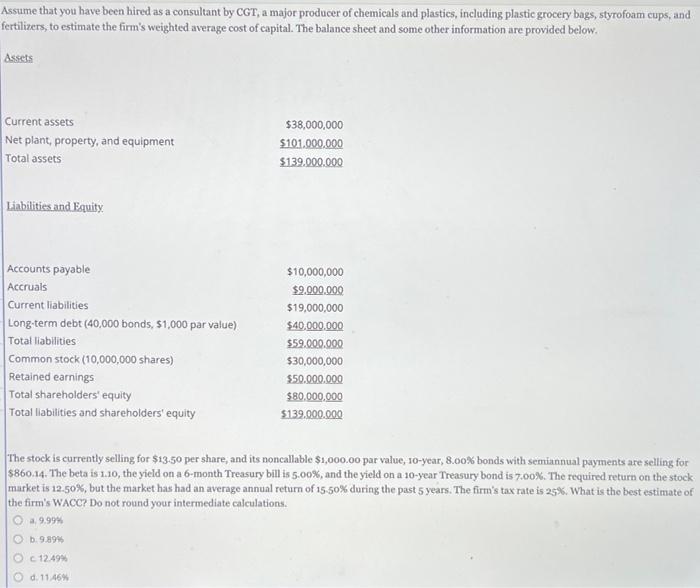

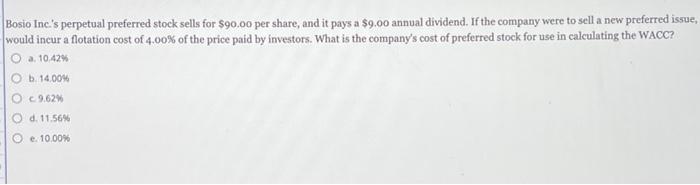

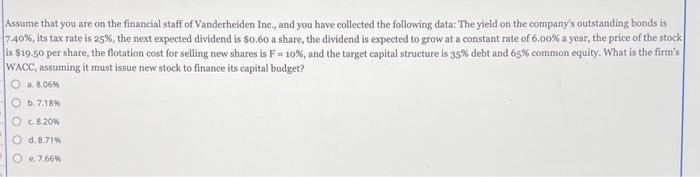

Assume that you have been hired as a consultant by CGT, a major producer of chemicals and plastics, including plastic grocery bags, styrofoam cups, and fertilizers, to estimate the firm's weighted average cost of capital. The balance sheet and some other information are provided below. Assets Current assets Net plant, property, and equipment Total assets $38,000,000 $101.000.000 $139.000.000 Liabilities and Equity Accounts payable Accruals Current liabilities Long-term debt (40,000 bonds, $1,000 par value) Total liabilities Common stock (10,000,000 shares) Retained earnings Total shareholders' equity Total liabilities and shareholders' equity $10,000,000 $9.000.000 $19,000,000 $40,000,000 559.000.000 $30,000,000 $50.000.000 $80,000,000 $139.000.000 The stock is currently selling for $13.50 per share, and its noncallable $1,000.00 par value, 10-year, 8.00% bonds with semiannual payments are selling for $860.14. The beta is 1.10, the yield on a 6-month Treasury bill is 5.00%, and the yield on a 10-year Treasury bond is 7.00%. The required return on the stock market is 12.50%, but the market has had an average annual return of 15-50% during the past 5 years. The firm's tax rate is 25%. What is the best estimate of the firm's WACC? Do not round your intermediate calculations. 9.99% b: 9.89 12.49% d. 11,46% Bosio Inc.'s perpetual preferred stock sells for $90.00 per share, and it pays a $9.00 annual dividend. If the company were to sell a new preferred issue, would incur a flotation cost of 4.00% of the price paid by investors. What is the company's cost of preferred stock for use in calculating the WACC? a. 10.42% b. 14.00% O 962 d. 11.56% e. 10.00% Assume that you are on the financial staff of Vanderheiden Inc., and you have collected the following data: The yield on the company's outstanding bonds is 7.40%, its tax rate is 25%, the next expected dividend is $0.60 a share, the dividend is expected to grow at a constant rate of 6.00% a year, the price of the stock is $19.50 per share the flotation cost for selling new shares is F = 10%, and the target capital structure is 35% debt and 65% common equity. What is the firm's WACC, assuming it must issue new stock to finance its capital budget? a8.06 b.7.189 c.8.20 O d. 8.719 @ .7.66%