Answered step by step

Verified Expert Solution

Question

1 Approved Answer

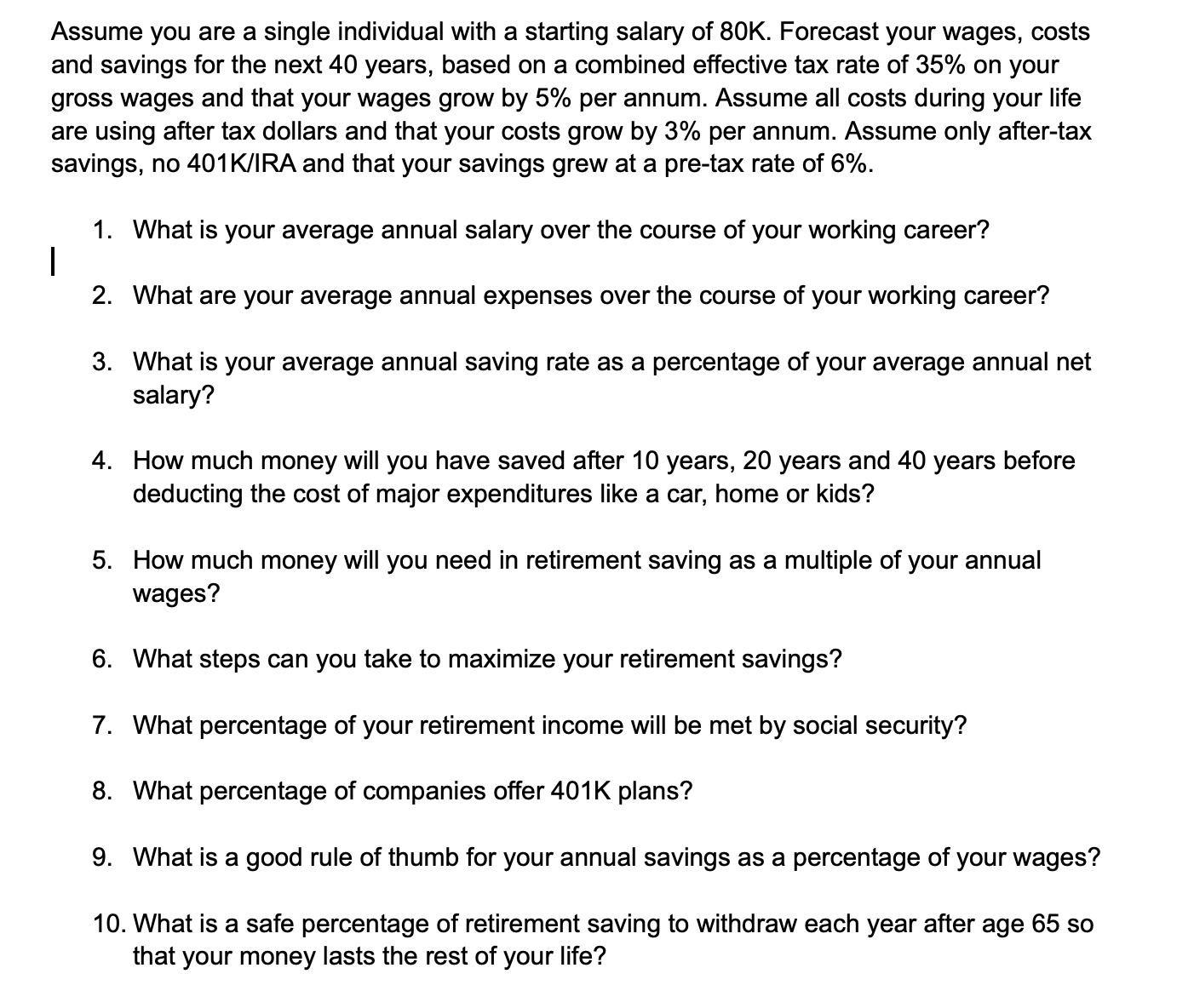

Assume you are a single individual with a starting salary of 8 0 K . Forecast your wages, costs and savings for the next 4

Assume you are a single individual with a starting salary of Forecast your wages, costs

and savings for the next years, based on a combined effective tax rate of on your

gross wages and that your wages grow by per annum. Assume all costs during your life

are using after tax dollars and that your costs grow by per annum. Assume only aftertax

savings, no and that your savings grew at a pretax rate of

What is your average annual salary over the course of your working career?

What are your average annual expenses over the course of your working career?

What is your average annual saving rate as a percentage of your average annual net

salary?

How much money will you have saved after years, years and years before

deducting the cost of major expenditures like a car, home or kids?

How much money will you need in retirement saving as a multiple of your annual

wages?

What steps can you take to maximize your retirement savings?

What percentage of your retirement income will be met by social security?

What percentage of companies offer plans?

What is a good rule of thumb for your annual savings as a percentage of your wages?

What is a safe percentage of retirement saving to withdraw each year after age so

that your money lasts the rest of your life?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started