Answered step by step

Verified Expert Solution

Question

1 Approved Answer

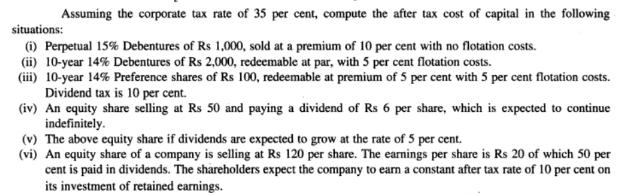

Assuming the corporate tax rate of 35 per cent, compute the after tax cost of capital in the following situations: (i) Perpetual 15% Debentures

Assuming the corporate tax rate of 35 per cent, compute the after tax cost of capital in the following situations: (i) Perpetual 15% Debentures of Rs 1,000, sold at a premium of 10 per cent with no flotation costs. (ii) 10-year 14% Debentures of Rs 2,000, redeemable at par, with 5 per cent flotation costs. (iii) 10-year 14% Preference shares of Rs 100, redeemable at premium of 5 per cent with 5 per cent flotation costs. Dividend tax is 10 per cent. (iv) An equity share selling at Rs 50 and paying a dividend of Rs 6 per share, which is expected to continue indefinitely. (v) The above equity share if dividends are expected to grow at the rate of 5 per cent. (vi) An equity share of a company is selling at Rs 120 per share. The earnings per share is Rs 20 of which 50 per cent is paid in dividends. The shareholders expect the company to earn a constant after tax rate of 10 per cent on its investment of retained earnings.

Step by Step Solution

★★★★★

3.45 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Computation of After Tax Cost of Capital Case1 Cost o...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started