Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assume that you will buy and operate a piece of equipment. The machine costs $425,000. You estimate that the equipment will generate $100,000 revenue,

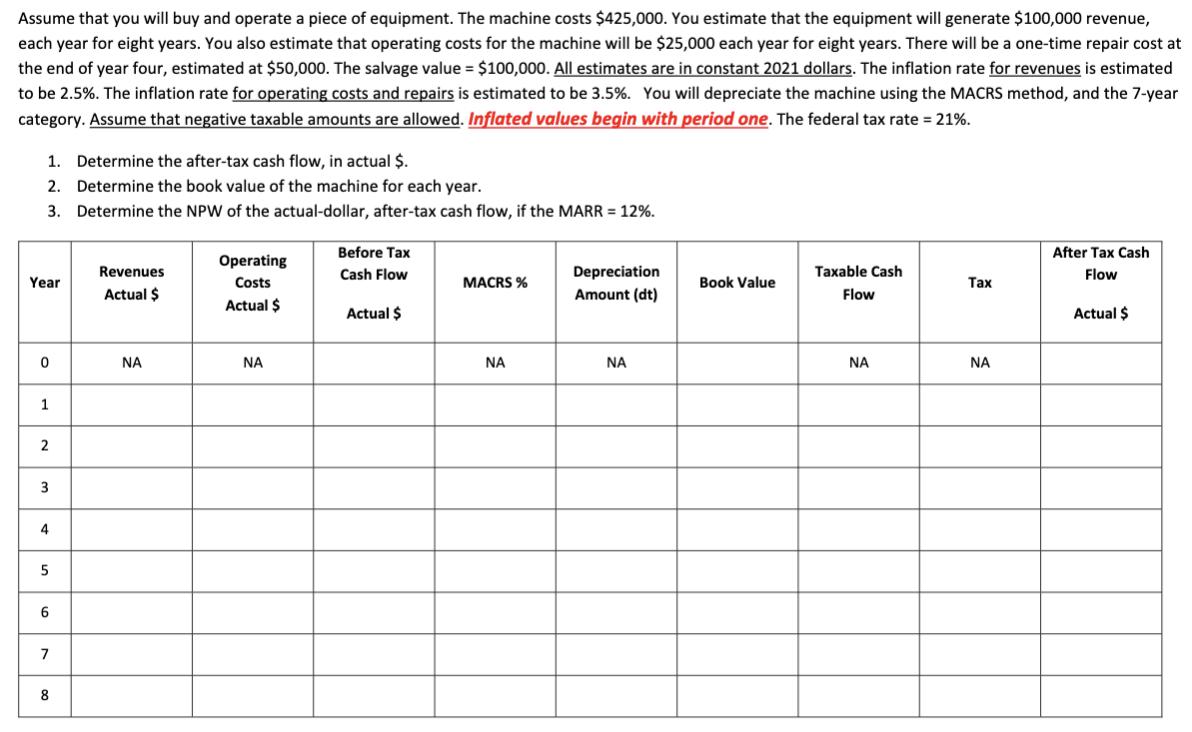

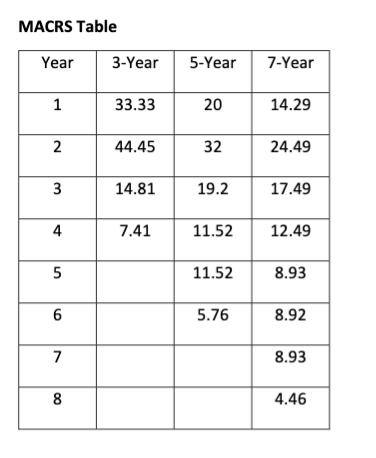

Assume that you will buy and operate a piece of equipment. The machine costs $425,000. You estimate that the equipment will generate $100,000 revenue, each year for eight years. You also estimate that operating costs for the machine will be $25,000 each year for eight years. There will be a one-time repair cost at the end of year four, estimated at $50,000. The salvage value = $100,000. All estimates are in constant 2021 dollars. The inflation rate for revenues is estimated to be 2.5%. The inflation rate for operating costs and repairs is estimated to be 3.5%. You will depreciate the machine using the MACRS method, and the 7-year category. Assume that negative taxable amounts are allowed. Inflated values begin with period one. The federal tax rate = 21%. 1. Determine the after-tax cash flow, in actual $. 2. Determine the book value of the machine for each year. 3. Determine the NPW of the actual-dollar, after-tax cash flow, if the MARR = 12%. Year 0 1 2 3 4 5 6 7 8 Revenues Actual $ Operating Costs Actual $ Before Tax Cash Flow Actual $ MACRS % Depreciation Amount (dt) Book Value Taxable Cash Flow Tax After Tax Cash Flow Actual $ MACRS Table Year 1 2 3 4 5 6 7 8 3-Year 33.33 44.45 14.81 7.41 5-Year 20 32 19.2 11.52 11.52 5.76 7-Year 14.29 24.49 17.49 12.49 8.93 8.92 8.93 4.46

Step by Step Solution

★★★★★

3.38 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started