Answered step by step

Verified Expert Solution

Question

1 Approved Answer

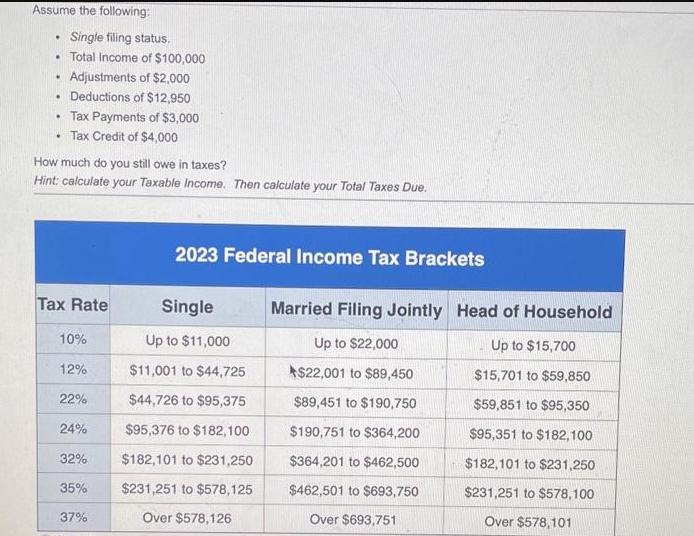

Assume the following: Single filing status. Total Income of $100,000 . . . Adjustments of $2,000 Deductions of $12,950 Tax Payments of $3,000 Tax

Assume the following: Single filing status. Total Income of $100,000 . . . Adjustments of $2,000 Deductions of $12,950 Tax Payments of $3,000 Tax Credit of $4,000 . How much do you still owe in taxes? Hint: calculate your Taxable Income. Then calculate your Total Taxes Due. Tax Rate 10% 12% 22% 24% 32% 35% 37% 2023 Federal Income Tax Brackets Single Up to $11,000 $11,001 to $44,725 $44,726 to $95,375 $95,376 to $182,100 $182,101 to $231,250 $231,251 to $578,125 Over $578,126 Married Filing Jointly Head of Household Up to $22,000 $22,001 to $89,450 $89,451 to $190,750 Up to $15,700 $15,701 to $59,850 $59,851 to $95,350 $95,351 to $182,100 $190,751 to $364,200 $364,201 to $462,500 $462,501 to $693,750 $182,101 to $231,250 $231,251 to $578,100 Over $578,101 Over $693,751

Step by Step Solution

★★★★★

3.39 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

To determine the amount you still owe in taxes well need to calculate your taxable income and then c...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started