Answered step by step

Verified Expert Solution

Question

1 Approved Answer

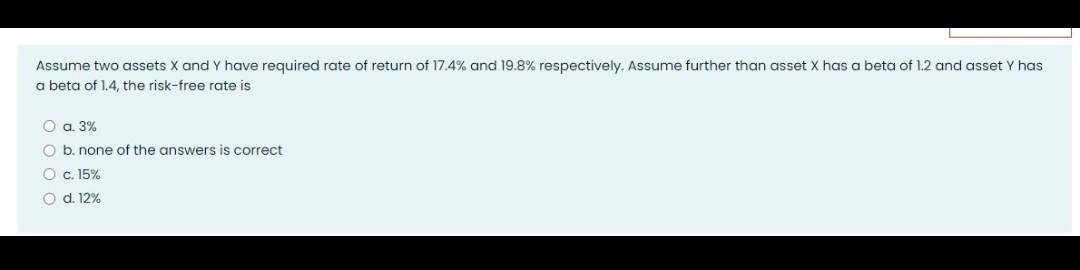

Assume two assets X and Y have required rate of return of 17.4% and 19.8% respectively. Assume further than asset X has a beta of

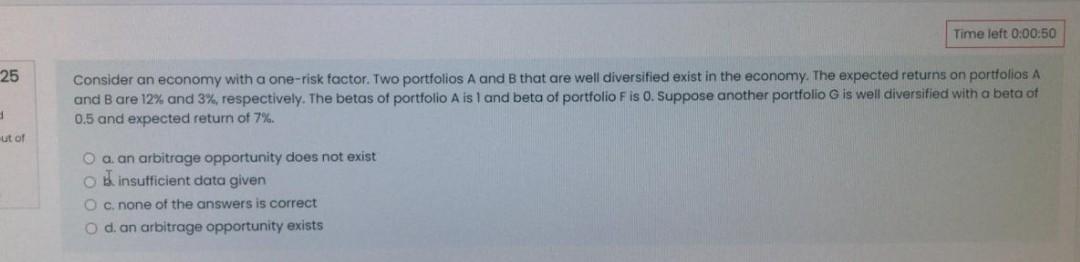

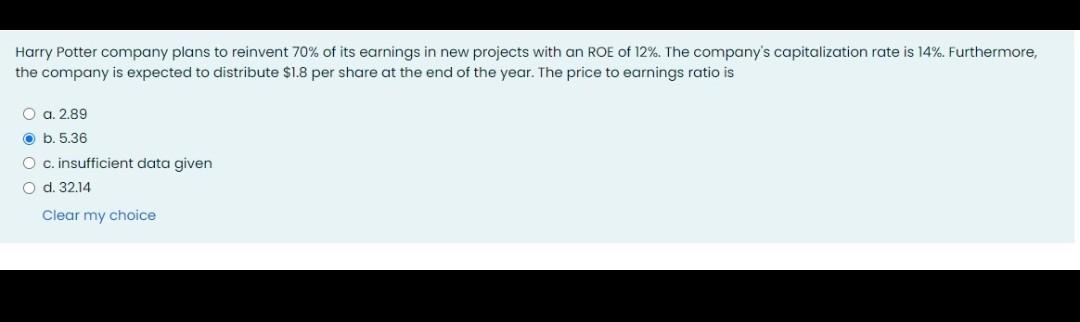

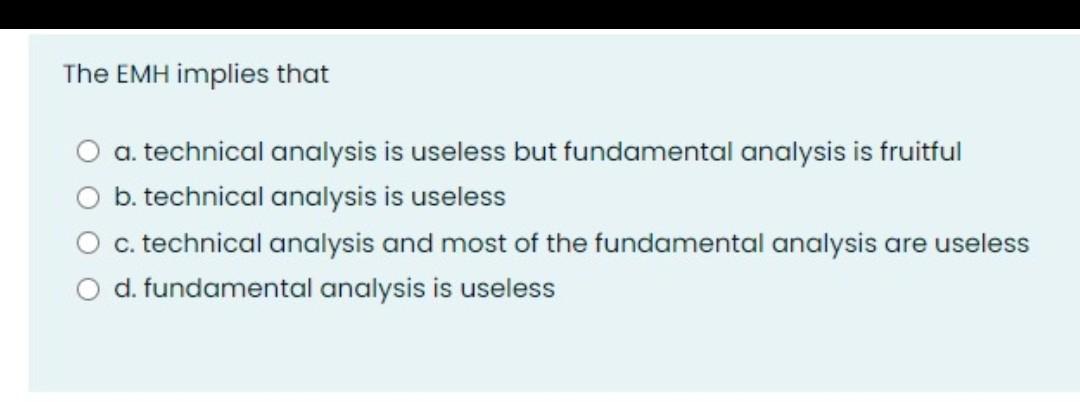

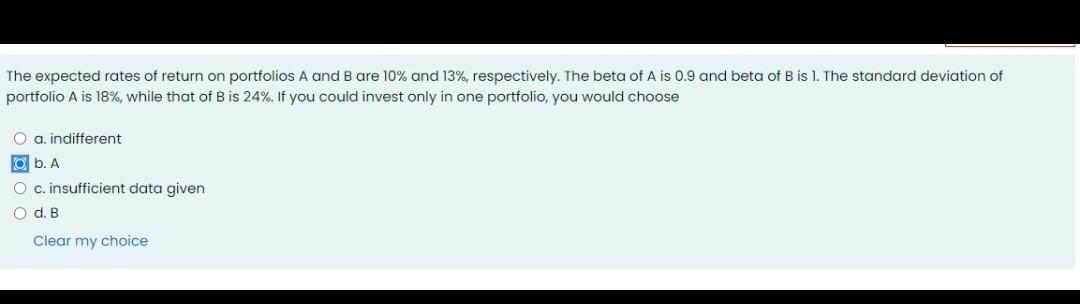

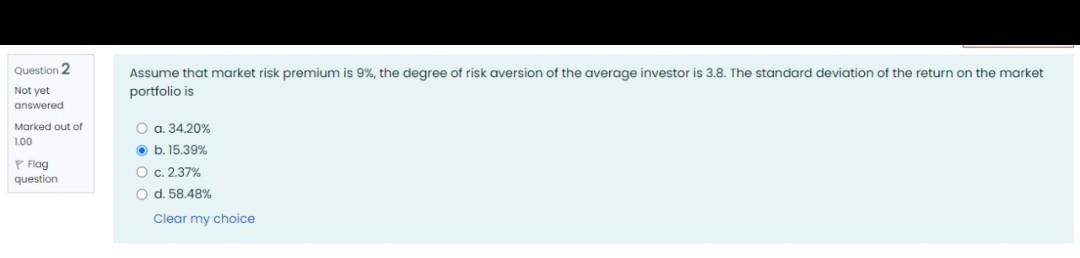

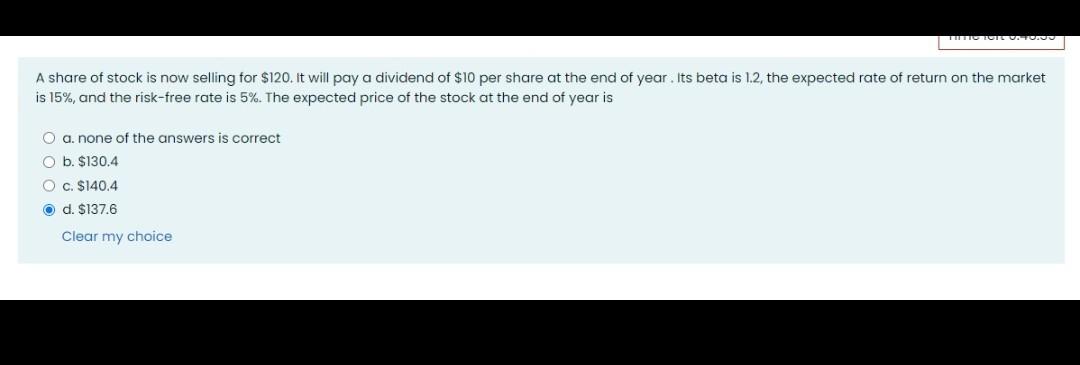

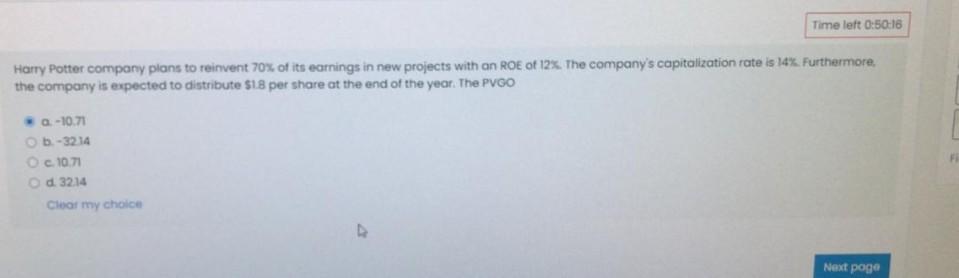

Assume two assets X and Y have required rate of return of 17.4% and 19.8% respectively. Assume further than asset X has a beta of 1.2 and asset Y has a beta of 1.4, the risk-free rate is O a. 3% O b. none of the answers is correct O c. 15% O d. 12% Time left 0:00:50 25 Consider an economy with a one-risk factor. Two portfolios A and B that are well diversified exist in the economy. The expected returns on portfolios A and Bare 12% and 3%, respectively. The betas of portfolio A is 1 and beta of portfolio F is 