Answered step by step

Verified Expert Solution

Question

1 Approved Answer

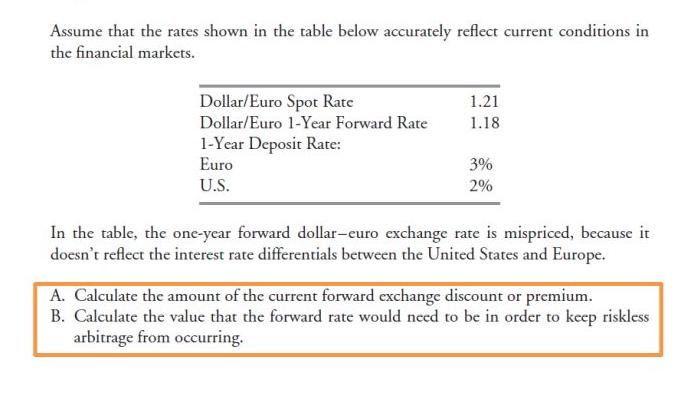

Assume that the rates shown in the table below accurately reflect current conditions in the financial markets. Dollar/Euro Spot Rate Dollar/Euro 1-Year Forward Rate

Assume that the rates shown in the table below accurately reflect current conditions in the financial markets. Dollar/Euro Spot Rate Dollar/Euro 1-Year Forward Rate 1-Year Deposit Rate: Euro U.S. 1.21 1.18 3% 2% In the table, the one-year forward dollar-euro exchange rate is mispriced, because it doesn't reflect the interest rate differentials between the United States and Europe. A. Calculate the amount of the current forward exchange discount or premium. B. Calculate the value that the forward rate would need to be in order to keep riskless arbitrage from occurring.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the current forward exchange discount or premium and to find the value the forward rate would need to be in order to keep riskless arbitr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started