Answered step by step

Verified Expert Solution

Question

1 Approved Answer

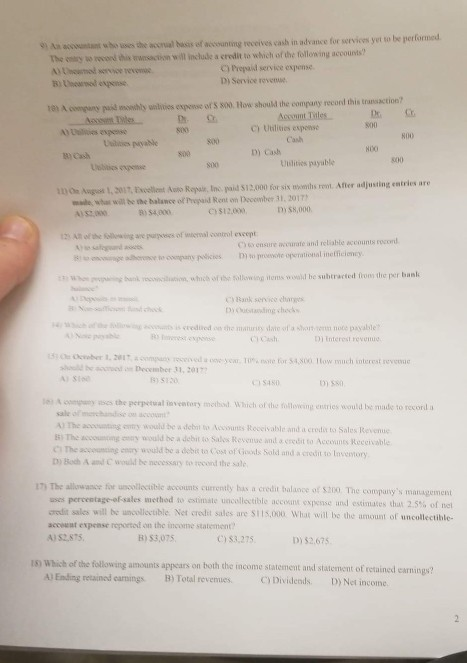

asuntant who uses the acorual bass of wecunting receives cash in advance for services yet to be performed The eney so wcond this wwnsaction will

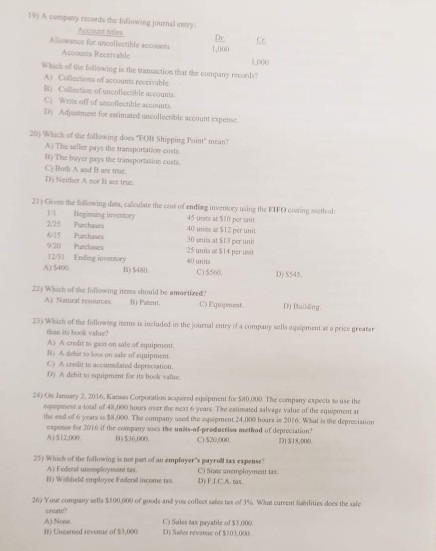

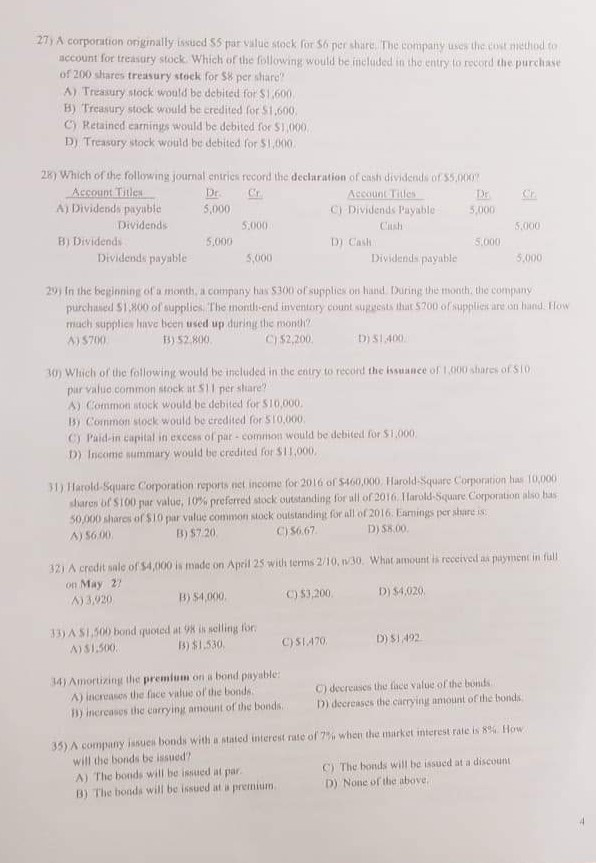

asuntant who uses the acorual bass of wecunting receives cash in advance for services yet to be performed The eney so wcond this wwnsaction will iclude a crvdit to which of the tolloning accounts? C) Prepaid service expense D) Service rovenue A comnpany past moswhlty walivies expense of 's s00. How shoud the company recornd this Account Tiles Ass ci Uilities esponse Cash 800 es payable D) Cash B)Cash 800 Uilities payube 800 Repa, Inc paid $12.000 for six momths ret After adjusting entries are Angos 1, 2017, wade, whas wil be the balance of Trepaid Rent on December 31, 2017 D) $8,000 C$12000 8) 54,000 ofthe following are purposes of internal vontrol ensare wcurate and reliable accounts rocont Ch s te osngany pssicesD opreote opertiol inefficiony which of ihe ollowng ald be subtracted froes the per bank Bank service char Dutadingcheck ep Cash Di Enterest reveo onaber 1, 201, acompany received a Deeyen. Ii7% rwoe er sasoo. t tow much interest revenue sld be December 31, 20172 A)Si 8) S120 A ompwny ases the perpetual ieventory method Which of the tolowing enstries would be mude to record a sale ol merchandsen acco A) The accounting B) The accousing y would be a debit to Sales Revenue and a credit to Accoants Receivable C The acouning enry would be a dobit to Cost of Gods Sold and a credit to Inetory D)Boh A ad C would be necessary to recond the sale comy would be a debn to Accounts Receivable and a credis to Sales Revee 1 The allowance for uncolloctible accounts currently has a credit balance of $200 The company's management uses percentage-o(sales method to estimate uncollectible account expense and estimates that 2.5% of net credit sales will be uncollectible Net credit sales are SI15.,000 What will lbe the amount of uncollectible- acceuat expense roported on the income statement A) S2875 B) $3,075 C) 83,275 D) $2675 1S) Which of the following amounts appears on both the income statement and statement of retained eanings? Emding retained canings B) Total revemues Dividends D) Net income 19) A company raconds the following journal cnery llon for uncollectible accot ccounts Peceivable 1.000 Which of the fillowing is the transactice that the company records A Collections of accounts recervable sCollectice of uncollectible account C) Wnte off of uncollectible accounts D Adjtment for estimated uncollectible account expense 20 Which of the following does "POB Shipping Point" mean A) The seller pays the transportation costs The byer peys the transportalion costs C Both A and B are troe Di Neither A nor a tue 21 ) Grm the Sallowing data, calulate the cost of ending inventory using the FIFO cotng method Beginning inventory 225 Parchase 15 Prchase 5 units at S10 por unit 4ounts $1 Z per unit 30 units at 513 per unit 25 unit= $ 14 per int 0 units Pa 2/51 Ending inventory )5400 B)5480 D) S345 C) 5560 22) Which ot dhe follorwing items should be amortized D) Bailding Natoral resunces B) Patent C) Equipmest 23) Which of the following items is inciuded in the journal entry if a compary sell eqipment st a price greater n its book value A A