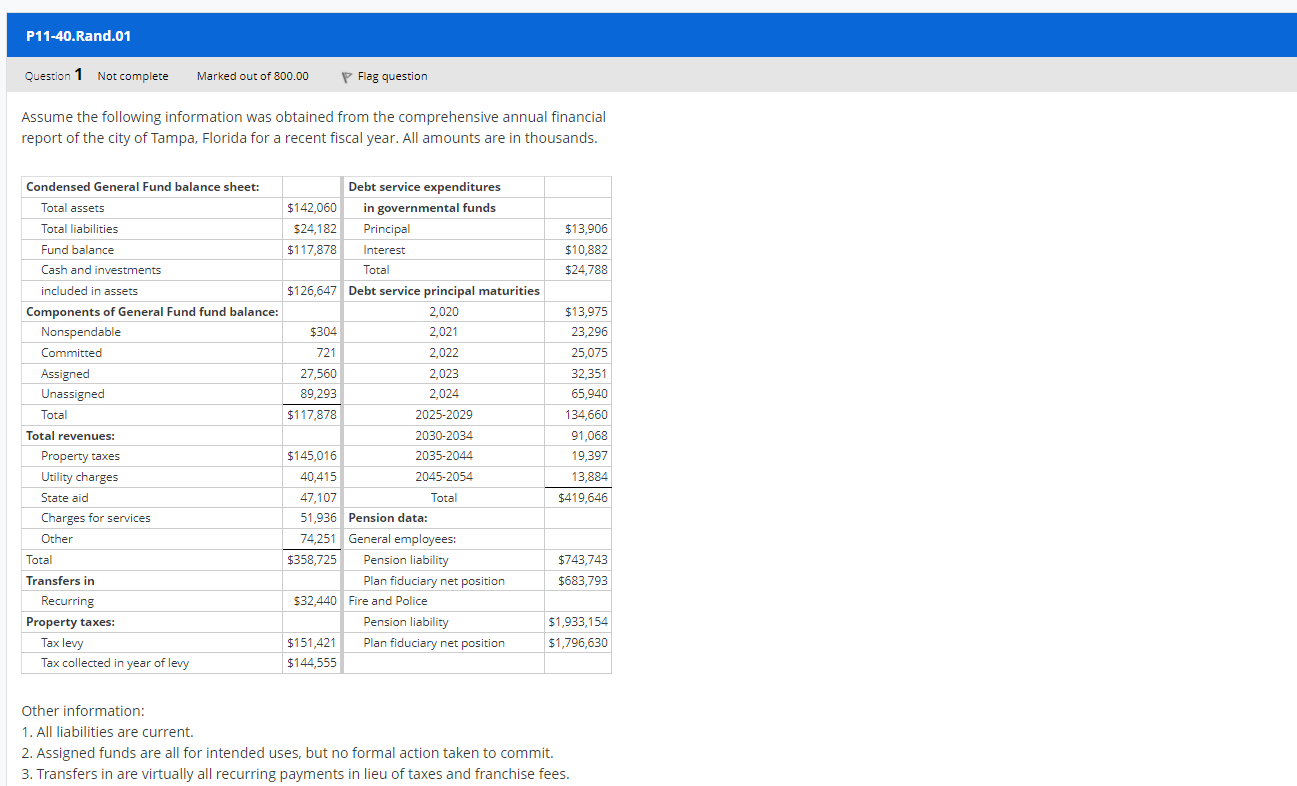

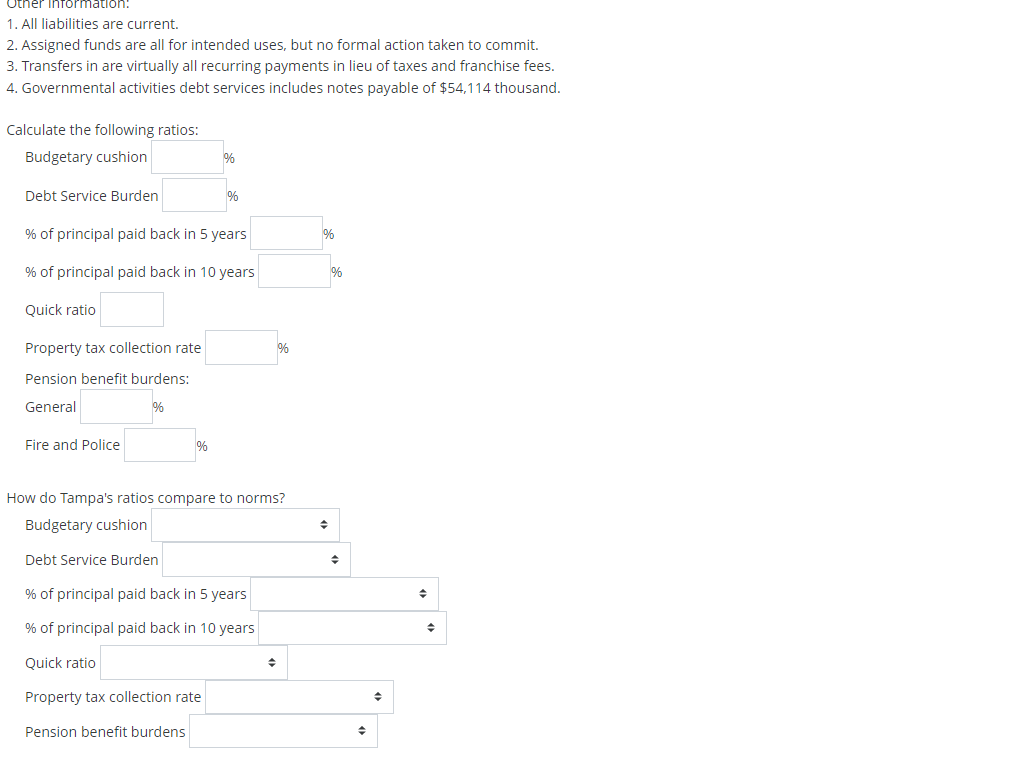

Assume the following information was obtained from the comprehensive annual financial report of the city of Tampa, Florida for a recent fiscal year. All amounts are in thousands. Other information: 1. All liabilities are current. 2. Assigned funds are all for intended uses, but no formal action taken to commit. 3. Transfers in are virtually all recurring payments in lieu of taxes and franchise fees. 1. All liabilities are current. 2. Assigned funds are all for intended uses, but no formal action taken to commit. 3. Transfers in are virtually all recurring payments in lieu of taxes and franchise fees. 4. Governmental activities debt services includes notes payable of $54,114 thousand. Calculate the following ratios: Budgetary cushion % Debt Service Burden % % of principal paid back in 5 years % % of principal paid back in 10 years % Quick ratio Property tax collection rate % Pension benefit burdens: General % Fire and Police % How do Tampa's ratios compare to norms? Budgetary cushion Debt Service Burden % of principal paid back in 5 years % of principal paid back in 10 years Quick ratio Property tax collection rate Pension benefit burdens Assume the following information was obtained from the comprehensive annual financial report of the city of Tampa, Florida for a recent fiscal year. All amounts are in thousands. Other information: 1. All liabilities are current. 2. Assigned funds are all for intended uses, but no formal action taken to commit. 3. Transfers in are virtually all recurring payments in lieu of taxes and franchise fees. 1. All liabilities are current. 2. Assigned funds are all for intended uses, but no formal action taken to commit. 3. Transfers in are virtually all recurring payments in lieu of taxes and franchise fees. 4. Governmental activities debt services includes notes payable of $54,114 thousand. Calculate the following ratios: Budgetary cushion % Debt Service Burden % % of principal paid back in 5 years % % of principal paid back in 10 years % Quick ratio Property tax collection rate % Pension benefit burdens: General % Fire and Police % How do Tampa's ratios compare to norms? Budgetary cushion Debt Service Burden % of principal paid back in 5 years % of principal paid back in 10 years Quick ratio Property tax collection rate Pension benefit burdens