Question

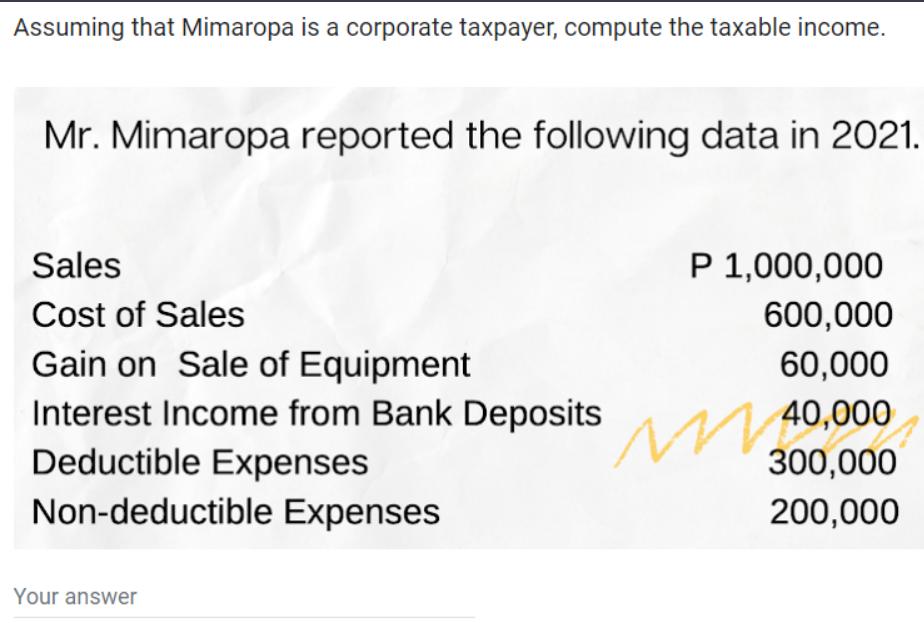

Assuming that Mimaropa is a corporate taxpayer, compute the taxable income. Mr. Mimaropa reported the following data in 2021. Sales Cost of Sales Gain

Assuming that Mimaropa is a corporate taxpayer, compute the taxable income. Mr. Mimaropa reported the following data in 2021. Sales Cost of Sales Gain on Sale of Equipment Interest Income from Bank Deposits Deductible Expenses Non-deductible Expenses Your answer P 1,000,000 600,000 60,000 40,000 300,000 200,000

Step by Step Solution

3.43 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

To compute the taxable income of Mimaropa we need to first determine its gross income an...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting

Authors: J. David Spiceland, James Sepe, Mark Nelson, Wayne Thomas

9th Edition

125972266X, 9781259722660

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App