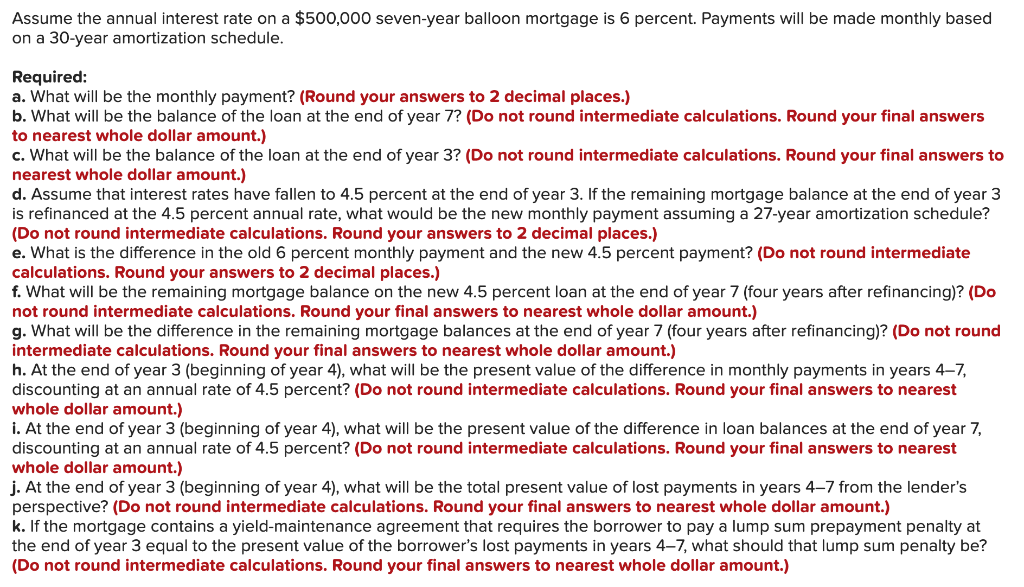

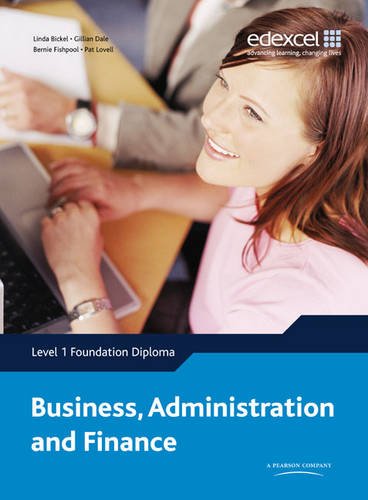

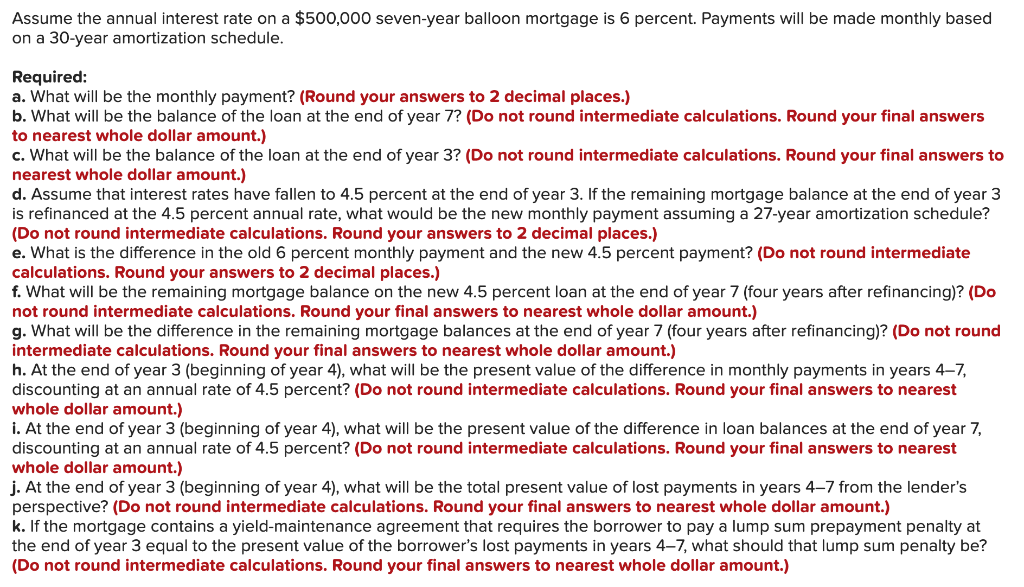

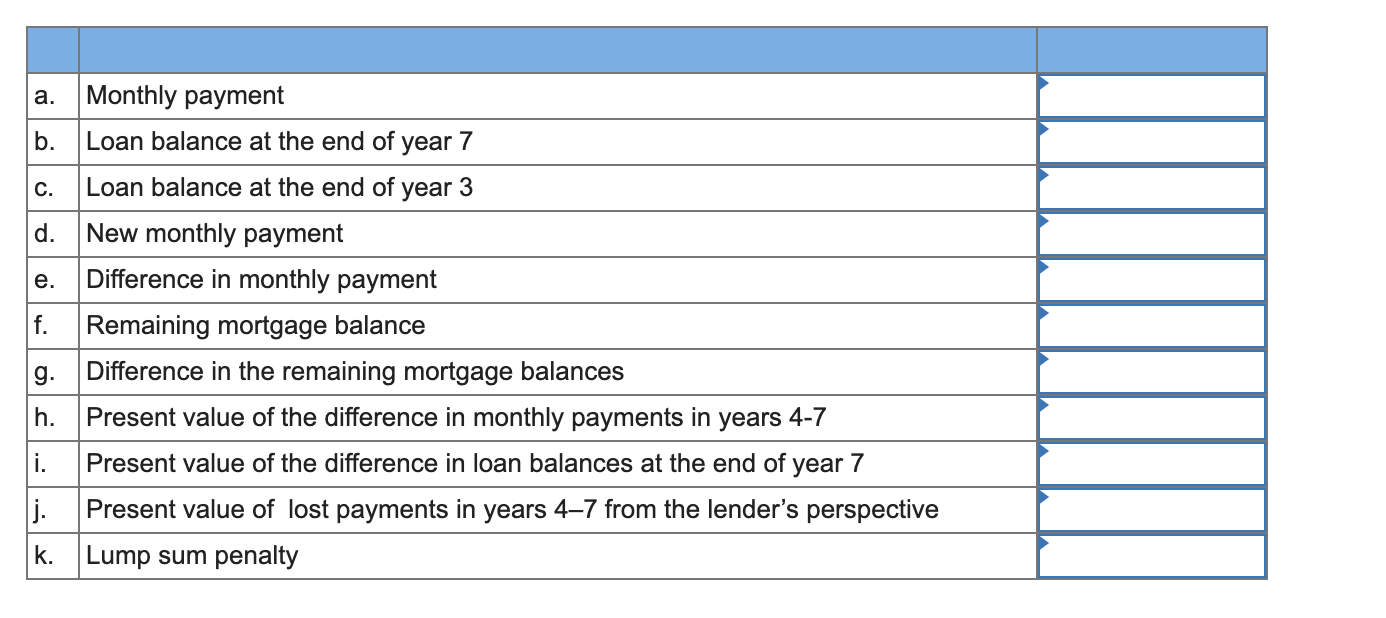

Assume the annual interest rate on a $500,000 seven-year balloon mortgage is 6 percent. Payments will be made monthly based on a 30-year amortization schedule. Required: a. What will be the monthly payment? (Round your answers to 2 decimal places.) b. What will be the balance of the loan at the end of year 7? (Do not round intermediate calculations. Round your final answers to nearest whole dollar amount.) c. What will be the balance of the loan at the end of year 3? (Do not round intermediate calculations. Round your final answers to nearest whole dollar amount.) d. Assume that interest rates have fallen to 4.5 percent at the end of year 3. If the remaining mortgage balance at the end of year 3 is refinanced at the 4.5 percent annual rate, what would be the new monthly payment assuming a 27-year amortization schedule? (Do not round intermediate calculations. Round your answers to 2 decimal places.) e. What is the difference in the old 6 percent monthly payment and the new 4.5 percent payment? (Do not round intermediate calculations. Round your answers to 2 decimal places.) f. What will be the remaining mortgage balance on the new 4.5 percent loan at the end of year 7 (four years after refinancing)? (Do not round intermediate calculations. Round your final answers to nearest whole dollar amount.) g. What will be the difference in the remaining mortgage balances at the end of year 7 (four years after refinancing)? (Do not round intermediate calculations. Round your