codit to gu on sale of equipment ) A debi to loss on sale of equipment C) A credit to accumulialed depreciation. D'j A dehit to equipment for its book value Corporation acgwired eqipment for 580,000 The eompany expects to use the d salvage valuc of the equipment at 24) Os Jamuary 226,s qipment a total of 48,000 hours over the next 6 years. The exinate the end otf 6 years i $8,00% The company ssed the oqsipment 24,000 hours is 2016. What is the depreciation eapenoe for 2 if the company uses the units-of preductien method of depreciation D) $18,000 18) 536,000 C 530,000 25) Which of thie fullowing is not pat of an employer's payrill tas espense A Foferal umployment By Wisheld employse Federl income tax.DF.IC.A C) State snemployment tax 26) Your ongury sels sooooo of goods and you collect sales tax of 3% what current lihli ties des thr sale create C) Sales tax payable of $3,000 Hi Uncaned sevonue of S3,00D) Saes reversse of $103,000 27y A corporation originally issued S5 par value stock for So per share. The company uses the cost metiod f account for treasury stock Which of the following would be included in the entry to record the purchase of 200 shares treasury stock for S8 per stiare A) Tressury stock would be debited for $1,600 B) Treasury stock would be credited for S1,600 C) Retained carnings would be debited for $1,000 D) Treasory stock woiuld be debited for $1,000 28) Which of the following journal entries record the declaration of cast dividends of $5,000 Dr r 5,000 De A) Dividends payable C) Dividends Payable5,000 Dividends 5,000 Cush B) Dividendis 5,000 D) Cash 5,000 Dividends payable Dividends payable 5,000 29) In the begioning of a month, a company has $300 of supplics on hand During themonth the company purchased S1,800 of supplics. The month-end inventory count susests that $200 of supplies are on hadow mach supplics have been used up during the montdh? ) 5700 D) S1 400 13) 52 800 C) $2,200 30) Which of the following would be included in the entry to record the issuance of 1,000 shares of SIo par Value common stock at S11 per shiare? A) Common stock would be debited for S10,000 lsy Common stock would be credited for S10,000 C) Paid-in capital in excess of pat- commion would be debited for $1,000 D) Income summary would be credited for $11,000 31) Harold-Square Coporation reports net income for 2016 of $40,00, arold Squure Corporation has 10,000 sharen of $100 pur valuc, 10%% preferred stock outstanding for all of 2016 llarold Square Coporation also bas 50,000 shares of S10 par value commion stock outs A) 5600 ings per share is sMock oustatnding for all of 2016. Eam D) 56.00 C)5667 B) $7.20 yment in full What amount is received as pa 32) A credit sale of $4,000 is made on April 25 with terms 2/10, v/30. on May 2 A) 3,920 D) 54,029 C) 53,200 1) $4,000 33) A $1,500 bond quoted at 98 is selling ior D) S1492 C)SI470 B) $1 ,530. A) $1.500 14) Amortizing the premium on a bond payable: Co decreaes the fie vat of the bes A) increases the face value of the bonds B) Incrcosos the carrying amount of the boodsD) decreases the carrying anount of the bonds 35 A company ssues bonds with n stated interest rase of" when the market interest raie is 8% How will the bonds be issued? A) The bonds will be issued at par B) The honda will be issued at a premium 9) The bonds will be issued at a discount D) None of the above

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started