Question

Assume that the CAPM holds. Consider a stock market that consists of only two risky securities, Stock 1 and Stock 2, with the following expected

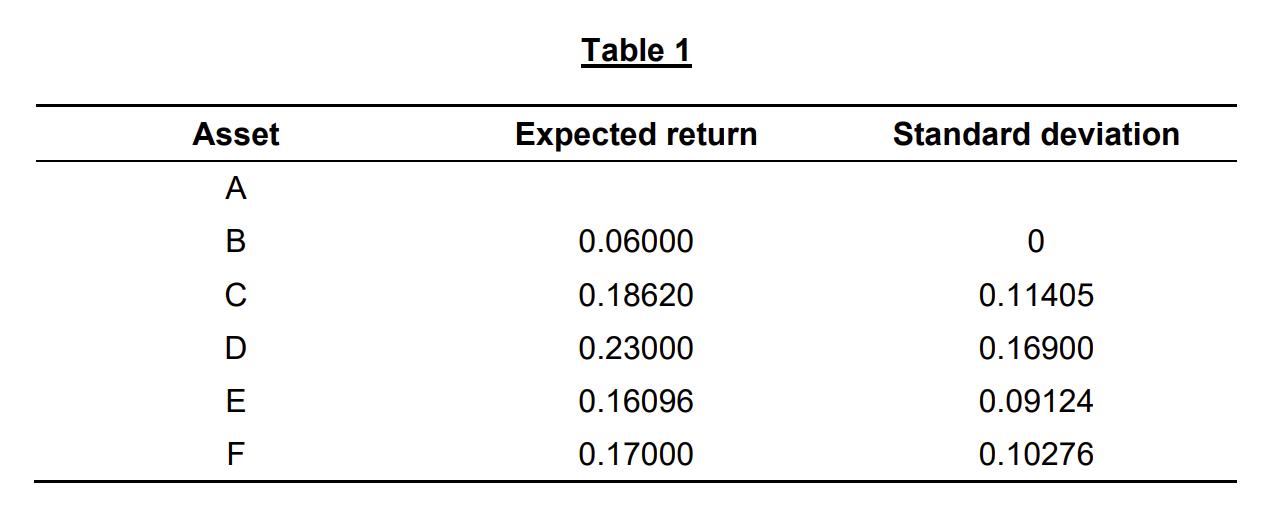

Assume that the CAPM holds. Consider a stock market that consists of only two risky securities, Stock 1 and Stock 2, with the following expected returns (µ) and standard deviations of returns (σ): µ1 = 0.25, σ1 = 0.20; µ2 = 0.15, σ2 = 0.10. Table 1 shows the expected returns and standard deviations for six assets, A to F (the entries for asset A are left intentionally blank). These assets are portfolios consisting of the risk-free asset, Stock 1, and Stock 2 in varying quantities (which may be positive, negative, or zero).

Given that Asset D has a zero investment in the risk-free asset and has a 0.8 weight in stock 1 and 0.2 weight in stock 2.

Given that Asset D has a zero investment in the risk-free asset and has a 0.8 weight in stock 1 and 0.2 weight in stock 2.

Given that the correlation between the returns of Stock 1 and Stock 2 is 0.40016 and the expected returns on asset A is 0.15588 and the standard deviation of asset A is 0.099410.

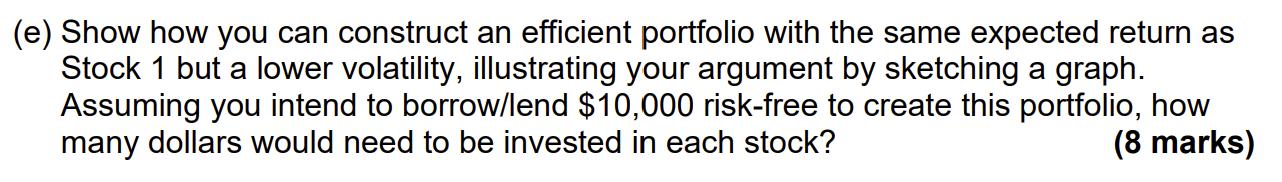

Answer part (e) as below:

Table 1 Asset Expected return Standard deviation A B C D E F 0.06000 0 0.18620 0.11405 0.23000 0.16900 0.16096 0.09124 0.17000 0.10276

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started