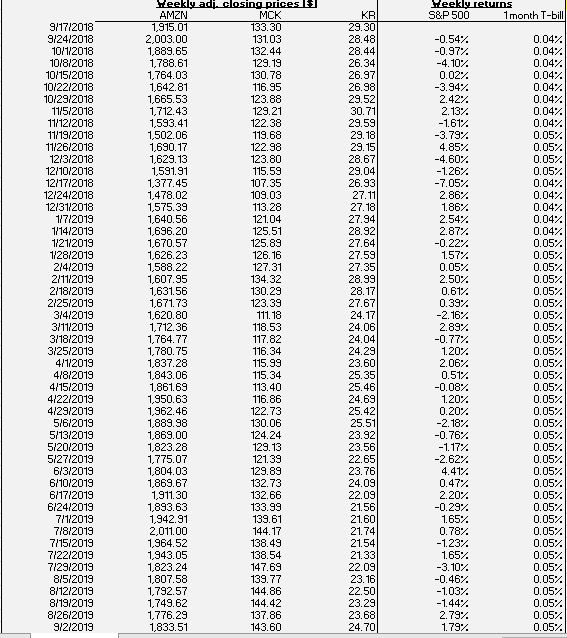

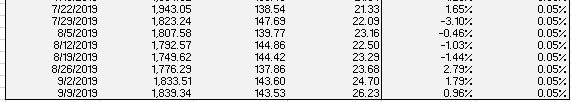

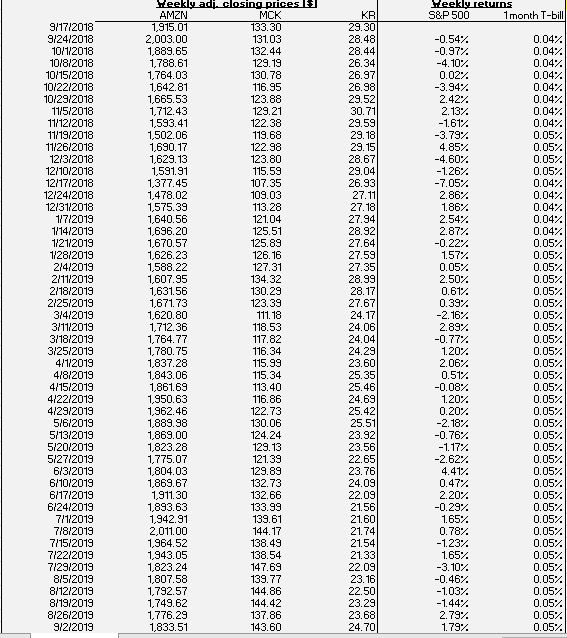

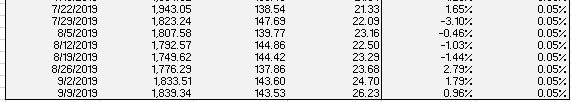

Assume you're creating a portfolio using MCK and KR stock only. Which two portfolio weights will minimize the standard deviation of the portfolio?  |

