Question

Assume that the Florence PlasticsFlorence Plastics Inc., a manufacturer of plastic pipe for the construction industry and located in Red Deer, Alberta, faced the following

Assume that the Florence PlasticsFlorence Plastics Inc., a manufacturer of plastic pipe for the construction industry and located in Red Deer, Alberta, faced the following liability situations at June 30, 2017, the end of the company's fiscal year. Show how Florence PlasticsFlorence Plastics Inc. would report these liabilities on its balance sheet at June 30, 2017.

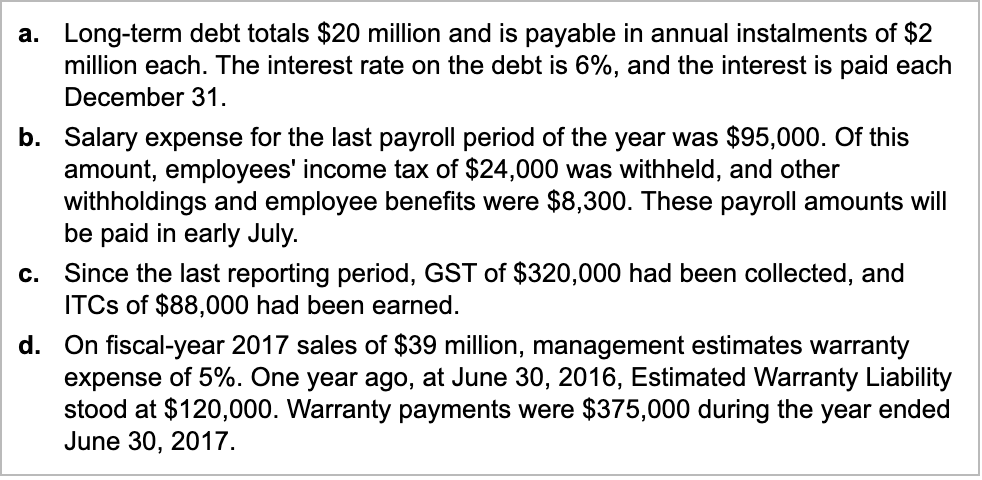

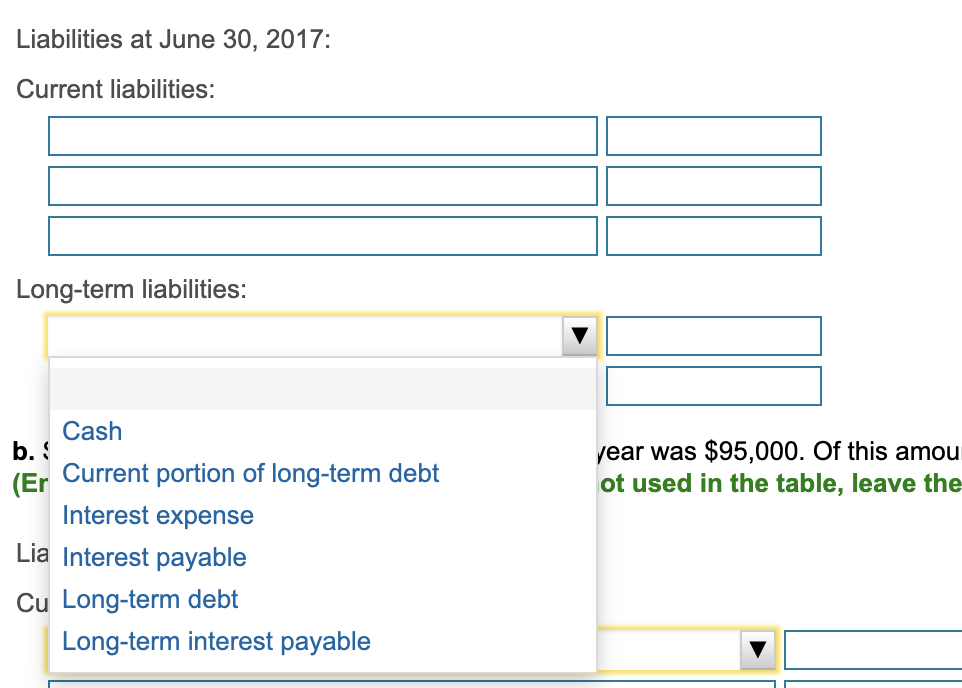

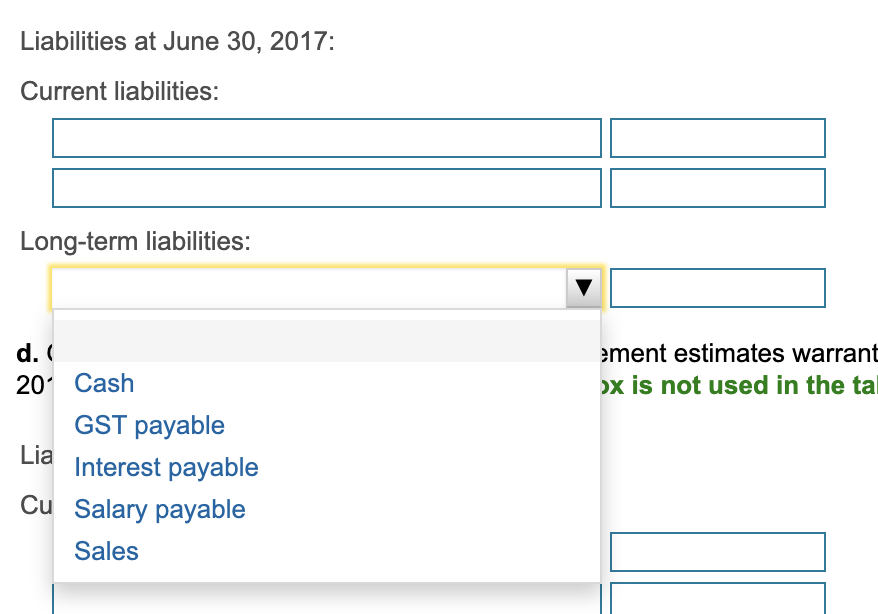

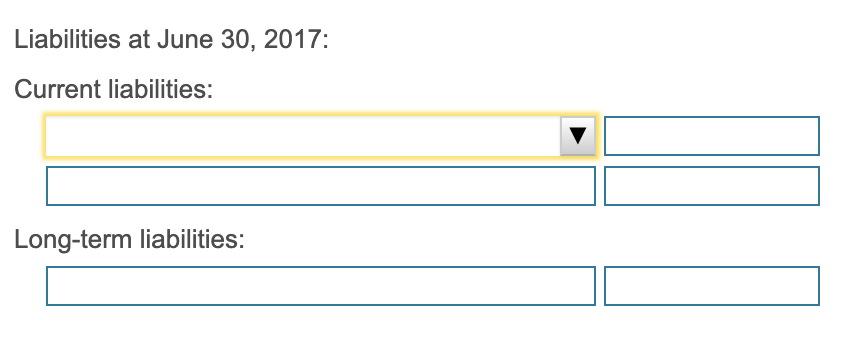

a. Long-term debt totals $20 million and is payable in annual instalments of $2 million each. The interest rate on the debt is 6%, and the interest is paid each December 31. (Enter all amounts in whole dollars. If a box is not used in the table, leave the box empty; do not select a label or enter a zero.)

