Question

Assume the current spot rate is $1.1701/, and U.S. Dollar ($) is the home currency. A CALL option on Euro () has a strike

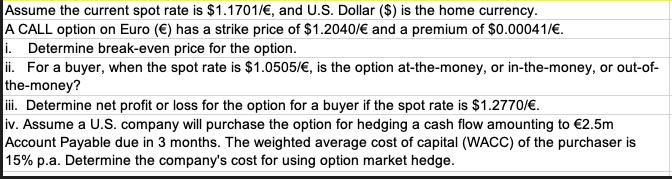

Assume the current spot rate is $1.1701/, and U.S. Dollar ($) is the home currency. A CALL option on Euro () has a strike price of $1.2040/ and a premium of $0.00041/. i. Determine break-even price for the option. ii. For a buyer, when the spot rate is $1.0505/, is the option at-the-money, or in-the-money, or out-of- the-money? iii. Determine net profit or loss for the option for a buyer if the spot rate is $1.2770/. iv. Assume a U.S. company will purchase the option for hedging a cash flow amounting to 2.5m Account Payable due in 3 months. The weighted average cost of capital (WACC) of the purchaser is 15% p.a. Determine the company's cost for using option market hedge.

Step by Step Solution

3.45 Rating (142 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION i The breakeven price for the option can be calculated by adding the strike price to the pr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Multinational Business Finance

Authors: David K. Eiteman, Arthur I. Stonehill, Michael H. Moffett

14th edition

133879879, 978-0133879872

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App