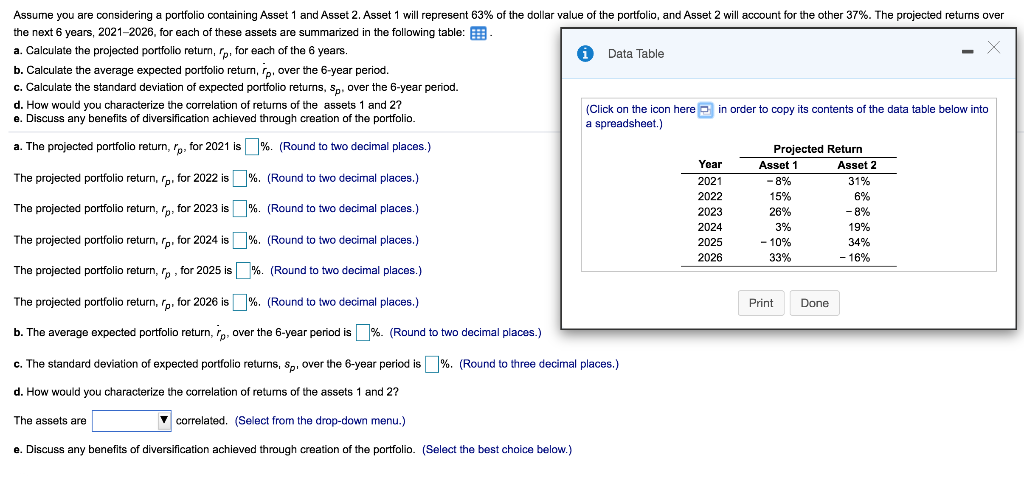

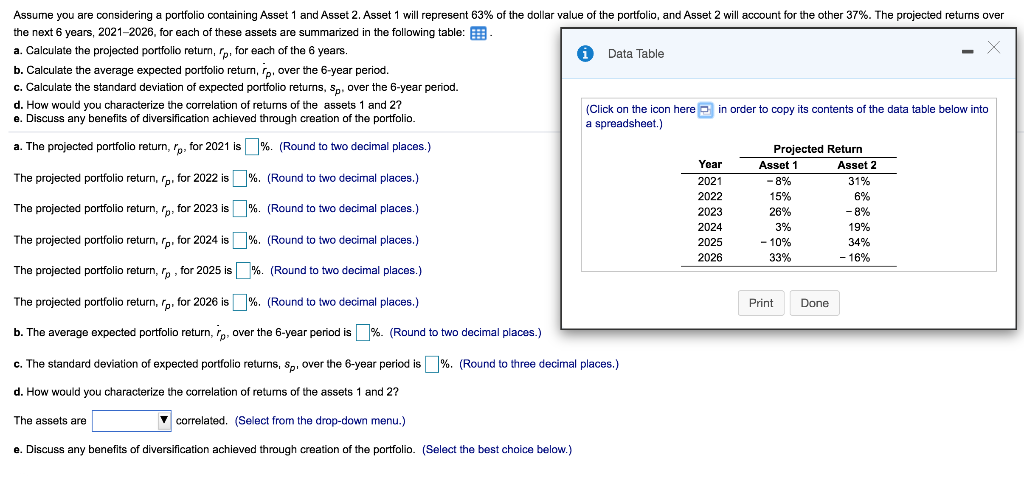

Assume you are considering a portfolio containing Asset 1 and Asset 2. Asset 1 will represent 63% of the dollar value of the portfolio, and Asset 2 will account for the other 37%. The projected returns over t6 years, 2021-2026, for each of these assets are summarized in the following table: a. Calculate the projected portfolio retur, fp, for each of the 6 years. Data Table - X b. Calculate the average expected portfolio return, fp, over the 6-year period. c. Calculate the standard deviation of expected portfolio returns, Sp, over the 6-year period. d. How would you characterize the correlation of returns of the assets 1 and 2? e. Discuss any benefits of diversification achieved through creation of the portfolio. (Click on the icon here in order to copy its contents of the data table below into a spreadsheet.) a. The projected portfolio return, lo, for 2021 is %. (Round to two decimal places.) Projected Return Year Asset 1 Asset 2 The projected portfolio return. p. for 2022 is %. (Round to two decimal places.) 2021 -8% 31% 2022 15% 6% The projected portfolio return, lp, for 2023 is %. (Round to two decimal places.) 2023 26% -8% 2024 3% 19% The projected portfolio return, fp, for 2024 is %. (Round to two decimal places.) 2025 - 10% 34% 2026 33% -16% The projected portfolio return, lp, for 2025 is % (Round to two decimal places.) Print Done The projected portfolio return, fp, for 2026 is %. (Round to two decimal places.) b. The average expected portfolio return, 1, over the 6-year period is %. (Round to two decimal places.) c. The standard deviation of expected portfolio returns, Sp, over the 6-year period is %. (Round to three decimal places.) d. How would you characterize the correlation of retums of the assets 1 and 2? The assets are correlated. (Select from the drop-down menu.) e. Discuss any benefits of diversification achieved through creation of the portfolio. (Select the best choice below.) e. Discuss any benefits of diversification achieved through creation of the portfolio. (Select the best choice below.) O A. By combining these two negatively correlated assets, the overall portfolio risk is reduced. O B. By combining these two positively correlated assets, the overall portfolio risk is reduced. O C. By combining these two negatively correlated assets, the overall portfolio risk is eliminated. O D. By combining these two negatively correlated assets, the overall portfolio risk is increased