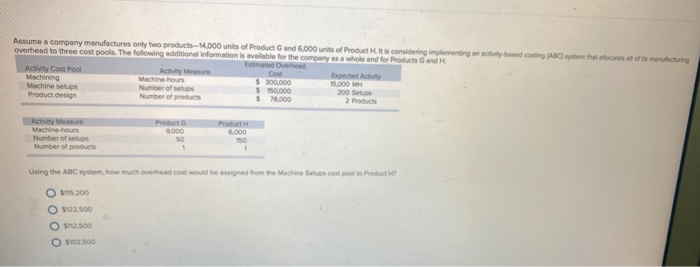

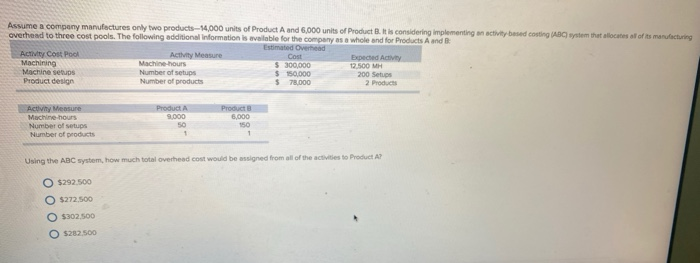

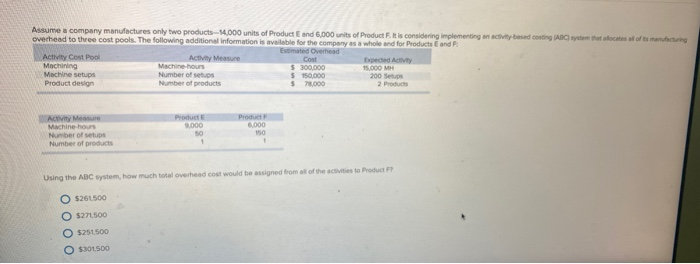

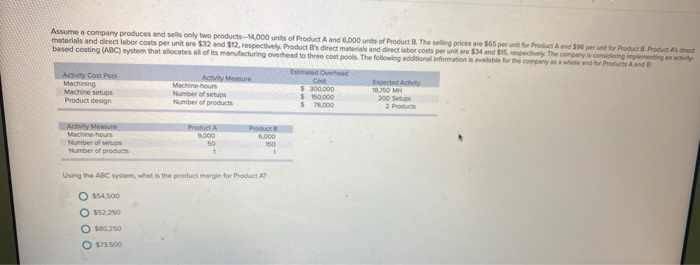

Astume a company manufactures only two products - 14.000 units of Product and 6,000 units of Product is considering implementing an activity based costing system that allocates los motring Overhead to three cost pools. The following additional information is available for the company as a whole and for Products and Ested Overhead Activity Cost Pool Activity Measure Cost Bed AM Machining $ 300.000 Machines Number of sets $ 150.000 200 Setup Product design Number of products $ 7.000 2 Products Activity Measure Machine-hours Number of setups Number of products Producto 31000 Product 6,000 Using the ABC system, how much overhead coat would be assigned from the Machine Setups cost pool to Product O $15.200 O 02.100 O $112.500 $102.500 Assume a company manufactures only two products--14,000 units of Product A and 6,000 units of Product B. it is considering implementing an activity based costing (ABCstem that allocates all of its manufacturing overhead to three cost pools. The following additional information is available for the company as a whole and for Products A and B Estimated Overhead Activity Cost Pool Activity Measure Cost Expected Active Machining Machine hours $ 300,000 12.500 MH Machine setups Number of setups $ 150.000 200 Setups Product design Number of products $ 78,000 2 Products Activy Measure Machine-hours Number of setups Number of products Product 9.00 50 1 Product 6,000 1 Using the ABC system, how much total overhead cost would be assigned from all of the activities to Product A! O $292,500 O $272,500 O $302.500 5282.500 Assume a company manufactures only two products-14,000 units of Product and 6,000 units of Product. It is considering implementing an activity based conting system that located aloft muturing overhead to three cost pools. The following additional information is available for the company as a whole and for Products and Estimated Overhead Activity Cost Pool Activity Measure Cost Expected Act Machining Machine hours $ 300.000 15,000 MH Machine setups Number of stos $ 150,000 200 Setup Product design Number of products $ 78,000 2 Products Ace Measure Machine-hours Number of setups Number of products Product 5.000 so 1 Product 600D 150 . Using the ABC system, how much total overhead coat would be assigned from all of the activities to Product F? O $26.500 O $271.500 O $251.500 $301.500 Assume a company produces and sells only two products - 14,000 units of Product A and 6,000 units of Product B. The selling prices are $65 per unit for Product A and per unit for Product Products direct materials and direct labor costs per unit are $32 and $12, respectively. Products direct materials and direct labor costs per unit are $34 and $15, respectively. The company is considering implementing an activity based costing (ABC) system that allocates all of its manufacturing overhead to three cost pools. The following additional information is available for the company as a whole and for Products A and B Estimated Ovet Activity Cost Pool Activity Measure Expected Act Machining Machine hours $ 300.000 1850 MH Machine setups Number of setups $ 150.000 200 Setups Product design Number of products $ 7.000 2 Products Cour Activity Measure Machine-hours Number of setups Number of products Product 9.000 50 1 Product 6.000 Using the ABC system, what is the product margin for Product $54.500 O 552.250 0 580 250 O 573.500