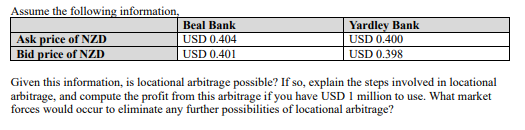

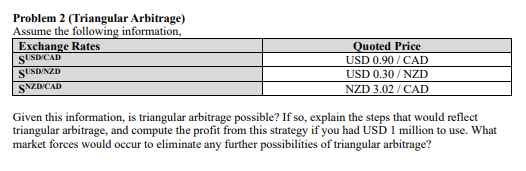

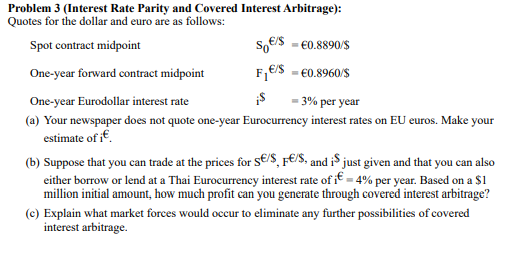

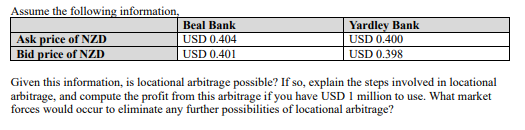

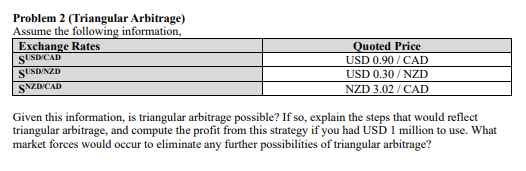

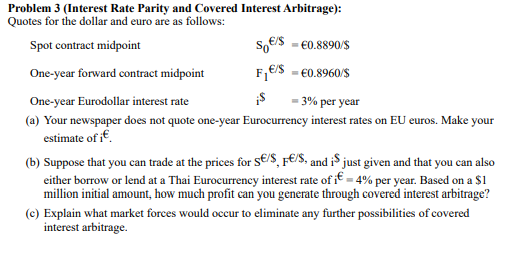

Assume the following information, Beal Bank Ask price of NZD USD 0.404 Bid price of NZD USD 0.401 Yardley Bank USD 0.400 USD 0.398 Given this information, is locational arbitrage possible? If so, explain the steps involved in locational arbitrage, and compute the profit from this arbitrage if you have USD 1 million to use. What market forces would occur to eliminate any further possibilities of locational arbitrage? Problem 2 (Triangular Arbitrage) Assume the following information, Exchange Rates SUNDICAD SUNDNZD SNZD CAD Quoted Price USD 0.90 / CAD USD 0.30/NZD NZD 3.02 / CAD Given this information, is triangular arbitrage possible? If so, explain the steps that would reflect triangular arbitrage, and compute the profit from this strategy if you had USD 1 million to use. What market forces would occur to eliminate any further possibilities of triangular arbitrage? Problem 3 (Interest Rate Parity and Covered Interest Arbitrage): Quotes for the dollar and euro are as follows: Spot contract midpoint s.$ = 0.8890$ One-year forward contract midpoint F,$ = 0.8960$ One-year Eurodollar interest rate - 3% per year (a) Your newspaper does not quote one-year Eurocurrency interest rates on EU euros. Make your estimate of it (b) Suppose that you can trade at the prices for s/$,f/, and is just given and that you can also either borrow or lend at a Thai Eurocurrency interest rate of it = 4% per year. Based on a $1 million initial amount, how much profit can you generate through covered interest arbitrage? (c) Explain what market forces would occur to eliminate any further possibilities of covered interest arbitrage. Assume the following information, Beal Bank Ask price of NZD USD 0.404 Bid price of NZD USD 0.401 Yardley Bank USD 0.400 USD 0.398 Given this information, is locational arbitrage possible? If so, explain the steps involved in locational arbitrage, and compute the profit from this arbitrage if you have USD 1 million to use. What market forces would occur to eliminate any further possibilities of locational arbitrage? Problem 2 (Triangular Arbitrage) Assume the following information, Exchange Rates SUNDICAD SUNDNZD SNZD CAD Quoted Price USD 0.90 / CAD USD 0.30/NZD NZD 3.02 / CAD Given this information, is triangular arbitrage possible? If so, explain the steps that would reflect triangular arbitrage, and compute the profit from this strategy if you had USD 1 million to use. What market forces would occur to eliminate any further possibilities of triangular arbitrage? Problem 3 (Interest Rate Parity and Covered Interest Arbitrage): Quotes for the dollar and euro are as follows: Spot contract midpoint s.$ = 0.8890$ One-year forward contract midpoint F,$ = 0.8960$ One-year Eurodollar interest rate - 3% per year (a) Your newspaper does not quote one-year Eurocurrency interest rates on EU euros. Make your estimate of it (b) Suppose that you can trade at the prices for s/$,f/, and is just given and that you can also either borrow or lend at a Thai Eurocurrency interest rate of it = 4% per year. Based on a $1 million initial amount, how much profit can you generate through covered interest arbitrage? (c) Explain what market forces would occur to eliminate any further possibilities of covered interest arbitrage