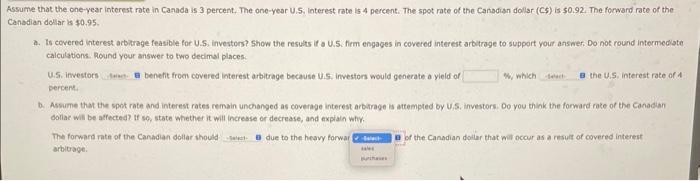

Assume that the one-year interest iate in Cansda is 3 percent. The one-year U.S, interest rate is 4 percent. The spot nate of the Carsdian dollar (Cs) is 50.92 . The forward rate of the: Canadian dollar is 50.95 a. Is covered interest arbitrge feosible for U.S. Investons? Show the results if a U.S. firm engages in covered interest arbitrage to support your answer. Do not round intermediate calculations. Round your answer to two decimul places. U.5. investers benefi from covered interest arbitrage because U.S. investors would generate a yield of S, which the U.S. interest rate of 4 percent b. Assume that the spot rate and interest rates remain unchanged as coverage interest arbitrage is attempted by U.5; investors. Do you think the forward rate of the Canadian doliar will be affected? If so, state whether it will increase or decrease, and explain why. The forward rspe of the Canadian dollar should due to the beavy forward of the Canadian dollor that witi occur as a resuit of covered interest arbitrage. a. Is covered interest arbitrage feasible for U.S. investors? Show the results if a U.S. firm engages in covered interest arbitrage to support your answec. Do not round interinediate caiculations. Round your answer to two decimal places. U.S. investo benefit from covered interest arbitrage because U.S. investars would generate a yeid of W, which the U.S. interest rate of 4 percent. ias b. Assume that uw wqur rate and interost rates remain unchanged as coverage imerest arbitrage is attempted by U.S. investors. Do you think the forward rate of the Canadian dollar will be affected? if wo, state whether it will incresse or decrease, and explain why. The forward rate of the Canadian dollar should due to the heavy forward of the Canadian dollar that will cccur as a result of covered interent arbitrage ussume that the one-year interest rate in Cansda is 3 percent. The one-year U.S. interest rate is 4 percent. The spot rate of the Canadian doliar (C5) is s0.92. The forward rate of the Canadian dollar is $0.95. a. Is covered interest arbitrage feasible for U.S. investors? Show the results if a U.S. firm engages in covered interest arbitrage to support your answer. Do not round intermedlate calculabions. Round your antwer to two decimst places. U.5. investors benefit from covered interest arbitrage because U.S. Investors would generate a yleld of percent: b. Aswime that the loet rate and interest rates remain unchanged as coverpge interest arbitnage is attempted by U.S. investork. Do you treis ine iorward rate of the Canadin dollar will be alfected? If so, state whether it will incresse or decrease, and explain wiy: The formard rake of the Canadun dollar should due to the heavy forward of the Canadan dolisr that will occur as a cesuit of covered interest arbitroge. Assume that the one-year interest rate in Canods is 3 percent. The one-year U.S. interest rate is 4 percent. The spot rate of the Canadian dollar (CS) is so.92. The forward rate of the Canadian dollar is 50.95 . a. Is covered interest arbitrage feasible for U.S. investors? Show the resuits if a U.S. firm engages in covered interest arbitrage to support your answer. Do not round intermedtate caiculations. Round your answer to two decimal pisces. U.5. investors benefit trom covered interest arbitrage because U.S. investors would generate a yield of Which the U.S. interest rate of 4 percent. 6. Aswime that the spot rate and intereut rates remain unchonged as coverage interest arbitrage is attempted by u.5. inveiters. Do vou think the forward rate of the Canaean dollar n wh be affected? if so, state whether it will increase or decrease, and explain why. The forward rate of the Candian dotiar shou oue to the heavy forward of the Canadian doliar that will eccur as a result of covered interest arbitroge. Essume that the one-year interest rate in Canada is 3 percent. The one-year U.5. interest rabe is 4 percent. The spot rate of the Canadisn dollar (C5) is s0.92. The forward rate of the Canddian dollar is $0.95. a. Is covered interest arbitrage feasible for U.S; investors? Show the results if a U.5. firm engages in covered interest arbitrage to support your answer. Do nok round intermediate calculations. Round your answer to two decimbl places. 0.5. investors benefit from covered interest arbitrage becavise U.S. investors would generate a yield of W. which the 4.5 , interest rate of A percent. b. Assume that the spot rath and interest rates remain unchanged as coverage interest arbatrage is attempted by U.S, investors. Do you think the forward rate of the Canacian doliae will be affected? if so, state whether it will incresse or decrease, and expiain why. The forward rate of the Canadan dollar thould due to the hesvy forwal Iof the Canadian doilar that wil occur as a result of covered interest arbitrage