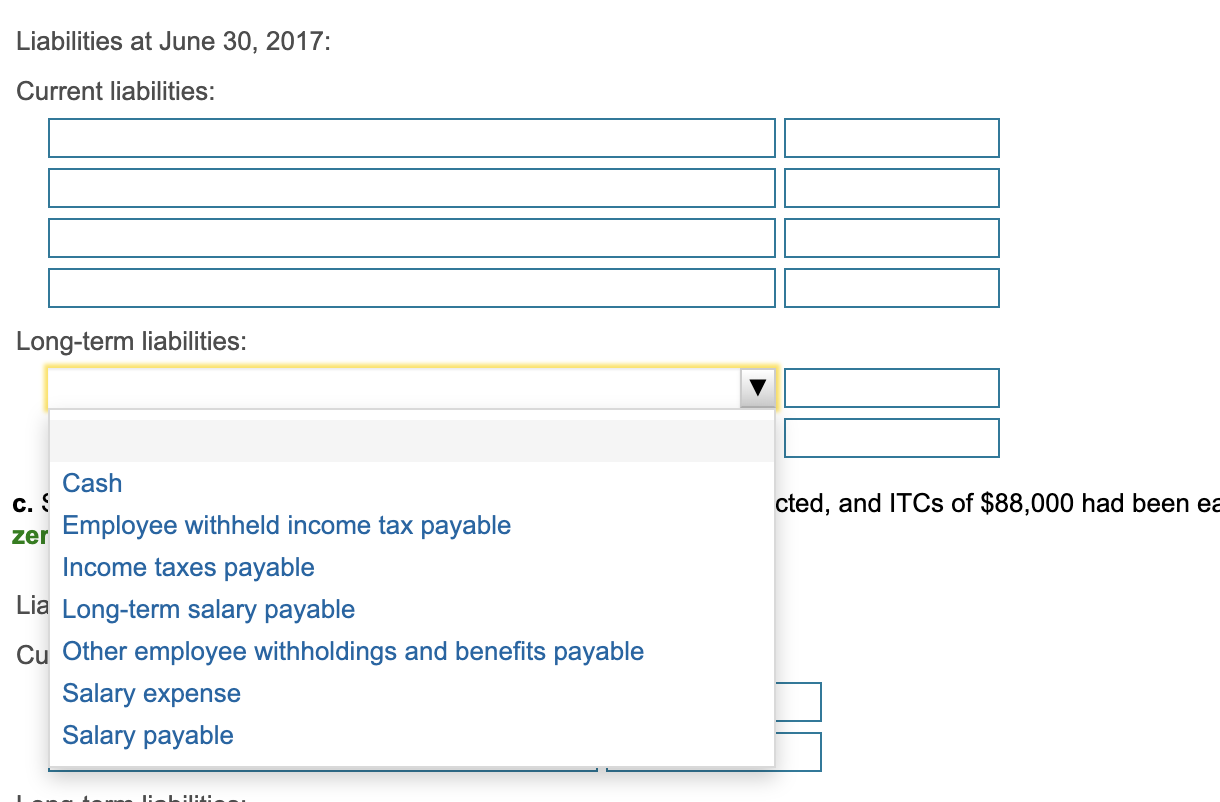

b. Salary expense for the last payroll period of the year was $95,000. Of this amount, employees' income tax of $24,000 was withheld, and other withholdings and employee benefits were $8,300. These payroll amounts will be paid in early July. (Enter all amounts in whole dollars. If a box is not used in the table, leave the box empty; do not select a label or enter a zero.)

c. Since the last reporting period, GST of $320,000 had been collected, and ITCs of $88,000 had been earned. (Enter all amounts in whole dollars. If a box is not used in the table, leave the box empty; do not select a label or enter a zero.)

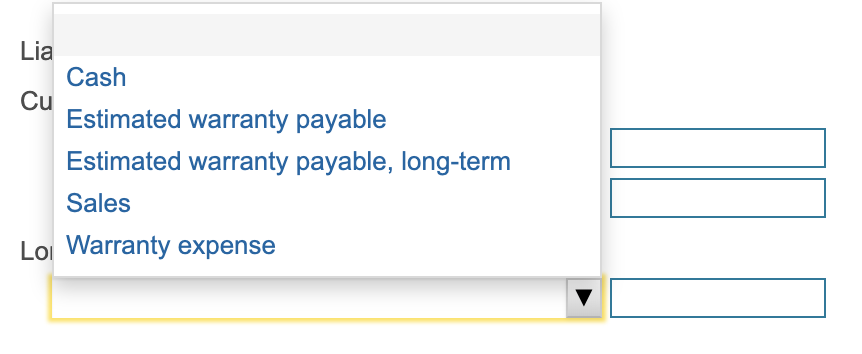

d. On fiscal-year 2017 sales of $39 million, management estimates warranty expense of 5%. One year ago, at June 30, 2016, Estimated Warranty Liability stood at $120,000.

Warranty payments were $375,000 during the year ended June 30, 2017. (Enter all amounts in whole dollars. If a box is not used in the table, leave the box empty; do not select a label or enter a zero.)

a. Long-term debt totals $20 million and is payable in annual instalments of $2 million each. The interest rate on the debt is 6%, and the interest is paid each December 31. b. Salary expense for the last payroll period of the year was $95,000. Of this amount, employees' income tax of $24,000 was withheld, and other withholdings and employee benefits were $8,300. These payroll amounts will be paid in early July. C. Since the last reporting period, GST of $320,000 had been collected, and ITCs of $88,000 had been earned. d. On fiscal-year 2017 sales of $39 million, management estimates warranty expense of 5%. One year ago, at June 30, 2016, Estimated Warranty Liability stood at $120,000. Warranty payments were $375,000 during the year ended June 30, 2017 Liabilities at June 30, 2017: Current liabilities: Long-term liabilities: year was $95,000. Of this amou ot used in the table, leave the (Er Cash b. Current portion of long-term debt Interest expense Lia Interest payable Cu Long-term debt Long-term interest payable Liabilities at June 30, 2017: Current liabilities: Long-term liabilities: ement estimates warrant >x is not used in the tal d.( 20- Cash GST payable Interest payable Cu Salary payable Sales Lia Liabilities at June 30, 2017: Current liabilities: Long-term liabilities: Cash Estimated warranty payable Estimated warranty payable, long-term Sales Loi Warranty expense

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started