Question

Assumptions are in blue text. During 2019 Duluth Trading merged with EarthWear to form DTE Inc. It is January 25, 2021 and you are part

Assumptions are in blue text. During 2019 Duluth Trading merged with EarthWear to form DTE Inc. It is January 25, 2021 and you are part of the audit team examining the unaudited 2020 data. Assume any knowledge you acquired by studying EarthWear carries over to the merged company.

The consolidated total revenues for DTE Inc. is as follows:

2020 [unaudited]: $ 2,032,154

2019 $ 2,015,026

2018 $ 1,900,986

The manager of your audit team has identified two of DTEs asset accounts as requiring additional audit analysis: Cash and Accounts Receivable. The following question relates to these two accounts.

The manager of your audit team has identified two of DTEs asset accounts as requiring additional audit analysis: Cash and Accounts Receivable. The following question relates to these two accounts.

ADDITIONAL ASSUMPTIONS FOR PART II. You have completed the initial audit steps for the planning phase of the DTE, Inc. audit and are ready to conduct control risk [CR] assessment. At this point in the audit, you assess risk of material misstatement [RMM] to be .10

a. For our audit of DTE Inc., what would be a reasonable quantitative target AR [ i.e. AR' ]? State why this is a reasonable target.

b. Given your target or budgeted AR', what would be an appropriate quantitative level of DR? Show your calculations.

After your initial ICE work [Internal Control Evaluation] including study of documentation, you believe the Control Risk [CR] that the auditor can assume is .05

c. In words, what does a .05 level of CR mean?

d. How reliable are the controls if CR is assumed to be .05?

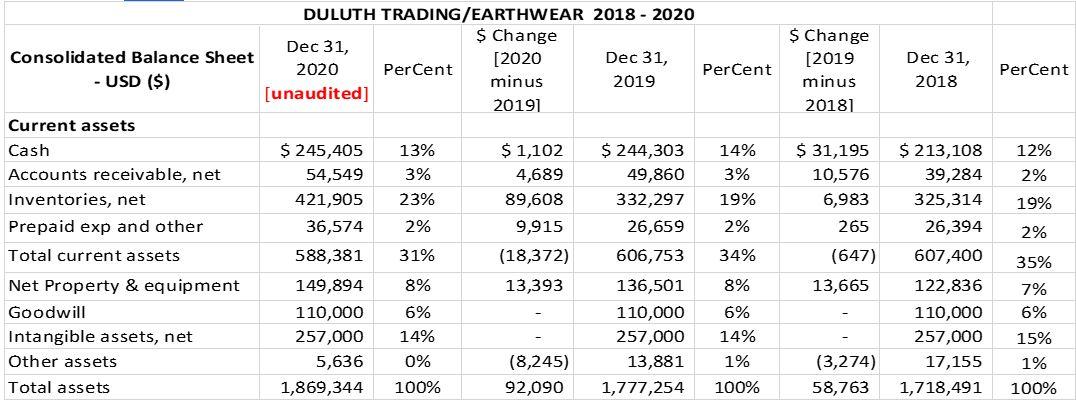

Consolidated Balance Sheet - USD ($) DULUTH TRADING/EARTHWEAR 2018 - 2020 $ Change Dec 31, [2020 Dec 31, 2020 Percent Percent minus 2019 [unaudited] 20191 $ Change [2019 minus 20181 Dec 31, 2018 Per Cent Current assets Cash Accounts receivable, net Inventories, net Prepaid exp and other Total current assets 13% 3% 23% 14% 3% 19% 12% 2% $ 31,195 10,576 6,983 265 19% $ 1,102 4,689 89,608 9,915 (18,372) 13,393 2% 2% 2% 31% 34% $ 245,405 54,549 421,905 36,574 588,381 149,894 110,000 257,000 5,636 1,869,344 35% $ 244,303 49,860 332,297 26,659 606,753 136,501 110,000 257,000 13,881 1,777,254 (647) 13,665 $ 213,108 39,284 325,314 26,394 607,400 122,836 110,000 257,000 17,155 1,718,491 8% Net Property & equipment Goodwill Intangible assets, net Other assets Total assets 8% 6% 14% 0% 7% 6% 15% 6% 14% 1% 100% (8,245) 92,090 (3,274) 58,763 1% 100% 100% Consolidated Balance Sheet - USD ($) DULUTH TRADING/EARTHWEAR 2018 - 2020 $ Change Dec 31, [2020 Dec 31, 2020 Percent Percent minus 2019 [unaudited] 20191 $ Change [2019 minus 20181 Dec 31, 2018 Per Cent Current assets Cash Accounts receivable, net Inventories, net Prepaid exp and other Total current assets 13% 3% 23% 14% 3% 19% 12% 2% $ 31,195 10,576 6,983 265 19% $ 1,102 4,689 89,608 9,915 (18,372) 13,393 2% 2% 2% 31% 34% $ 245,405 54,549 421,905 36,574 588,381 149,894 110,000 257,000 5,636 1,869,344 35% $ 244,303 49,860 332,297 26,659 606,753 136,501 110,000 257,000 13,881 1,777,254 (647) 13,665 $ 213,108 39,284 325,314 26,394 607,400 122,836 110,000 257,000 17,155 1,718,491 8% Net Property & equipment Goodwill Intangible assets, net Other assets Total assets 8% 6% 14% 0% 7% 6% 15% 6% 14% 1% 100% (8,245) 92,090 (3,274) 58,763 1% 100% 100%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started