Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assume you are a manager for a pension fund that is mostly allocated in equity and bonds. The fund has recently suffered a setback

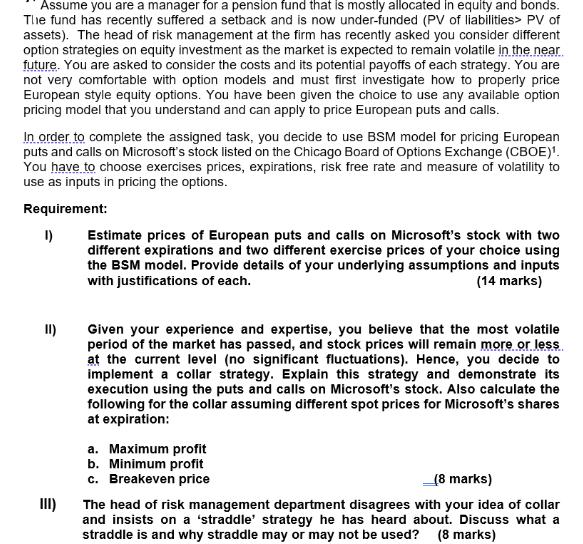

Assume you are a manager for a pension fund that is mostly allocated in equity and bonds. The fund has recently suffered a setback and is now under-funded (PV of liabilities> PV of assets). The head of risk management at the firm has recently asked you consider different option strategies on equity investment as the market is expected to remain volatile in the near future. You are asked to consider the costs and its potential payoffs of each strategy. You are not very comfortable with option models and must first investigate how to properly price European style equity options. You have been given the choice to use any available option pricing model that you understand and can apply to price European puts and calls. In order to complete the assigned task, you decide to use BSM model for pricing European puts and calls on Microsoft's stock listed on the Chicago Board of Options Exchange (CBOE). You have to choose exercises prices, expirations, risk free rate and measure of volatility to use as inputs in pricing the options. Requirement: 1) II) III) Estimate prices of European puts and calls on Microsoft's stock with two different expirations and two different exercise prices of your choice using the BSM model. Provide details of your underlying assumptions and inputs with justifications of each. (14 marks) Given your experience and expertise, you believe that the most volatile period of the market has passed, and stock prices will remain more or less at the current level (no significant fluctuations). Hence, you decide to implement a collar strategy. Explain this strategy and demonstrate its execution using the puts and calls on Microsoft's stock. Also calculate the following for the collar assuming different spot prices for Microsoft's shares at expiration: a. Maximum profit b. Minimum profit c. Breakeven price (8 marks) The head of risk management department disagrees with your idea of collar and insists on a 'straddle' strategy he has heard about. Discuss what a straddle is and why straddle may or may not be used? (8 marks) Assume you are a manager for a pension fund that is mostly allocated in equity and bonds. The fund has recently suffered a setback and is now under-funded (PV of liabilities> PV of assets). The head of risk management at the firm has recently asked you consider different option strategies on equity investment as the market is expected to remain volatile in the near future. You are asked to consider the costs and its potential payoffs of each strategy. You are not very comfortable with option models and must first investigate how to properly price European style equity options. You have been given the choice to use any available option pricing model that you understand and can apply to price European puts and calls. In order to complete the assigned task, you decide to use BSM model for pricing European puts and calls on Microsoft's stock listed on the Chicago Board of Options Exchange (CBOE). You have to choose exercises prices, expirations, risk free rate and measure of volatility to use as inputs in pricing the options. Requirement: 1) II) III) Estimate prices of European puts and calls on Microsoft's stock with two different expirations and two different exercise prices of your choice using the BSM model. Provide details of your underlying assumptions and inputs with justifications of each. (14 marks) Given your experience and expertise, you believe that the most volatile period of the market has passed, and stock prices will remain more or less at the current level (no significant fluctuations). Hence, you decide to implement a collar strategy. Explain this strategy and demonstrate its execution using the puts and calls on Microsoft's stock. Also calculate the following for the collar assuming different spot prices for Microsoft's shares at expiration: a. Maximum profit b. Minimum profit c. Breakeven price (8 marks) The head of risk management department disagrees with your idea of collar and insists on a 'straddle' strategy he has heard about. Discuss what a straddle is and why straddle may or may not be used? (8 marks)

Step by Step Solution

★★★★★

3.47 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Answer Part I Pricing European Puts and Calls using the BSM Model To price European puts and calls using the BlackScholesMerton BSM model we need to m...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started