Answered step by step

Verified Expert Solution

Question

1 Approved Answer

At 30th September 2020 Diaz trade receivables totalled 60,000 and the allowance based on past experience for receivables was 600 (equivalent to 1% of

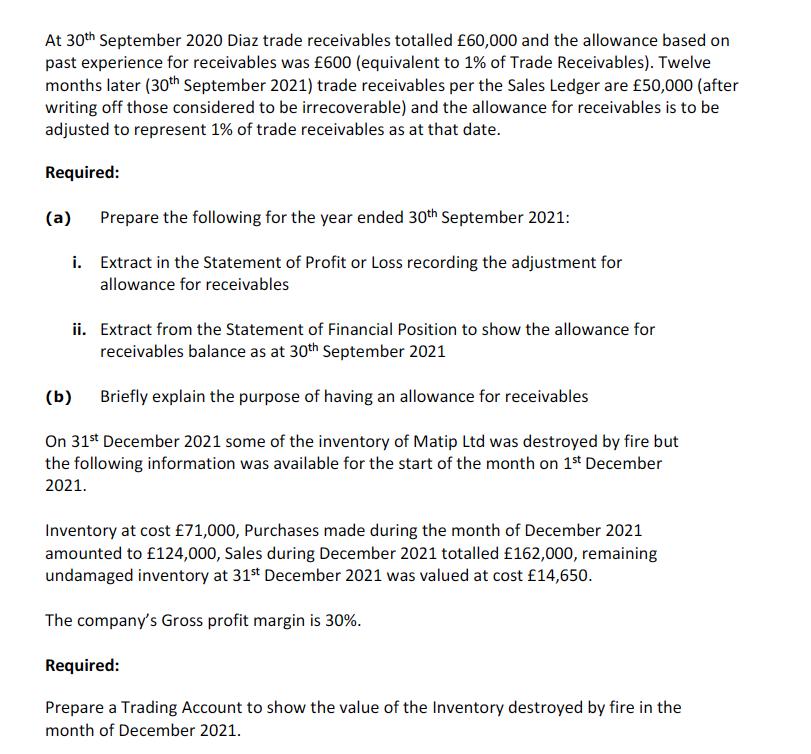

At 30th September 2020 Diaz trade receivables totalled 60,000 and the allowance based on past experience for receivables was 600 (equivalent to 1% of Trade Receivables). Twelve months later (30th September 2021) trade receivables per the Sales Ledger are 50,000 (after writing off those considered to be irrecoverable) and the allowance for receivables is to be adjusted to represent 1% of trade receivables as at that date. Required: (a) Prepare the following for the year ended 30th September 2021: i. Extract in the Statement of Profit or Loss recording the adjustment for allowance for receivables ii. Extract from the Statement of Financial Position to show the allowance for receivables balance as at 30th September 2021 (b) Briefly explain the purpose of having an allowance for receivables On 31st December 2021 some of the inventory of Matip Ltd was destroyed by fire but the following information was available for the start of the month on 1st December 2021. Inventory at cost 71,000, Purchases made during the month of December 2021 amounted to 124,000, Sales during December 2021 totalled 162,000, remaining undamaged inventory at 31st December 2021 was valued at cost 14,650. The company's Gross profit margin is 30%. Required: Prepare a Trading Account to show the value of the Inventory destroyed by fire in the month of December 2021.

Step by Step Solution

★★★★★

3.51 Rating (168 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started