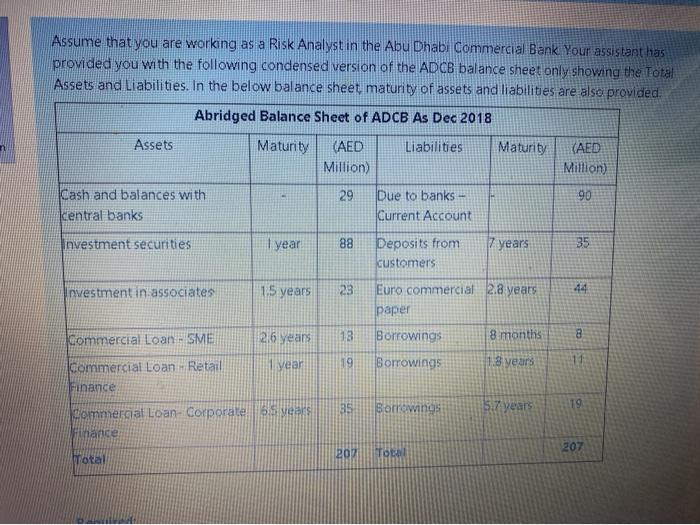

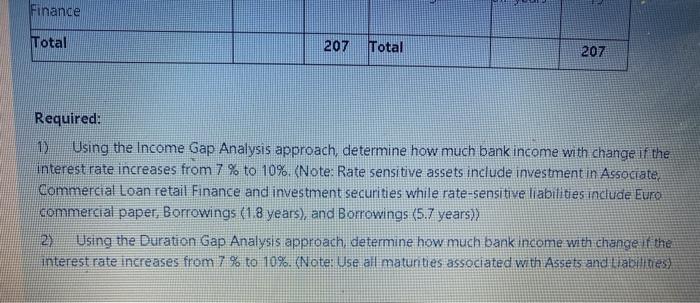

Assume that you are working as a Risk Analyst in the Abu Dhabi Commercial Bank. Your assistant has provided you with the following condensed version of the ADCB balance sheet only showing the Total Assets and Liabilities. In the below balance sheet maturity of assets and liabilities are also provided Abridged Balance Sheet of ADCB As Dec 2018 Assets Maturity (AED Liabilities Maturity (AED Million) Million) Cash and balances with 29 Due to banks - 90 central banks Current Account Investment securities 1 year 88 Deposits from 7 years 35 customers Investment in associates 1.5 years 23 14 Euro commercial 2.8 years paper 216 years commercial Loan - SME 18 8 months 8 Borrowings Sorrowings 19 year 10 1.8 years commercial Loan Retail Finance 35 19 Borowing 57 years commercial Loan-Corporate years Finance 202 Total 207 Total Finance Total 207 Total 207 Required: 1) Using the Income Gap Analysis approach, determine how much bank income with change if the interest rate increases from 7% to 10%. (Note: Rate sensitive assets include investment in Associate, Commercial Loan retail Finance and investment securities while rate-sensitive liabilities include Euro commercial paper, Borrowings (1.8 years), and Borrowings (5.7 years)) 2) Using the Duration Gap Analysis approach, determine how much bank income with change if the interest rate increases from 7 % to 10%. (Note: Use all matunties associated with Assets and abilities) Assume that you are working as a Risk Analyst in the Abu Dhabi Commercial Bank. Your assistant has provided you with the following condensed version of the ADCB balance sheet only showing the Total Assets and Liabilities. In the below balance sheet maturity of assets and liabilities are also provided Abridged Balance Sheet of ADCB As Dec 2018 Assets Maturity (AED Liabilities Maturity (AED Million) Million) Cash and balances with 29 Due to banks - 90 central banks Current Account Investment securities 1 year 88 Deposits from 7 years 35 customers Investment in associates 1.5 years 23 14 Euro commercial 2.8 years paper 216 years commercial Loan - SME 18 8 months 8 Borrowings Sorrowings 19 year 10 1.8 years commercial Loan Retail Finance 35 19 Borowing 57 years commercial Loan-Corporate years Finance 202 Total 207 Total Finance Total 207 Total 207 Required: 1) Using the Income Gap Analysis approach, determine how much bank income with change if the interest rate increases from 7% to 10%. (Note: Rate sensitive assets include investment in Associate, Commercial Loan retail Finance and investment securities while rate-sensitive liabilities include Euro commercial paper, Borrowings (1.8 years), and Borrowings (5.7 years)) 2) Using the Duration Gap Analysis approach, determine how much bank income with change if the interest rate increases from 7 % to 10%. (Note: Use all matunties associated with Assets and abilities)