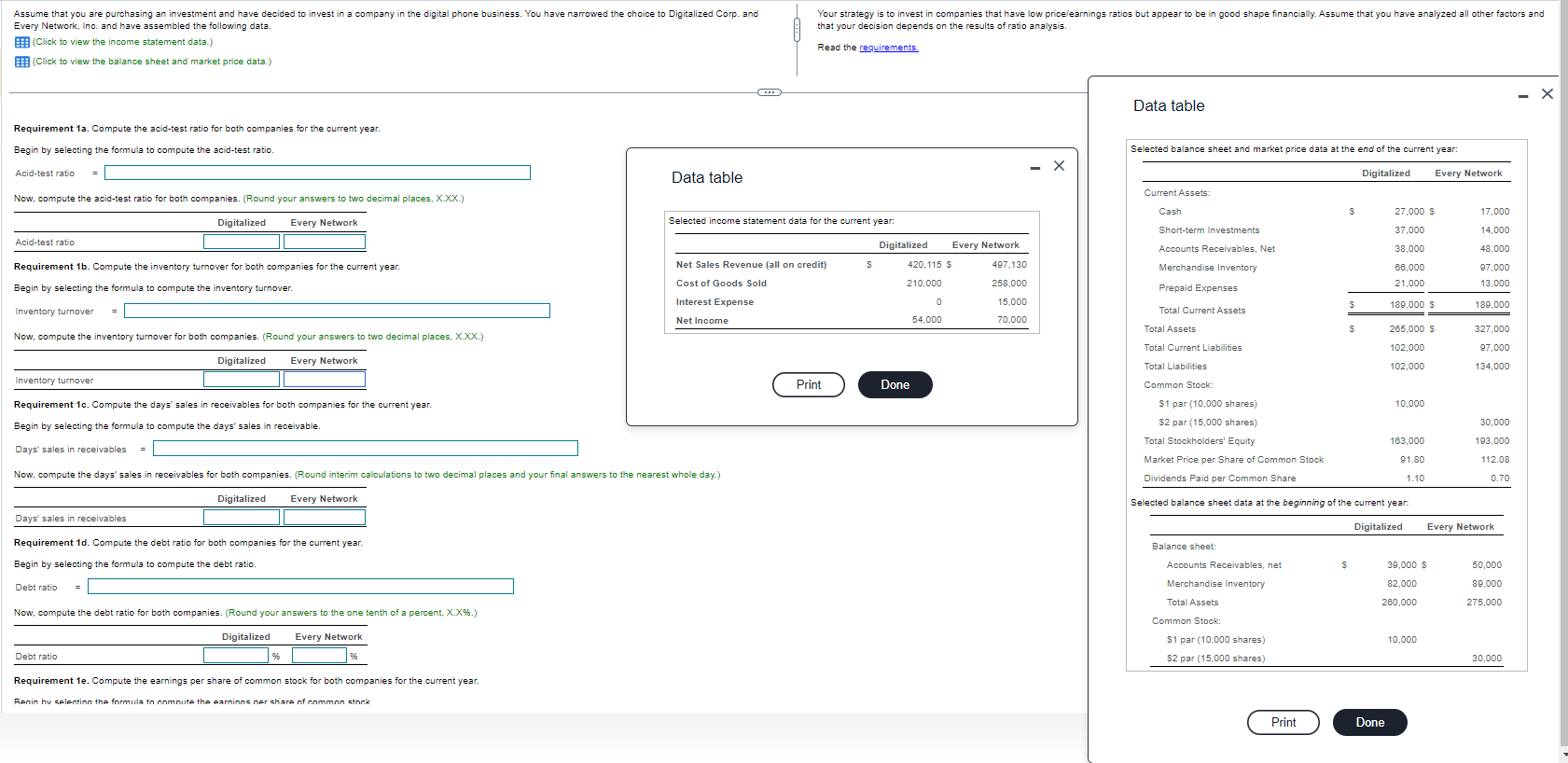

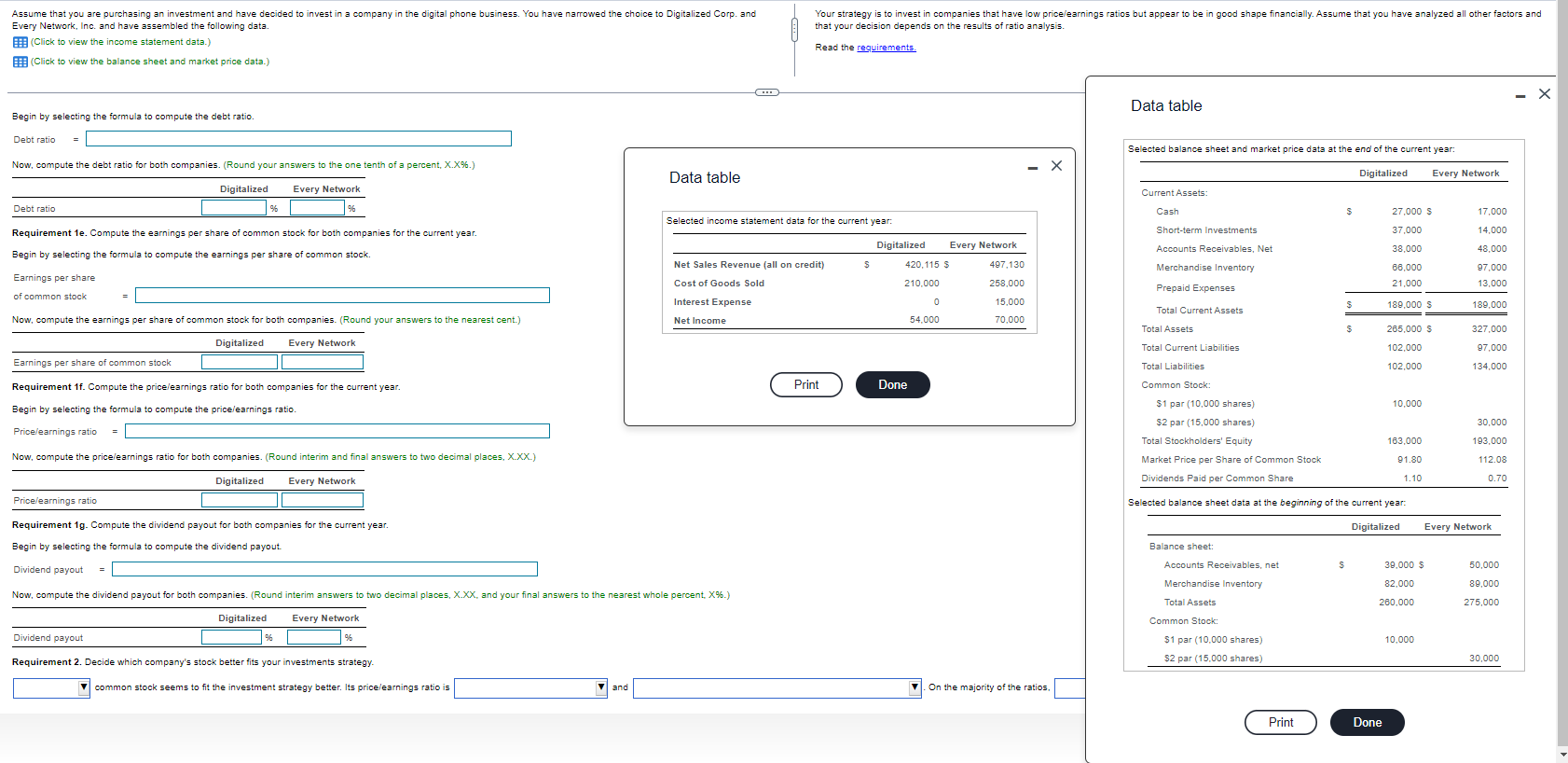

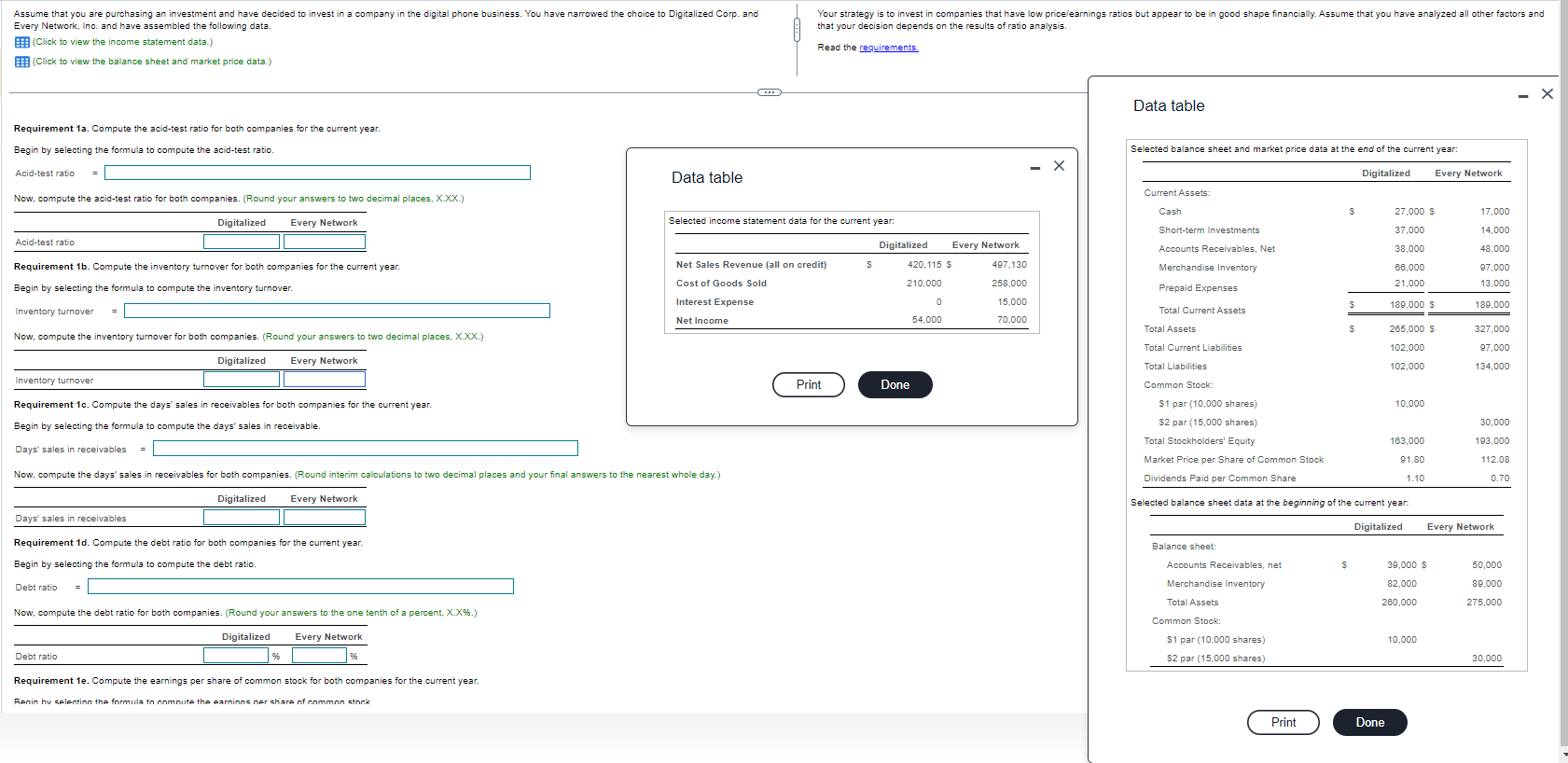

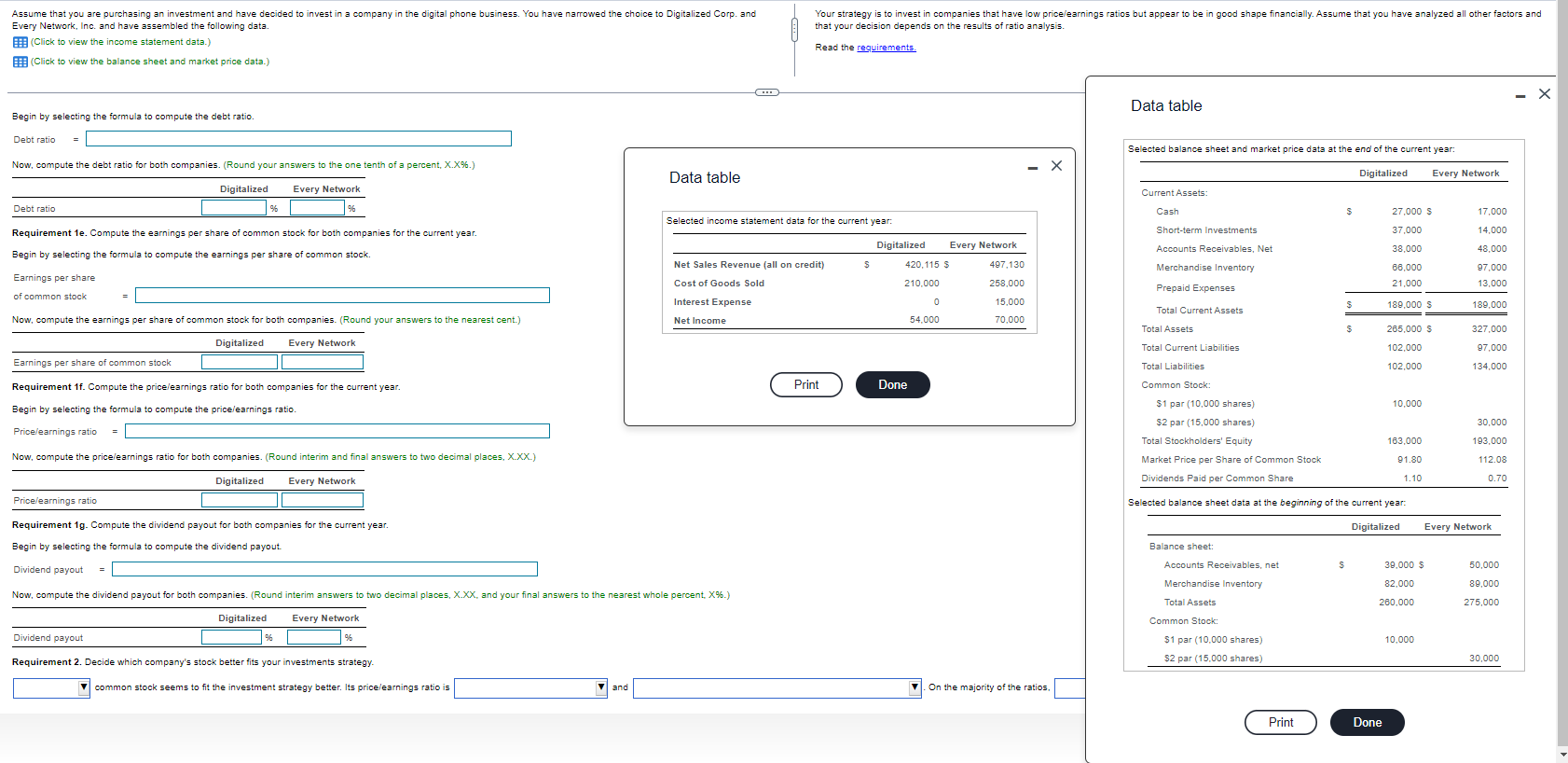

Assume that you are purchasing an investment and have decided to invest in a company in the digital phone business. You have narrowed the choice to Digitalized Corp. and Your strategy is to invest in companies that have low price/earnings ratios but appear to be in good shape financially. Assume that you have analyzed all other factors and Every Network, Inc. and have assembled the following data. (Click