Question

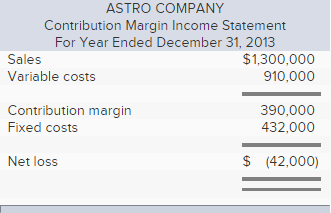

Astro Co. sold 26,000 units of its only product and incurred a $42,000 loss (ignoring taxes) for the current year as shown here. During a

| Astro Co. sold 26,000 units of its only product and incurred a $42,000 loss (ignoring taxes) for the current year as shown here. During a planning session for year 2014s activities, the production manager notes that variable costs can be reduced 50% by installing a machine that automates several operations. To obtain these savings, the company must increase its annual fixed costs by $330,000. The maximum output capacity of the company is 40,000 units per year.

|

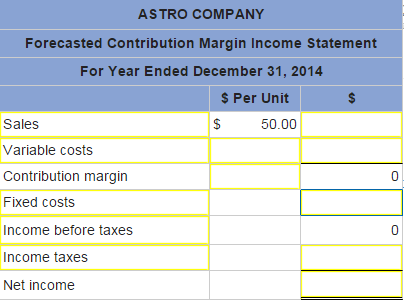

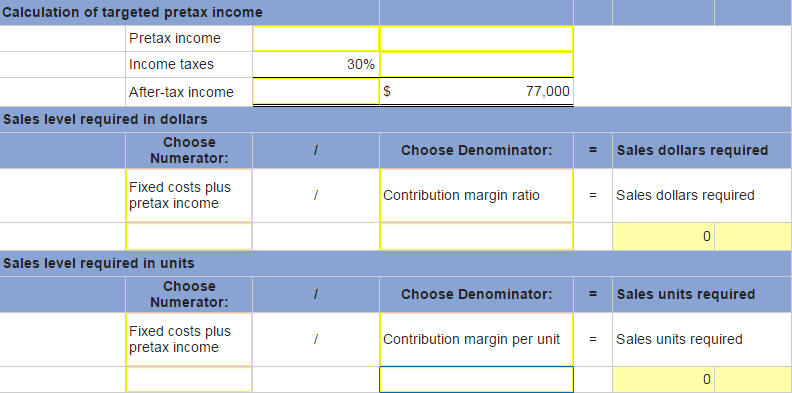

| Prepare a forecasted contribution margin income statement that shows the results at the sales level computed in part 4. Assume an income tax rate of 30%.

|

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started