Heekly adj closing prices E AMZN 1915.01 2,003.00 1,889.65 1,788.61 1,764.03 1,642.81 1,665.53 1,712.43 1,593.41 1,502.06 1,690.17 1,629.13 1591.91 1,377.45 1,478.02 1,575.39 1,640.56 1,696.20 1,670.57 1,626.23 1,588,22 1,607.95 1,631.56 1,671.73 1,620.80 1,712.36 1,764.77 1,780.75 1,837.28 1,843.06 1,861.69 1,950.63 1,962.46 1,889.98 1,869.00 1,823.28 1,775.07 1,804.03 1,869.67 1,911.30 1,893.63 1942.91 2,011.00 1,964.52 1,943.05 1,823.24 1,807.58 1,792.57 1,749.62 1,776.29 1,833.51 Heekly returns S&P 500 MCK 133.30 KR 29.30 1month T-bill 9/17/2018 9/24/2018 10/1/2018 10/8/2018 10/15/2018 10/22/2018 10/29/2018 11/5/2018 1112/2018 11/19/2018 1126/2018 12/3/2018 12/10/2018 12/17/2018 12124/2018 12/31/2018 117/2019 1/14/2019 1121/2019 1128/2019 214/2019 2/11/2019 2/18/2019 2/25/2013 3/4/2019 3/11/2019 3/18/2019 3/25/2019 4/1/2019 418/2019 4/15/2019 4/22/2019 4129/2019 5/6/2019 5/13/2019 5/20/2019 5/2712019 131.03 132.44 28.48 28.44 26.34 26.97 26.98 29.52 30.71 29.59 29.18 29.15 28.67 29.04 26.93 27.11 27.18 27.94 28.92 27.64 27.59 27.35 28.99 28.17 27.67 24.17 24.06 24.04 24.29 23.60 25.35 25.46 24.69 25.42 25.51 23.92 23.56 22.65 23.76 24.09 22.09 -0.54% 0.97% -4.10:% 0.02% -3.94% 2.42% 2.13 0.04% 0.04% 0.04% 0.04% 0.04% 0.04% 0.04% 0.04% 0.05% 0.05% 0.05% 0.05% 0.04% 0.04% 0.04% 0.04% 04% 0.05% 0.05% 0.05% 0.05% 005% 0.05% 005% 0.05% 005% 0.05% 005% 0.05% 005% 0.05% 0.05% 0.05% 129.19 130.78 116.95 123.88 129.21 122.38 119.68 -161% -3.79% 4.85% 4.60% -1.26% -7.05% 122.98 123.80 115.59 107.35 109.03 113.28 121.04 125.51 125.89 126.16 127.31 134.32 130.29 123.39 111.18 118.53 117.82 116.34 115,99 115.34 113,40 116.86 122.73 130.06 124.24 129.13 121.39 129.89 132.73 132.66 133.99 139.61 144.17 138.49 138.54 147.69 2.86% 186% 2.54% 2.87% -0.22% 157% 0.05% 2.50% 0.61 0.39% -2.16% 2.89% -0.77% 120% 2.06% 0.51% -0.08% 120% 0.20% -2.18% -0.76% -1.17% -2.62% 4.41% 0.47 2.20% -0.29% 165% 0.78% -123% 0.05% 0.05% 0.05% 0.05% 0.05% 0.05% 0.05% 0.05% 0.05% 0.05% 0.05% 0.05% 0.05% 0.05% 0.05% 0.05% 0.05% 6/3/2019 6/10/2019 6/17/2019 6/24/2019 21.56 21.60 21.74 21,54 7/1/2019 7/8/2019 7/15/2019 7/22/2019 712912019 815/2019 8/12/2019 8/19/2019 21.33 22.09 23.16 1.65% -3.10% -0.46 % -1.03 % -144% 139.77 144.86 22.50 23.29 23.68 24.70 144.42 137,86 8126/2019 9/2/2013 2.79% 179% 143.60 1943.05 1,823.24 1,807.58 1,792.57 1,749.62 1,776.29 1,833.51 1,839.34 1.65 -3.10% -0.46 % 7/2212019 7/29/2019 8/5/2019 8/12/2019 8/19/2019 8/26/2019 9/2/2019 9/9/2019 138.54 147.69 139.77 144.86 144.42 21.33 22.09 23.16 22,50 23.29 23.68 0.05% 0.05% 0.05% 0.05% 0.05% 0.05% 0.05% 0.05% -1.03% -1.44% 2.79% 1.79 0.96% 137.86 143.60 143.53 24.70 26.23 