Answered step by step

Verified Expert Solution

Question

1 Approved Answer

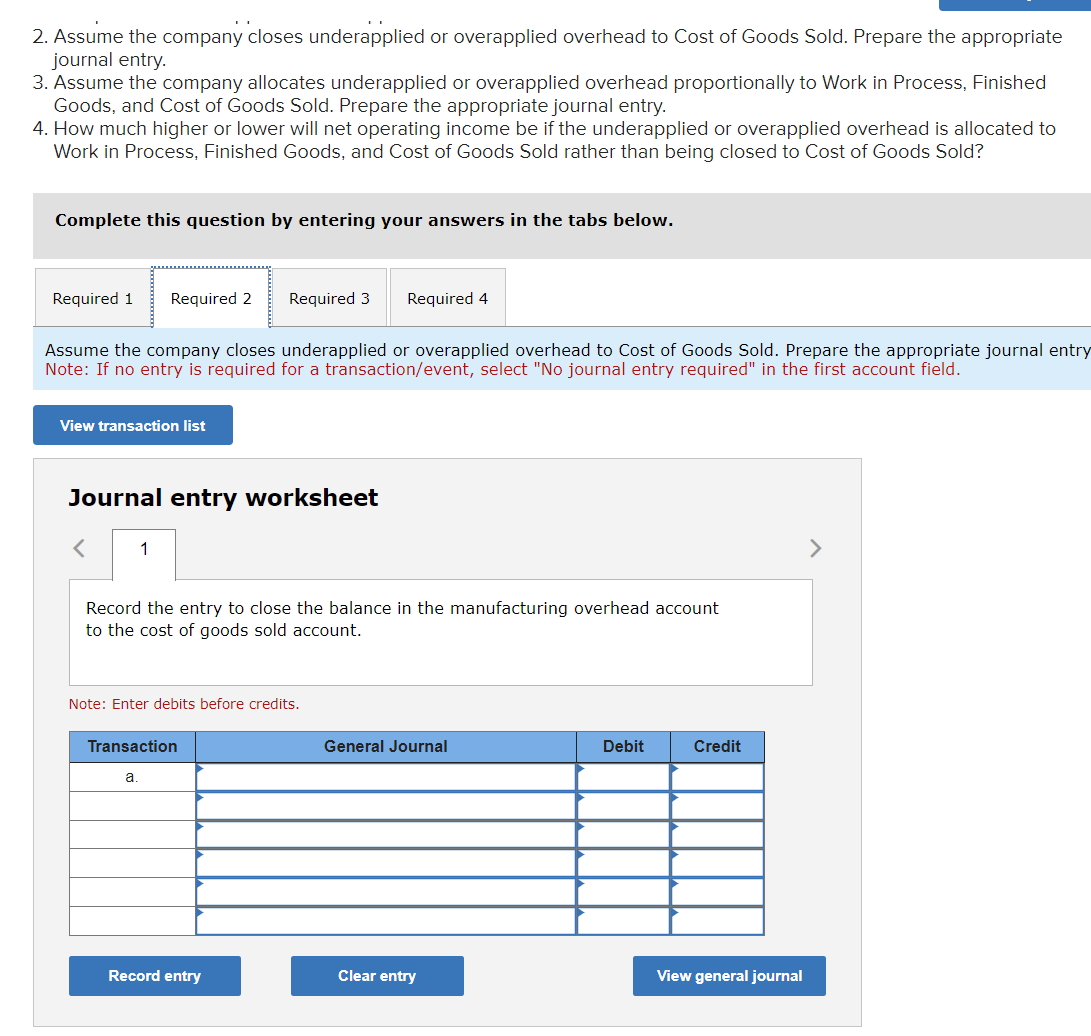

Assume the company closes underapplied or overapplied overhead to Cost of Goods Sold. Prepare the appropriate journal entry. Assume the company allocates underapplied or overapplied

Assume the company closes underapplied or overapplied overhead to Cost of Goods Sold. Prepare the appropriate

journal entry.

Assume the company allocates underapplied or overapplied overhead proportionally to Work in Process, Finished

Goods, and Cost of Goods Sold. Prepare the appropriate journal entry.

How much higher or lower will net operating income be if the underapplied or overapplied overhead is allocated to

Work in Process, Finished Goods, and Cost of Goods Sold rather than being closed to Cost of Goods Sold?

Complete this question by entering your answers in the tabs below.

Required

Assume the company closes underapplied or overapplied overhead to Cost of Goods Sold. Prepare the appropriate journal entry

Note: If no entry is required for a transactionevent select No journal entry required" in the first account field.

Journal entry worksheet

Record the entry to close the balance in the manufacturing overhead account

to the cost of goods sold account.

Note: Enter debits before credits.

Can you break it down

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started