Question

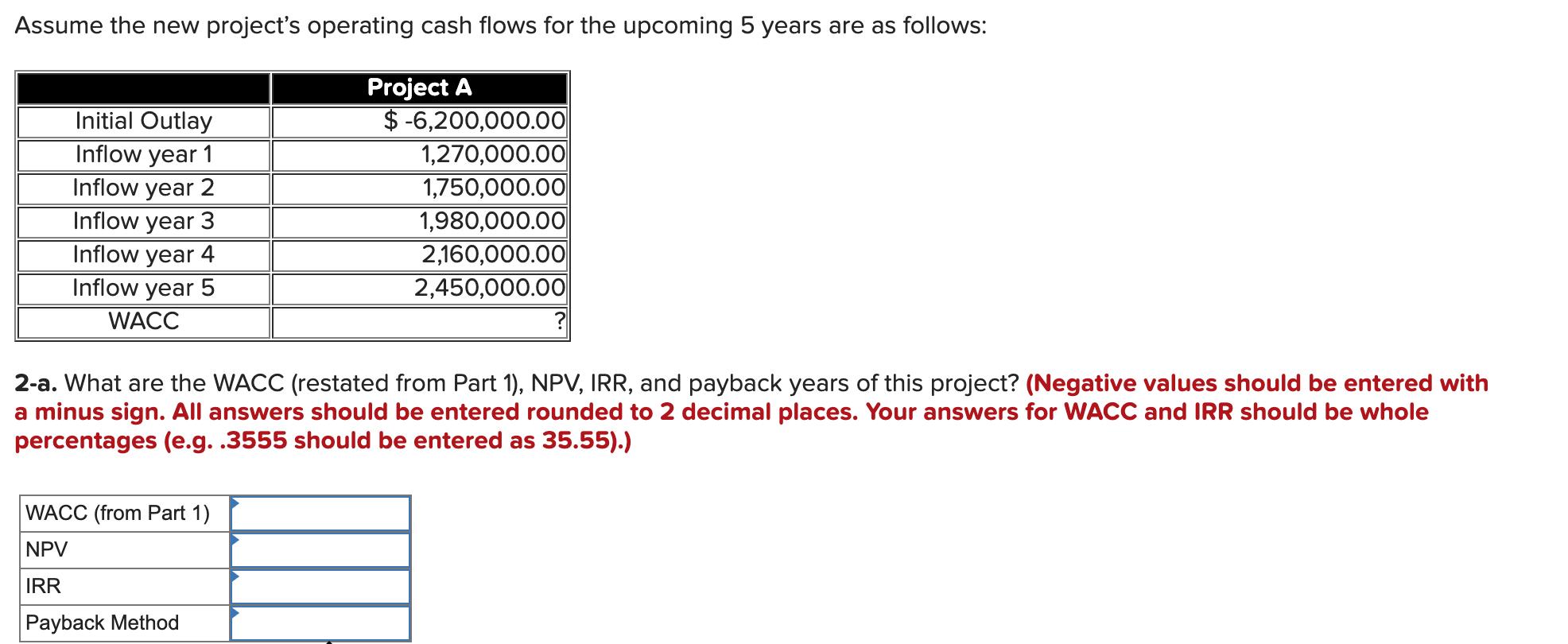

Assume the new project's operating cash flows for the upcoming 5 years are as follows: Project A $ -6,200,000.00 1,270,000.00 1,750,000.00 1,980,000.00 2,160,000.00 2,450,000.00

Assume the new project's operating cash flows for the upcoming 5 years are as follows: Project A $ -6,200,000.00 1,270,000.00 1,750,000.00 1,980,000.00 2,160,000.00 2,450,000.00 Initial Outlay Inflow year 1 Inflow year 2 Inflow year 3 Inflow year 4 Inflow year 5 WACC 2-a. What are the WACC (restated from Part 1), NPV, IRR, and payback years of this project? (Negative values should be entered with a minus sign. All answers should be entered rounded to 2 decimal places. Your answers for WACC and IRR should be whole percentages (e.g. .3555 should be entered as 35.55).) WACC (from Part 1) NPV IRR Payback Method

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the WACC NPV IRR and payback years of Project A we need the discount rate WACC Since th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Cost Management A Strategic Emphasis

Authors: Edward Blocher, David F. Stout, Paul Juras, Steven Smith

8th Edition

1259917029, 978-1259917028

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App