Heekly adj closing prices E AMZN 1915.01 2,003.00 1,889.65 1,788.61 1,764.03 1,642.81 1,665.53 1,712.43 1,593.41 1,502.06 1,690.17 1,629.13 1591.91 1,377.45 1,478.02 1,575.39 1,640.56 1,696.20 1,670.57 1,626.23 1,588,22 1,607.95 1,631.56 1,671.73 1,620.80 1,712.36 1,764.77 1,780.75 1,837.28 1,843.06 1,861.69 1,950.63 1,962.46 1,889.98 1,869.00 1,823.28 1,775.07 1,804.03 1,869.67 1,911.30 1,893.63 1942.91 2,011.00 1,964.52 1,943.05 1,823.24 1,807.58 1,792.57 1,749.62 1,776.29 1,833.51 Heekly returns S&P 500 MCK 133.30 KR 29.30 1month T-bill 9/17/2018 9/24/2018 10/1/2018 10/8/2018 10/15/2018 10/22/2018 10/29/2018 11/5/2018 1112/2018 11/19/2018 1126/2018 12/3/2018 12/10/2018 12/17/2018 12124/2018 12/31/2018 117/2019 1/14/2019 1121/2019 1128/2019 214/2019 2/11/2019 2/18/2019 2/25/2013 3/4/2019 3/11/2019 3/18/2019 3/25/2019 4/1/2019 418/2019 4/15/2019 4/22/2019 4129/2019 5/6/2019 5/13/2019 5/20/2019 5/2712019 131.03 132.44 28.48 28.44 26.34 26.97 26.98 29.52 30.71 29.59 29.18 29.15 28.67 29.04 26.93 27.11 27.18 27.94 28.92 27.64 27.59 27.35 28.99 28.17 27.67 24.17 24.06 24.04 24.29 23.60 25.35 25.46 24.69 25.42 25.51 23.92 23.56 22.65 23.76 24.09 22.09 -0.54% 0.97% -4.10:% 0.02% -3.94% 2.42% 2.13 0.04% 0.04% 0.04% 0.04% 0.04% 0.04% 0.04% 0.04% 0.05% 0.05% 0.05% 0.05% 0.04% 0.04% 0.04% 0.04% 04% 0.05% 0.05% 0.05% 0.05% 005% 0.05% 005% 0.05% 005% 0.05% 005% 0.05% 005% 0.05% 0.05% 0.05% 129.19 130.78 116.95 123.88 129.21 122.38 119.68 -161% -3.79% 4.85% 4.60% -1.26% -7.05% 122.98 123.80 115.59 107.35 109.03 113.28 121.04 125.51 125.89 126.16 127.31 134.32 130.29 123.39 111.18 118.53 117.82 116.34 115,99 115.34 113,40 116.86 122.73 130.06 124.24 129.13 121.39 129.89 132.73 132.66 133.99 139.61 144.17 138.49 138.54 147.69 2.86% 186% 2.54% 2.87% -0.22% 157% 0.05% 2.50% 0.61 0.39% -2.16% 2.89% -0.77% 120% 2.06% 0.51% -0.08% 120% 0.20% -2.18% -0.76% -1.17% -2.62% 4.41% 0.47 2.20% -0.29% 165% 0.78% -123% 0.05% 0.05% 0.05% 0.05% 0.05% 0.05% 0.05% 0.05% 0.05% 0.05% 0.05% 0.05% 0.05% 0.05% 0.05% 0.05% 0.05% 6/3/2019 6/10/2019 6/17/2019 6/24/2019 21.56 21.60 21.74 21,54 7/1/2019 7/8/2019 7/15/2019 7/22/2019 712912019 815/2019 8/12/2019 8/19/2019 21.33 22.09 23.16 1.65% -3.10% -0.46 % -1.03 % -144% 139.77 144.86 22.50 23.29 23.68 24.70 144.42 137,86 8126/2019 9/2/2013 2.79% 179% 143.60 1943.05 1,823.24 1,807.58 1,792.57 1,749.62 1,776.29 1,833.51 1,839.34 1.65 -3.10% -0.46 % 7/2212019 7/29/2019 8/5/2019 8/12/2019 8/19/2019 8/26/2019 9/2/2019 9/9/2019 138.54 147.69 139.77 144.86 144.42 21.33 22.09 23.16 22,50 23.29 23.68 0.05% 0.05% 0.05% 0.05% 0.05% 0.05% 0.05% 0.05% -1.03% -1.44% 2.79% 1.79 0.96% 137.86 143.60 143.53 24.70 26.23