Question

Assume there is an American call option on GBP/USD at a strike price of GBP/USD 1.27 and a premium of USD0.045 per GBP. The

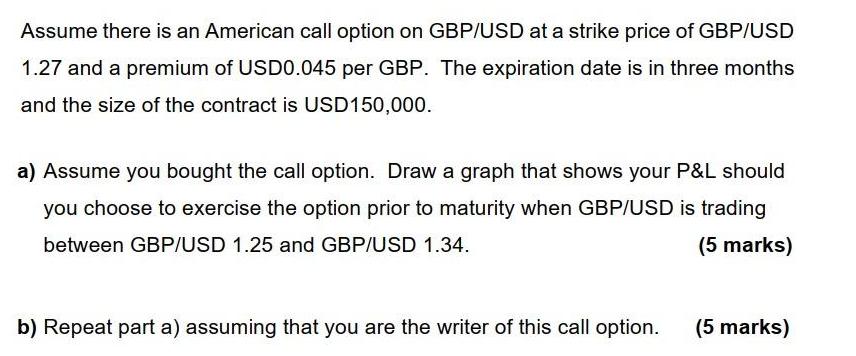

Assume there is an American call option on GBP/USD at a strike price of GBP/USD 1.27 and a premium of USD0.045 per GBP. The expiration date is in three months and the size of the contract is USD150,000. a) Assume you bought the call option. Draw a graph that shows your P&L should you choose to exercise the option prior to maturity when GBP/USD is trading between GBP/USD 1.25 and GBP/USD 1.34. (5 marks) b) Repeat part a) assuming that you are the writer of this call option. (5 marks)

Step by Step Solution

3.32 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

a If you bought the call option To draw the PL graph we need to consider the relevant price range for GBPUSD and calculate the profit or loss based on ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

International Accounting

Authors: Timothy Doupnik, Hector Perera

4th edition

77862201, 978-0077760298, 77760298, 978-0077862206

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App