Answered step by step

Verified Expert Solution

Question

1 Approved Answer

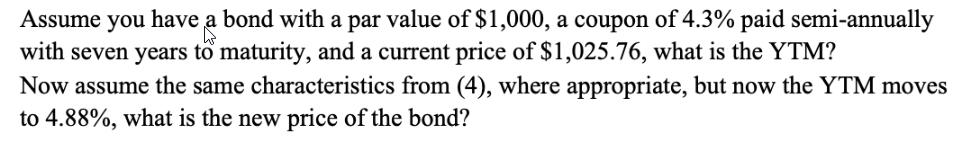

Assume you have a bond with a par value of $1,000, a coupon of 4.3% paid semi-annually with seven years to maturity, and a

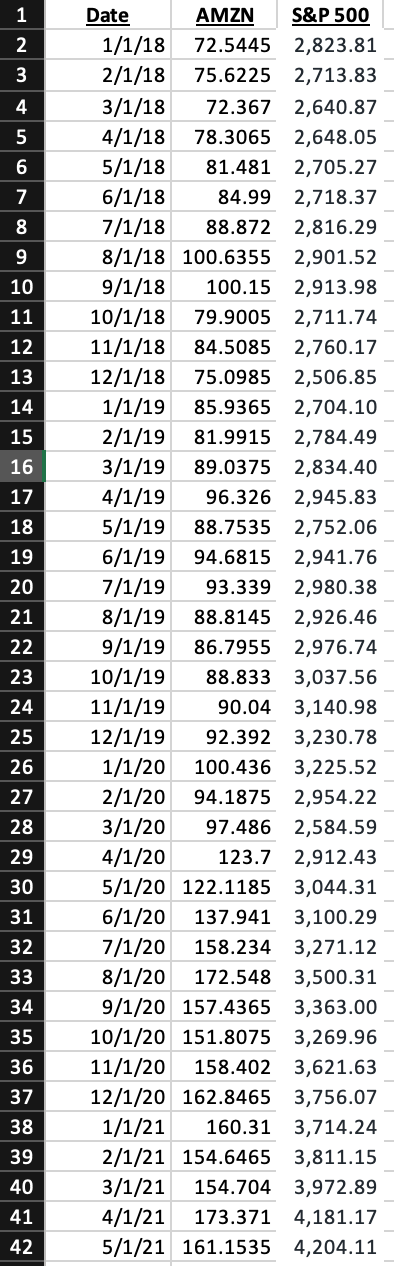

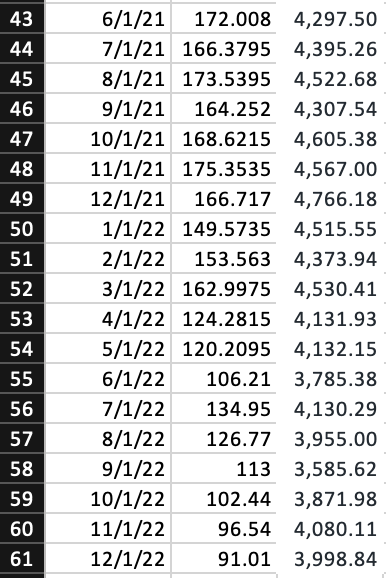

Assume you have a bond with a par value of $1,000, a coupon of 4.3% paid semi-annually with seven years to maturity, and a current price of $1,025.76, what is the YTM? Now assume the same characteristics from (4), where appropriate, but now the YTM moves to 4.88%, what is the new price of the bond? 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 Date 1/1/18 2/1/18 3/1/18 4/1/18 5/1/18 6/1/18 7/1/18 8/1/18 9/1/18 10/1/18 11/1/18 12/1/18 1/1/19 2/1/19 3/1/19 4/1/19 5/1/19 6/1/19 7/1/19 8/1/19 9/1/19 10/1/19 11/1/19 12/1/19 AMZN S&P 500 72.5445 2,823.81 75.6225 2,713.83 72.367 2,640.87 78.3065 2,648.05 81.481 2,705.27 84.99 2,718.37 88.872 2,816.29 100.6355 2,901.52 100.15 2,913.98 79.9005 2,711.74 84.5085 2,760.17 75.0985 2,506.85 85.9365 81.9915 89.0375 96.326 88.7535 94.6815 93.339 88.8145 86.7955 88.833 90.04 92.392 1/1/20 100.436 2/1/20 94.1875 3/1/20 4/1/20 2,704.10 2,784.49 2,834.40 2,945.83 2,752.06 2,941.76 2,980.38 2,926.46 2,976.74 3,037.56 3,140.98 3,230.78 3,225.52 2,954.22 97.486 2,584.59 123.7 2,912.43 5/1/20 122.1185 3,044.31 6/1/20 137.941 3,100.29 7/1/20 158.234 3,271.12 8/1/20 172.548 3,500.31 9/1/20 157.4365 3,363.00 10/1/20 151.8075 3,269.96 11/1/20 158.402 3,621.63 12/1/20 162.8465 3,756.07 1/1/21 160.31 3,714.24 2/1/21 154.6465 3,811.15 3/1/21 154.704 3,972.89 4/1/21 173.371 4,181.17 5/1/21 161.1535 4,204.11 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 6/1/21 172.008 4,297.50 7/1/21 166.3795 4,395.26 8/1/21 173.5395 4,522.68 9/1/21 164.252 4,307.54 10/1/21 168.6215 4,605.38 11/1/21 175.3535 4,567.00 12/1/21 166.717 4,766.18 1/1/22 149.5735 4,515.55 2/1/22 153.563 4,373.94 162.9975 4,530.41 3/1/22 4/1/22 124.2815 4,131.93 5/1/22 120.2095 4,132.15 6/1/22 3,785.38 7/1/22 4,130.29 8/1/22 3,955.00 9/1/22 3,585.62 10/1/22 3,871.98 11/1/22 12/1/22 106.21 134.95 126.77 113 102.44 96.54 4,080.11 91.01 3,998.84

Step by Step Solution

★★★★★

3.38 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the yield to maturity YTM for the bond we can use the following formula PC1r1C1r2C1r3C1...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started