Answered step by step

Verified Expert Solution

Question

1 Approved Answer

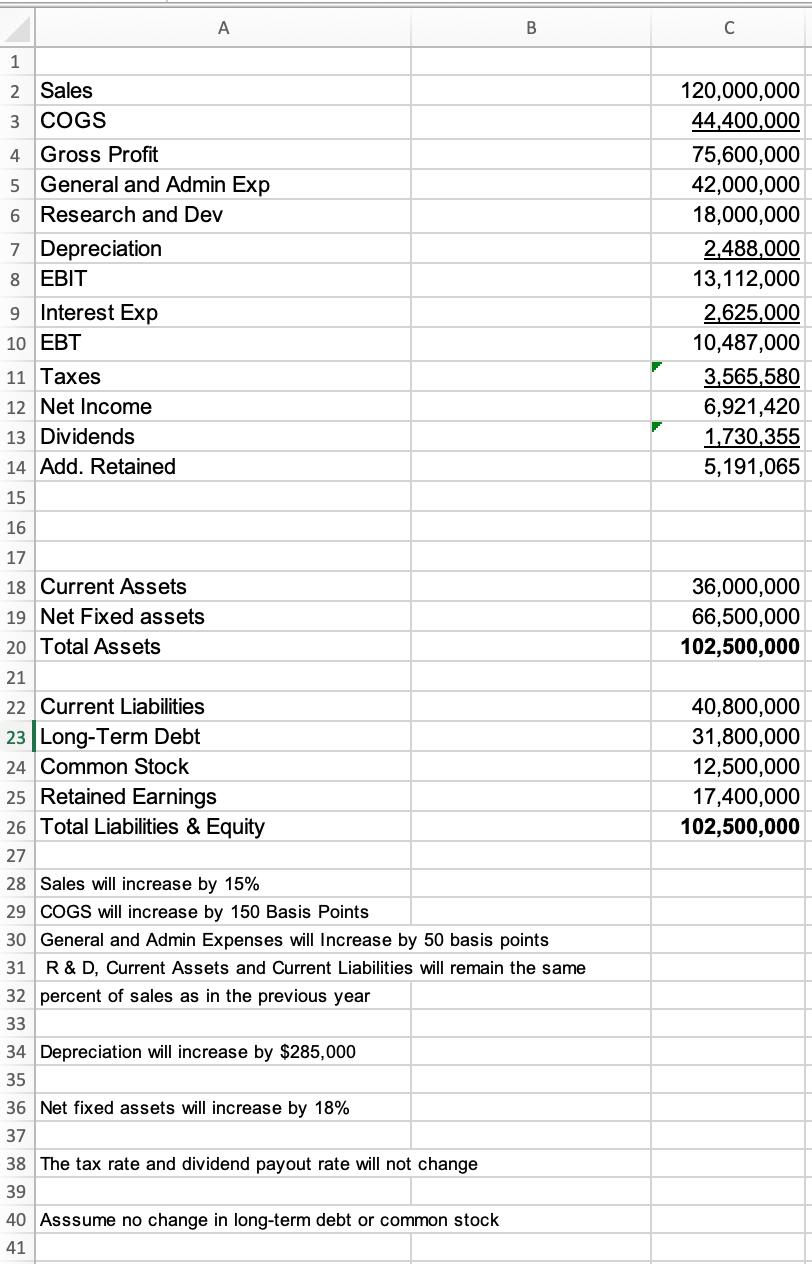

Assumptions : Sales will increase by 15% COGS will increase by 150 Basis Points General and Admin Expenses will Increase by 50 basis points R

Assumptions :

| Sales will increase by 15% | |

| COGS will increase by 150 Basis Points | |

| General and Admin Expenses will Increase by 50 basis points | |

| R & D, Current Assets and Current Liabilities will remain the same | |

| percent of sales as in the previous year | |

| Depreciation will increase by $285,000 | |

| Net fixed assets will increase by 18% | |

| The tax rate and dividend payout rate will not change | |

| Asssume no change in long-term debt or common stock | |

Using the assumption please provide me

| Sales |

| Cost of Goods Sold |

| Gross Profit |

| Operating Expenses |

| Depreciation |

| EBIT |

| Interest Expense |

| EBT |

| Taxes |

| Net Income |

| Dividends |

| Additional Retained |

Also provide current assets and liabillies :

| Current Assets |

| Cash |

| Account Receivable |

| Inventory |

| Total |

| Net Fixed Assets |

| Total Assets |

| Current Liabilities |

| Accounts Payable |

| Accruals |

| Notes Payable |

| Total |

| Long-term Debt |

| Total Liabilities |

Also provide :

| Common Stock |

| Retained Earnings |

| Total Equity |

| Total Liabilities and Equity |

| External Required |

1 2 Sales 3 COGS 4 Gross Profit 5 General and Admin Exp 6 Research and Dev 7 Depreciation 8 A EBIT 9 Interest Exp 10 EBT 11 Taxes 12 Net Income 13 Dividends 14 Add. Retained 15 16 17 18 Current Assets 19 Net Fixed assets 20 Total Assets 21 22 Current Liabilities 23 Long-Term Debt 24 Common Stock 25 Retained Earnings 26 Total Liabilities & Equity 27 28 Sales will increase by 15% 29 COGS will increase by 150 Basis Points 30 General and Admin Expenses will Increase by 50 basis points 31 R & D, Current Assets and Current Liabilities will remain the same 32 percent of sales as in the previous year 33 34 Depreciation will increase by $285,000 35 36 Net fixed assets will increase by 18% 37 38 The tax rate and dividend payout rate will not change 39 B 40 Asssume no change in long-term debt or common stock 41 C 120,000,000 44,400,000 75,600,000 42,000,000 18,000,000 2,488,000 13,112,000 2,625,000 10,487,000 3,565,580 6,921,420 1,730,355 5,191,065 36,000,000 66,500,000 102,500,000 40,800,000 31,800,000 12,500,000 17,400,000 102,500,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Based on the provided assumptions here is the analysis of the financial information Sales Given 75600000 Assumption Sales will increase by 15 New Sale...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started