final answers to nearest whole dollar amount.) h. At the end of year 3 (beginning of year 4), what will be the present value of the difference in monthly payments in years 4-7, discounting at an annual rate of 4.5 percent? (Do not round intermediate calculations. Round your final answers to nearest whole dollar amount.) i. At the end of year 3 (beginning of year 4), what will be the present value of the difference in loan balances at the end of year 7, discounting at an annual rate of 4.5 percent? (Do not round intermediate calculations. Round your final answers to nearest whole dollar amount.) j. At the end of year 3 (beginning of year 4), what will be the total present value of lost payments in years 4-7 from the lender's perspective? (Do not round intermediate calculations. Round your final answers to nearest whole dollar amount.) k. If the mortgage contains a yield-maintenance agreement that requires the borrower to pay a lump sum prepayment penalty at the end of year 3 equal to the present value of the borrower's lost payments in years 4-7, what should that lump sum penalty be? (Do not round intermediate calculations. Round your final answers to nearest whole dollar amount.) a. C. e. Monthly payment b. Loan balance at the end of year 7 Loan balance at the end of year 3 d. New monthly payment Difference in monthly payment f. Remaining mortgage balance g. Difference in the remaining mortgage balances h. Present value of the difference in monthly payments in years 4-7 Present value of the difference in loan balances at the end of year 7 j. Present value of lost payments in years 4-7 from the lender's perspective k. Lump sum penalty