0. Suppose another portfolio G is well diversified with a beta of 0.5 and expected return of 7%. ut of a. an arbitrage opportunity does not exist OB insufficient data given O c. none of the answers is correct O d. an arbitrage opportunity exists Harry Potter company plans to reinvent 70% of its earnings in new projects with an ROE of 12%. The company's capitalization rate is 14%. Furthermore, the company is expected to distribute $1.8 per share at the end of the year. The price to earnings ratio is O a. 2.89 b. 5.36 O c. insufficient data given O d. 32.14 Clear my choice The EMH implies that a technical analysis is useless but fundamental analysis is fruitful b. technical analysis is useless c. technical analysis and most of the fundamental analysis are useless d. fundamental analysis is useless The expected rates of return on portfolios A and B are 10% and 13%, respectively. The beta of A is 0.9 and beta of Bis 1. The standard deviation of portfolio A is 18%, while that of Bis 24%. If you could invest only in one portfolio, you would choose O a. indifferent b. A O c. insufficient data given O d. B Clear my choice Question 2 Not yet answered Assume that market risk premium is 9%, the degree of risk aversion of the average investor is 3.8. The standard deviation of the return on the market portfolio is Marked out of LOO O a. 34.20% . b. 15.39% O c. 2.37% Flag question O d. 58.48% Clear my choice A share of stock is now selling for $120. It will pay a dividend of $10 per share at the end of year. Its beta is 1.2, the expected rate of return on the market is 15%, and the risk-free rate is 5%. The expected price of the stock at the end of year is O a. none of the answers is correct O b. $130.4 O c. $140.4 O d. $137.6 Clear my choice Time left 0:50:16 Harry Potter company plans to reinvent 70% of its earnings in new projects with an ROE of 12%. The company's capitalization rate is 14%. Furthermore, the company is expected to distribute 518 per share at the end of the year. The PVCO .-10.71 b-3214 c. 10,71 d. 32.14 Cleo my choice Next page

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started