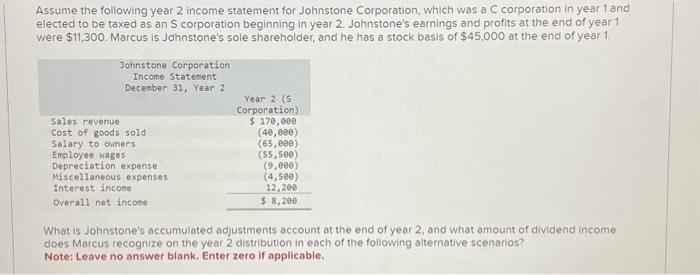

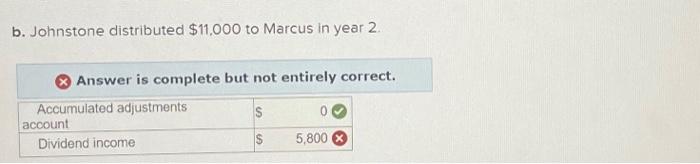

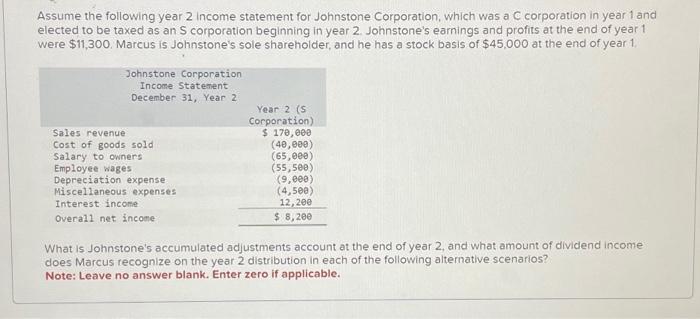

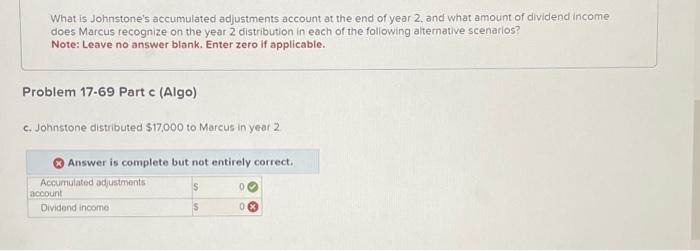

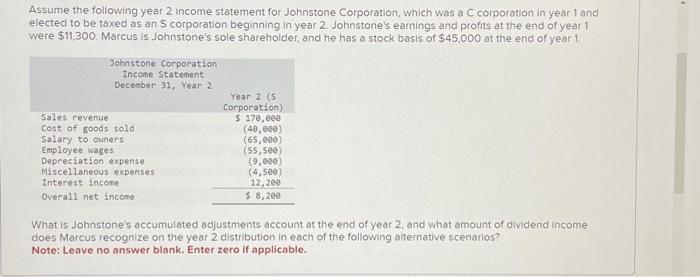

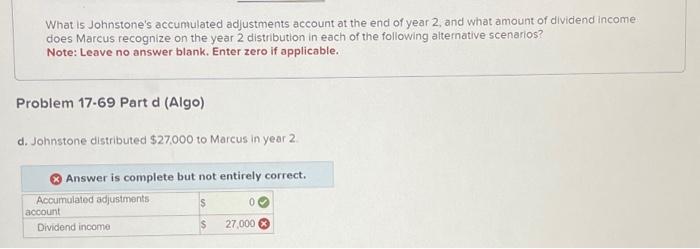

Assume the following year 2 income statement for Johnstone Corporation, which was a C corporation in year 1 and elected to be taxed as an S corporation beginning in year 2. Johnstone's earnings and profits at the end of year 1 were $11,300. Marcus is Johnstone's sole shareholder, and he has a stock basis of $45,000 at the end of year 1. What is Johnstone's accumulated adjustments account at the end of year 2 , and what amount of dividend income does Marcus recognize on the year 2 distribution in each of the following alternative scenarios? Note: Leave no answer blank, Enter zero if applicable. b. Johnstone distributed $11.000 to Marcus in year 2 . Answer is complete but not entirely correct. Assume the following year 2 Income statement for Johnstone Corporation, which was a corporation in year 1 and elected to be taxed as an S corporation beginning in year 2. Johnstone's earnings and profits at the end of year 1 were $11,300. Marcus is Johnstone's sole shareholder, and he has a stock basis of $45,000 at the end of year 1 . What is Johnstone's accumulated adjustments account at the end of year 2 , and what amount of dividend income does Marcus recognize on the year 2 distribution in each of the following alternative scenarios? Note: Leave no answer blank. Enter zero if applicable. What is Johnstone's accumulated adjustments account at the end of year 2 . and what amount of dividend income does Marcus recognize on the year 2 distribution in each of the following alternative scenarios? Note: Leave no answer blank. Enter zero if applicable. Problem 17.69 Part c (Algo) c. Johnstone distributed $17,000 to Marcus in year 2 Answer is complete but not entirely correct. Assume the following year 2 income statement for Johnstone Corporation, which was a C corporation in year 1 and elected to be taxed as an S corporation beginning in year 2 . Johnstone's earnings and profits at the end of year 1 were $11,300. Marcus is Johnstone's sole sharehoider, and he has a stock basis of $45,000 at the end of year 1. What is Johnstone's accumulated adjustments account at the end of year 2, and what amount of dividend income does Marcus recognize on the year 2 distribution in each of the following alternative scenarios? Note: Leave no answer blank. Enter zero if applicable. What is Johnstone's accumulated adjustments account at the end of year 2 , and what amount of dividend income does Marcus recognize on the year 2 distribution in each of the following alternative scenarios? Note: Leave no answer blank. Enter zero if applicable. Problem 17.69 Part d (Algo) d. Johnstone distributed $27,000 to Marcus in year 2 (8) Answer is complete but not entirely correct