Question

Assume that you can borrow or lend in the US for 2-years at a 4% (annual) rate, and assume that you can borrow or

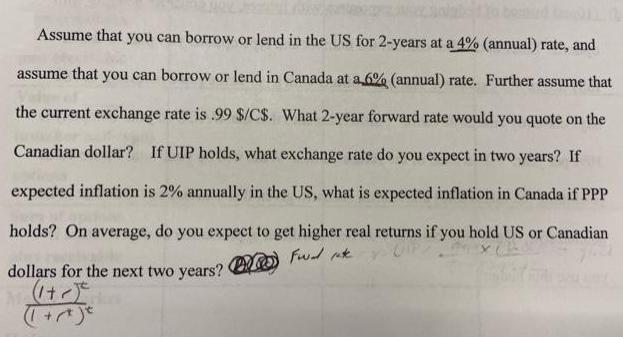

Assume that you can borrow or lend in the US for 2-years at a 4% (annual) rate, and assume that you can borrow or lend in Canada at a 6% (annual) rate. Further assume that the current exchange rate is .99 $/C$. What 2-year forward rate would you quote on the Canadian dollar? If UIP holds, what exchange rate do you expect in two years? If expected inflation is 2% annually in the US, what is expected inflation in Canada if PPP holds? On average, do you expect to get higher real returns if you hold US or Canadian dollars for the next two years? ()

Step by Step Solution

3.41 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Solution Uncovered Interest Rate Parity Interest rate in US ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals of Futures and Options Markets

Authors: John C. Hull

8th edition

978-1292155036, 1292155035, 132993341, 978-0132993340

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App