Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assume that you recently graduated with an MBA degree and have just landed a job as a financial planner with Henrys Investment Inc. Your first

Assume that you recently graduated with an MBA degree and have just landed a job as a financial planner with Henrys Investment Inc. Your first assignment is to create a portfolio for a client by selecting two stocks on the market.

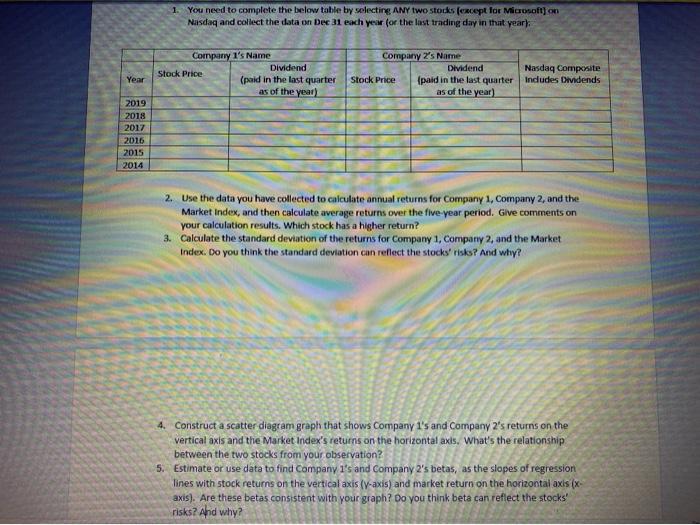

1. You need to complete the below table by selecting ANY two stocks (except for Microsoft) on Nasdaq and collect the data on Dec 31 each year (or the last trading day in that year):

| Company 1s Name | Company 2s Name | Nasdaq Composite Includes Dividends | ||

Year | Stock Price

| Dividend (paid in the last quarter as of the year) | Stock Price | Dividend (paid in the last quarter as of the year) |

|

2019 |

|

|

|

|

|

2018 |

|

|

|

|

|

2017 |

|

|

|

|

|

2016 |

|

|

|

|

|

2015 |

|

|

|

|

|

2014 |

| ||||

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started