to view the income statement data.) that your decision depends on the results of ratio analysis. Requirement 1a. Compute the acid-test ratio for both companies for the current year. Begin by selecting the formula to compute the acid-test ratio. Acid-test ratio = Data table Now, compute the acid-test ratio for both companies. (Round your answers to two decimal places, X.XXX.) Selected income statement data for the current vear: Requirement 1b. Compute the inventory turnover for both companies for the current year. Begin by selecting the formula to compute the inventory turnover. Inventory turnover = Now, compute the inventory turnover for both companies. (Round your answers to two decimal places, X.XX.) Requirement 1c. Compute the days' sales in receivables for both companies for the current year. Begin by selecting the formula to compute the days' sales in receivable. Days' sales in receivables = Now, compute the days' sales in receivables for both companies. (Round interim calculations to two decimal places and your final answers to the nearest whole day.) Selected balance sheet data at the beginning of the current year: Requirement 1d. Compute the debt ratio for both companies for the current year. Begin by selecting the formula to compute the debt ratio Debt ratio = Now, compute the debt ratio for both companies. (Round your answers to the one tenth of a percent, X.X\%.) \begin{tabular}{lrrr} \hline Debt ratio & ninitslizan & Every Network \\ \hline & & \( \longdiv { \% } \) & \\ \hline \end{tabular} Requirement 1e. Compute the earnings per share of common stock for both companies for the current year. Fenin bu gelentinn the formula to nomnute the parninns ner ghare nf nnmmnn atnrk