Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assume that you wish to purchase a bond with a 25-year maturity, an annual coupon rate of 5.9 percent, a face value of RM1,000, and

- Assume that you wish to purchase a bond with a 25-year maturity, an annual coupon rate of 5.9 percent, a face value of RM1,000, and semiannual interest payments. If you require a 8 percent nominal yield to maturity on this investment, what is the maximum price you should be willing to pay for the bond?

- You intend to purchase a 10-year, RM1,000 face value bond that pays interest of RM66 every 6 months. If you are willing to pay RM 1,124 for this bond, calculate the nominal annual required rate of return, with semiannual compounding.

- The last dividend paid by Fall Company was RM2.40. Fall's growth rate is expected to be a constant 5 percent for 4 years, after which dividends are expected to grow at a rate of 10.5 percent forever. Fall's required rate of return on equity (rs) is 11 percent. What is the current price of Fall's common stock?

- You deposit RM5,000 each year in a savings account that pays 14 percent interest annually, compounded semiannually. How much will your account be worth in 14 years? Recalculate if the saving account pays 14 percent interest annually, compounded quarterly? Explain how does your present value and future value change, if you earn a higher compounding for your investments?

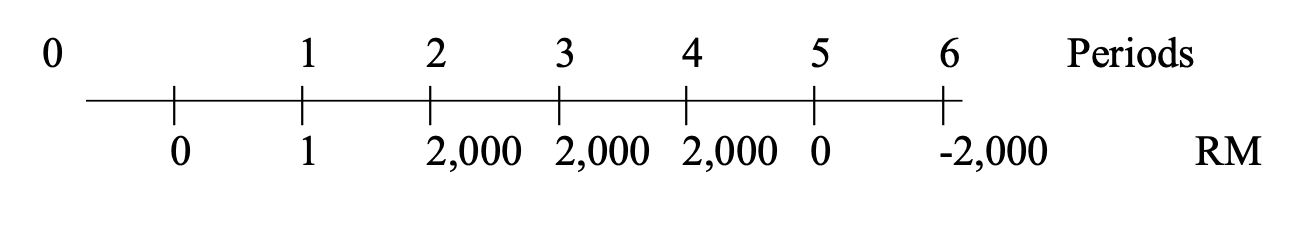

- You are given the following cash flows. What is the present value (t = 0) if the discount rate is 12.5 percent?

0 1 2 3 4 5 6 Periods + + + + 1 2,000 2,000 2,000 0 -2,000 RM

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The cash flows are Period 0 RM0 Period 1 RM1000 Period 2 RM2000 Period ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started