATI ASSETS DESCRIPTION POST, REF DEBIT CREDIT LIABILITIES Jun. 30 Interest Expense 19.397.00 Premium on Bonds Payable 3,103.00 Cash 22.500.00 30 Interest Expense 4 41,56000 Discount on Bonds Payable 6,560.00 Cash 35,000.00 30 Bonds Payable 2,000,000.00 Gain on Redemption of Bonds 41,000.00 65.600.00 Discount on Bonds Payable 1,893,400.00 Cash 10 49,500.00 Sep. 30 Interest Expense 11 Gain on Redemption of Bonds 41,000.00 9 Discount on Bonds Payable 65,600.00 10 Cash 1,893,400.00 11 Sep. 30 Interest Expense 49,500.00 12 Interest Payable 16,500.00 13 Notes Payable 251,451.00 14 Cash 317451.00 Dec. 31 15 Interest Expense 12,728.00 16 Interest Payable 12,728.00 17 31 Interest Expense 19,397.00 Premium on Bonds Payable 18 3,103.00 Cash 22,500.00 142582.00 Income Summary 20 31 142.582.00 Interest Expense 21 500,000.00 Bonds Payable 31 27 24,824.00 Premium on Bonds Payable 24 20,600.00 Loss on Redemption of Bonds 24 545,42400 Cash 25 19 Considering the journal entries for both years, answer the following questions. 1. What is the yearly payment amount required for the note payable? (Assume it is an installment note.) S 2. What is the interest rate on the note payable? % 3. Were the bonds in the entry on Dec. 31 of 20Y5 redeemed at maturity? 4. You suspect there is an error in one of the bond redemption entries. Assuming that the amounts are correct, which entry is questionable? Why? 5. Why do some bonds sell below face value? 6. Which of the following items are amortized? Check all that apply Interest expenses Contract rate of interest Discounts Redemption amount It depends on the face value of the bon pond Bonds Premiums Future cash receipts DATE DESCRIPTION POST. REF ACCOUNTINNG EOUATIOA ASSETS DEBIT CREDIT UABILITIES Jan. 1 Cash EQUITY 1,062,060.00 1 Premium on Bonds Payable 62,060.00 Bonds Payable 1,000,000.00 Jun 30 Interest Expense 19.39700 Premium on Bonds Payable 3,103.00 Cash 22,500 00 Jul. 1 Cash 1,921.28000 Discount on Bonds Payable 78,72000 Bonds Payable 2.000,000.00 1,100,00000 Oct 1 Cash 1,100,000.00 Notes Payable 19,39700 Dec. 31 Interest Expense 3,103.00 Premium on Bonds Payable 22,500.00 Cash 16,500.00 Interest Expense 31 16,500.00 Interest Payable 41,560.00 Interest Expense 31 6.560.00 Discount on Bonds Pavable Bonds Payable 2,000,000.00 Oct. 1 Cash 1,100,000.00 Notes Payable 1,100,000.00 Dec. 31 Interest Expense 19.39700 Premium on Bonds Payable 3.103.00 Cash 22.500.00 Interest Expense 31 16,500.00 Interest Payable 16,500.00 31 Interest Expense 41,56000 Discount on Bonds Payable 6,560.00 Cash 35,000.00 31 Income Summary 96,854.00 Interest Expense 96,854.00 You have been asked to continue your work on the SpringFit Corporation audit. The journal entries for the current year are shown as follows: Journal Entries, 20YS JOURNAL DATE ACCOUNTING EOUATI ASSETS DESCRIPTION POST, REF DEBIT CREDIT LIABILITIES Jun. 30 Interest Expense 19.397.00 Premium on Bonds Payable 3,103.00 Cash 22.500.00 30 Interest Expense 4 41,56000 Discount on Bonds Payable 6,560.00 Cash 35,000.00 30 Bonds Payable 2,000,000.00 Gain on Redemption of Bonds 41,000.00 65.600.00 Discount on Bonds Payable 1,893,400.00 Cash 10 49,500.00 Sep. 30 Interest Expense 11 Gain on Redemption of Bonds 41,000.00 9 Discount on Bonds Payable 65,600.00 10 Cash 1,893,400.00 11 Sep. 30 Interest Expense 49,500.00 12 Interest Payable 16,500.00 13 Notes Payable 251,451.00 14 Cash 317451.00 Dec. 31 15 Interest Expense 12,728.00 16 Interest Payable 12,728.00 17 31 Interest Expense 19,397.00 Premium on Bonds Payable 18 3,103.00 Cash 22,500.00 142582.00 Income Summary 20 31 142.582.00 Interest Expense 21 500,000.00 Bonds Payable 31 27 24,824.00 Premium on Bonds Payable 24 20,600.00 Loss on Redemption of Bonds 24 545,42400 Cash 25 19 Considering the journal entries for both years, answer the following questions. 1. What is the yearly payment amount required for the note payable? (Assume it is an installment note.) S 2. What is the interest rate on the note payable? % 3. Were the bonds in the entry on Dec. 31 of 20Y5 redeemed at maturity? 4. You suspect there is an error in one of the bond redemption entries. Assuming that the amounts are correct, which entry is questionable? Why? 5. Why do some bonds sell below face value? 6. Which of the following items are amortized? Check all that apply Interest expenses Contract rate of interest Discounts Redemption amount It depends on the face value of the bon pond Bonds Premiums Future cash receipts DATE DESCRIPTION POST. REF ACCOUNTINNG EOUATIOA ASSETS DEBIT CREDIT UABILITIES Jan. 1 Cash EQUITY 1,062,060.00 1 Premium on Bonds Payable 62,060.00 Bonds Payable 1,000,000.00 Jun 30 Interest Expense 19.39700 Premium on Bonds Payable 3,103.00 Cash 22,500 00 Jul. 1 Cash 1,921.28000 Discount on Bonds Payable 78,72000 Bonds Payable 2.000,000.00 1,100,00000 Oct 1 Cash 1,100,000.00 Notes Payable 19,39700 Dec. 31 Interest Expense 3,103.00 Premium on Bonds Payable 22,500.00 Cash 16,500.00 Interest Expense 31 16,500.00 Interest Payable 41,560.00 Interest Expense 31 6.560.00 Discount on Bonds Pavable Bonds Payable 2,000,000.00 Oct. 1 Cash 1,100,000.00 Notes Payable 1,100,000.00 Dec. 31 Interest Expense 19.39700 Premium on Bonds Payable 3.103.00 Cash 22.500.00 Interest Expense 31 16,500.00 Interest Payable 16,500.00 31 Interest Expense 41,56000 Discount on Bonds Payable 6,560.00 Cash 35,000.00 31 Income Summary 96,854.00 Interest Expense 96,854.00