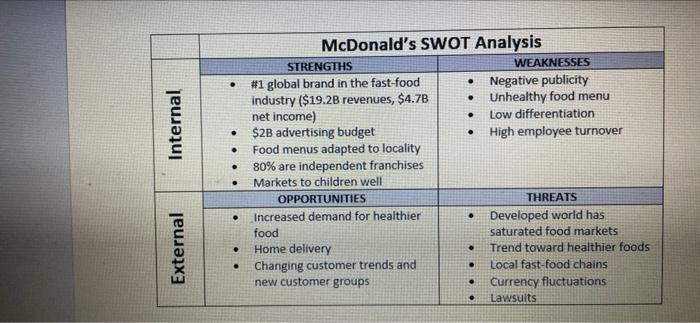

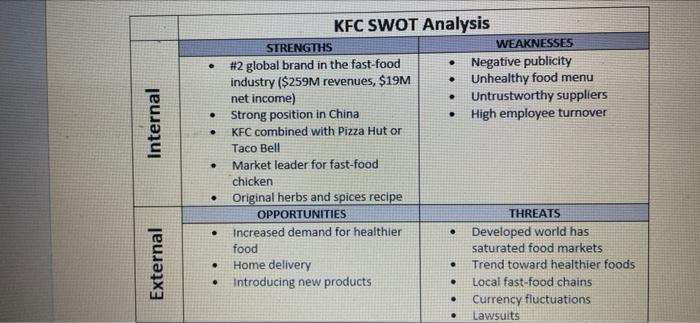

Assume you are the CFO of McDonald's Corporation. Your overall revenues have been steadily falling since 2016, however, you've managed to keep net income fairly stable by reducing operating costs. However, due to the economic effects of COVID19, your revenues again took a huge $1.2B hit in 2020. 1. You have created SWOT analyses (see below) of both McDonald's and KFC to see if KFC might be worth acquiring or aligning with in some way. Using the Framework for Choosing a Path for Ignoring Growth section in Chapter 6 of your text and the decision flowchart (Exhibit 6.20), determine the following. a. (4 points) Based on your SWOT analysis, what inorganic growth opportunity would be the best approach for McDonald's to take with KFC as an acquisition target? Select only one. b. (6 points) Explain your reasoning in terms of what benefits, coordination, and/or learning you expect to gain from your selected approach. c. (6 points) explain your reasoning in terms of McDonald's need for ownership and control. d. (6 points) Explain your reasoning in terms of managing risk exposure. . . Internal . . . McDonald's SWOT Analysis STRENGTHS WEAKNESSES #1 global brand in the fast-food . Negative publicity industry ($19.2B revenues, $4.7B Unhealthy food menu net income) Low differentiation $2B advertising budget High employee turnover Food menus adapted to locality 80% are independent franchises Markets to children well OPPORTUNITIES THREATS Increased demand for healthier Developed world has food saturated food markets Home delivery . Trend toward healthier foods Changing customer trends and Local fast-food chains new customer groups Currency fluctuations Lawsuits . . . External . . . . Internal KFC SWOT Analysis STRENGTHS WEAKNESSES #2 global brand in the fast-food Negative publicity industry ($259M revenues, $19M Unhealthy food menu net income) . Untrustworthy suppliers Strong position in China High employee turnover KFC combined with Pizza Hut or Taco Bell Market leader for fast-food chicken Original herbs and spices recipe OPPORTUNITIES THREATS Increased demand for healthier Developed world has food saturated food markets Home delivery . Trend toward healthier foods Introducing new products Local fast-food chains Currency fluctuations Lawsuits . . . External